Employee Background Screening: Fake CV Lands a Top NHS Job… Are Your Employees Telling the Truth?

Is Employee Background Screening as critical as they make it out to be?

A former builder who faked his CV to land a series of top NHS jobs has finally been forced to pay the full price for his ‘staggering lies’, says a shocking report on timesnewsuk.com/

Jon Andrewes, 69, spent a decade working as chairman of two NHS trusts and chief executive of a hospice after pretending to have a PhD, an MBA and a history of senior management roles. Mr Andrewes had been appointed chairman of the Royal Cornwall Hospitals NHS Trust (RCHT) ahead of 117 other candidates.

After Andrewes was exposed he was convicted of fraud, jailed for two years and ordered to hand over all his remaining assets of £96,737. But the confiscation order was overturned by the Court of Appeal two years ago when judges ruled he had given ‘full value’ for his salary in the jobs he did. Now, more than five years after pleading guilty to fraud charges, Andrewes has had the financial penalty reinstated by the Supreme Court and must pay back nearly £100,000.

Under his fake persona, Andrewes insisted on staff calling him ‘Dr’ and claimed to have degrees from three universities. But his only genuine higher education qualification was a certificate in social work. After starting as a builder he spent much of his career as a probation officer, customs officer or youth worker before inventing a new life for himself as an NHS manager.

His senior health jobs, which included a £75,000-a-year role as chief executive of a hospice in Taunton, earned him £643,602. He was appointed in 2004. He then led the Torbay NHS Trust in Devon for nearly a decade, before becoming chairman of the Royal Cornwall NHS Hospital Trust in 2015.

However, an investigation at the hospice uncovered discrepancies in his CV and led to police being called in. ‘He came across as very knowledgeable and competent,’ recalled David Shepperd, former head of legal services at Plymouth City Council, who liaised closely with Andrewes on a council-funded green project. ‘He was an affable, nice guy to deal with.’

‘It beggars belief that no due diligence was carried out when he was appointed to these roles in the NHS,’ says an NHS source, quoted in the timesnewsuk.com report.

The UK Screening Module covers:

- Identity Check: An independent check to authenticate an individual’s identity using various sources of stated data.

- Regulated Employment History & References: Regulated employment references to confirm previous employment details.

- Academic Qualifications: Confirmation of highest academic qualification, including details of institution and dates attended.

- Professional Qualifications: Confirmation of latest or most relevant Professional or Trade Memberships.

- FSA Register Search against the UK Financial Services Authority Individual Register and Prohibited Persons Register

- UK Credit Check Check to determine the general credit worthiness of the candidate.

- Directorship Search: Search for UK Directorships and any disqualifications.

- Negative Media Search: Search of press and other media focusing on derogatory information only.

- Compliance Database Check: Search for inclusion in governmental sanctions, enforcements, watchlists, blacklists and criminality.

- Criminal Record Checks — Standard Disclosure: A check of all convictions held on the PNC.

More details on the UK Screening Module can be had here.

A business must understand its exposure when hiring and type of insurance coverage and limits – does your policy cover a negligent hiring lawsuit? The checks are critical to any company’s success – hiring qualified, honest, and hard-working employees is an integral part of thriving in the business community.

IP infringement: The Intellectual Property and Youth Scoreboard 2022 is ut!

IP infringement by way of buying counterfeit goods online and accessing digital content from illegal sources, intentionally or by accident, remain a common practise among youth, says the 2022 edition of the Intellectual Property and Youth Scoreboard.

Released by the European Union Intellectual Property Office (EUIPO), the study provides an update on the behaviours of youth towards purchasing fake products and intellectual property infringement. It is based on a survey of young people between the ages of 15 and 24 in all 27 member states of the European Union (EU) and highlights the factors driving young people to purchase counterfeit goods or access digital content from illegal sources.

Key drivers behind purchasing fakes and accessing pirated content are mostly the price and availability. Peer and social influence such as the behaviour of family or friends also affect the decisions of European youth, says a report of the study on IP Helpdesk.

The Increasing Dangers of IP Infringement

Counterfeit goods pose a significant threat to consumers’ health and safety and is detrimental to the environment. Pirated wares also have a wide range of negative consequences for global economies, the report finds.

Fact: Young Europeans buy more fake products and continue to access pirated content

- 37% of young people bought one or several fake products intentionally in the last 12 months

- 21% of 15 to 24 year olds say they intentionally use illegal sources of digital content in the last 12 months

- 60% of young Europeans said they prefer to access digital content from legal sources, compared to 50% in 2019

- Price and availability remain the main factors for buying counterfeits and for digital piracy

The EUIPO is based in Spain and among one of the most innovative intellectual property offices globally. The European Observatory on Infringements of Intellectual Property Rights is a network of experts and specialist stakeholders. It was established in 2009, with a mission to fight the increasing danger of IP Infringement in Europe and to protect the rights of online property.

Employee Background Screening FAQs – PART III: Conflict of Interest Checks & FACIS Searches

This three-part series of articles looks at employee background screening FAQs.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling you is the truth? Or are you 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process?

Simply investing in sufficient screening systems can save you time, money and heartbreak, as the employee background screening FAQs ebook will show you.

Part One of the series, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this employee background screening FAQs ebook developed by the CRI® Group is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS IN THIS EMPLOYEE BACKGROUND SCREENING FAQs. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI® Group, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

Is it Possible to Identify Conflict of Interest During Checks?

Conflict of interest occurs when an individual or company have interests that might influence or be perceived as being capable of influencing their judgment even unconsciously. What your client wants you to do is to check whether the subject has any additional business or interests that are in conflict with what they were retained to do.

Example:

You head the public relations department of the UAE’s largest bank. The department is responsible for putting together a quality service recognition programme. Your bank’s public relations agency is designing the advertising speciality components for the programme targeting the bank’s 10,000 employees. Your wife owns XYZ Promotions, the largest advertising speciality firm in the state.

The company offers the best prices for large orders. XYZ Promotions has supplied products for a number of other accounts of the public relations firm. However, this is the first time that the public relations firm has used XYZ Promotions for a bank project. The public relations firm does not know that your wife owns XYZ Promotions. You have not suggested the use of XYZ Promotions.

The public relations firm has made its recommendations to you, including using XYZ Promotions as the vendor for the quality service recognition programme. The bottom line is that if somebody is contracted to do a job — so they do not have any connections from which they could benefit again (like above — you are working for the bank, and it is your job to select an advertising company and if you select XYZ you benefit again!) Essentially this is a conflict of interest because you would benefit from this if XYZ was given the job.

Would you like to learn more about our internal investigation and conflict of interest services? Get in touch and let us know how we can help!

What Will a Financial Regulatory Check Show?

These checks entail a search of individuals who have been disqualified from holding prudentially significant roles primarily within the Banking, Finance, Securities and Investment sector (BFSI), e.g. Individuals who have been disqualified from involvement in the management of a corporation, banned from being securities or futures representatives, banned or disqualified from practising in the financial services industry and individuals who have had Enforceable Undertakings accepted.

A Financial Regulatory Check may also cover whether a person or organisation holds a license where this license is a requirement of their role within the BFSI environment, e.g. Auditors, Liquidators, Authorised Representatives, Financial Planners etc. Availability and access to these checks vary per country.

Would you like to learn more about our Financial Investigations services? Get in touch and let us know how we can help! Or visit us here!

What is a Bankruptcy Check?

Confirms if an individual (including aliases and associated parties) has been declared bankrupt and recorded with the relevant body. This information is relevant to individuals holding positions of management responsibility and certain financial roles.

What about Directorships & Significant Shareholdings Search?

This search identifies potential conflicts of interest that can arise from an individual’s current and past directorships and their significant shareholdings. An individual’s performance as a Director can provide critical insight into their skills and experience. This search can highlight whether any of the companies they have been a director of have had an administrator appointed or deregistered.

What Type of Educational Qualifications can You Check?

Specific educational qualifications are required for many positions of responsibility, and salary packages are set accordingly. Failing to verify this information can result in unqualified people in positions in which they cannot perform their responsibilities.

CRI Group™ verifies the institution attended, the date of attendance, the qualification awarded and the graduation dates. CRI Group™ also verifies that the institution is an accredited provider from approved government databases. Suppose the institution does not appear on an accredited database. In that case, CRI Group™ will also check the institution’s name against a comprehensive list of unaccredited institutions to ensure that the institution is not a known degree mill.

What about Professional Qualifications & Membership Checks?

Specific professional qualifications and memberships are key requirements for many roles. CRI Group’s researchers will verify the type of professional qualification and/or membership received, the status of the membership (i.e. Valid or lapsed), attendance dates and graduation dates where applicable.

National Police Check?

CRI Group’s Police Record Check will reveal details of criminal records in line with the relevant legislation.

Can I Have Access to a Criminal Watch List?

Where CRI Group™ cannot conduct a recognised police record check due to either legal restrictions or simply the lack of such a database, we can offer the “next best alternative.” These searches review proprietary databases and criminal watch lists issued by various governments to identify known individuals. We combine this check with an extensive media search which provides a high degree of confidence that the individual has not been involved in high-level criminal activity.

Anti Money Laundering Check?

This check assists in identifying the risks associated with individuals due to specific or general involvement with Money Laundering (AML), Politically Exposed Persons (PEPs), terrorists and wanted criminals. It achieves this by detailing the relationship network between these individuals and various other entities.

The check provides an international due diligence report utilising up-to-the-day investigative information from an extensive range of available public domain information sources. It uses government, intelligence and police sites, global organisations, international and national media and all international sanctions lists. Would you like to learn more? Get in touch and let us know how we can help!

Credit & Civil Litigation Check

Access, availability, and information released vary across nations. In general:

- Civil litigation: Checks and researches public and private legal disputes on civil matters or through the courts. In other words, civil litigation refers to that branch of law dealing with disputes between individuals and/or organisations, in which compensation may be awarded to the victim. For instance, if a car crash victim claims damages against the driver for loss or injury sustained in an accident, this will be a civil litigation case.

- Credit check: Researches credit bureau for adverse financial judgments for debts and negative credit ratings where available, while a local agent will undertake alternative resources as per jurisdiction to ascertain the financial creditworthiness of the subject in question, which will include media checks, reputational and source comments from Central Bank resources where available.

Can you Conduct FACIS (Fraud & Abuse Control Information System) Searches?

Yes, we can; we conduct three levels of searches:

- FACIS Level 1 — A current and historical database of sanctions, exclusions, debarments and disciplinary actions for all provider types: federal sanctions

- FACIS Level 2 — A current and historical database of sanctions, exclusions, debarments and disciplinary actions for all provider types: federal and state healthcare entitlement programme sanctions

- FACIS Level 3 — A current and historical database of sanctions, exclusions, debarments and disciplinary actions for all provider types: federal and state sanctions

I AM LOOKING FOR UK SCREENING!

The UK Screening Module covers:

- Identity Check: An independent check to authenticate an individual’s identity using various sources of stated data.

- Regulated Employment History & References: Regulated employment references to confirm previous employment details.

- Academic Qualifications: Confirmation of highest academic qualification, including details of institution and dates attended.

- Professional Qualifications: Confirmation of latest or most relevant Professional or Trade Memberships.

- FSA Register Search against the UK Financial Services Authority Individual Register and Prohibited Persons Register

- UK Credit Check Check to determine the general credit worthiness of the candidate.

- Directorship Search: Search for UK Directorships and any disqualifications.

- Negative Media Search: Search of press and other media focusing on derogatory information only.

- Compliance Database Check: Search for inclusion in governmental sanctions, enforcements, watchlists, blacklists and criminality.

- Criminal Record Checks — Standard Disclosure: A check of all convictions held on the PNC.

More details on the UK Screening Module can be had here.

A business must understand its exposure when hiring and type of insurance coverage and limits – does your policy cover a negligent hiring lawsuit? The checks are critical to any company’s success – hiring qualified, honest, and hard-working employees is an integral part of thriving in the business community.

CRI Group™ Announces Webinars on Key Aspects of Due Diligence Investigations

The CRI Group™ is hosting a series of webinars on Due Diligence Investigations. The insightful webinars will help you go deep into crucial aspects of Due Diligence Investigations with lessons learned by industry leaders in various areas of business and best practices that you should adopt.

Details:

Webinar 1: Web-based or On-site Due Diligence Investigation: When and Why Do You Need it? And Who’s Going to Need it?

- Duration: 1h 15 min (1h sharing followed by 15 min Q&A)

- Date: 15 September 2022, Thu

- Time: 11.00am – 12.15pm UAE

- Speaker: Ashelea + Kevin (TBC)

- Format: Webinar

- Platform: MS Teams

Learning points:

- Web-based or on-site, or both? Which methods provide robust validity and trust to the information being investigated?

- How is a web-based due diligence investigation conducted?

- How is an on-site due diligence investigation conducted?

- How extensive does the due diligence investigation be with the web-based and on-site?

- When is a web-based due diligence investigation adequately required? And who will need it?

- When is on-site due diligence investigation adequately required? And who will need it?

- When are both web-based and on-site due diligence investigations required? And who will need it?

- What are the types of due diligence investigation offered on the current market

- Current Laws and Legislation around the world that are mandating businesses to conduct due diligence investigations

Webinar 2: The A-Z on How the Examiner Conducts Adequate Due Diligence Investigation

- Duration: 1h 15 min (1h sharing followed by 15 min Q&A)

- Date: TBC

- Time: 11.00am – 12.15pm UAE

- Speaker: Ashelea Arzadon

- Format: Webinar

The first webinar will be on “The A-Z on how the examiner conducts due diligence investigation” while the topic for the second webinar/podcast is “Web-based or On-site due diligence investigation. When and why do you need it? And who’s going to need it?”

The webinars will be addressed by CRI Group experts and will be of one-hour duration followed by a 15 minutes Q&A session. The dates for these webinars will be confirmed shortly. It is recommended that you register your interest here so that you are kept updated on the webinars.

Our Speaker

Ashelea is the Investigations Manager, leading the due diligence, C-level background screening, insurance claim and corporate investigations for multinational clients across various key industry sectors: public relations and advertising agencies of global brands, international law firms, aerospace and defence, and nuclear and energy companies. Her work includes multi-jurisdictional investigations in MENA, Europe and the Americas.

Before joining CRI Group™, she leveraged her knowledge of international law and politics as part of diplomatic and consular practices after working with the Department of Foreign Affairs in Manila. She graduated from Lyceum of the Philippines University with a bachelor’s degree in International Relations with a major in Diplomacy – and currently pursuing her master’s in Corruption and Governance at the University of Sussex. She became a Certified Fraud Examiner in 2018.

Due Diligence Investigations: Mitigate Critical Risks

At CRI™, we provide due diligence services where ever you are. Use our DueDiligence360™ reports to help you comply with anti-money laundering, anti-bribery, and anti-corruption regulations ahead of a merger, acquisition, or joint venture. You can also use them for third-party risk assessment, onboarding decision-making, and identifying beneficial ownership structures.

Due Diligence helps you Identify key risk issues clearly and concisely using accurate information in a well-structured and transparent report format. Our comprehensive range of reports includes specialised reports that support specific compliance requirements. Protect your reputation and the risk of financial damage and regulator action using our detailed reports. They enhance your knowledge and understanding of the customer, supplier, and third-party risk, helping you avoid those involved with financial crime.

The CRI Group™ invites you to schedule a quick appointment with them to discuss in more detail how conducting due diligence and compliance can help you and your organisation.

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, TPRM, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

Employee Background Screening FAQs – PART II: Pre-Employment Check

This three-part series of articles looks at employee background screening FAQs.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling you is the truth? Or are you just 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process?

Simply investing in sufficient screening systems can save you time, money and heartbreak.

Part One of the series of articles on employee background screening FAQs, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this employee background screening FAQs ebook developed by the CRI Group™ is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS TO DO WITH BACKGROUND SCREENING. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI® Group, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

Does a Candidate Have to Give Consent to Process a Background Check?

A job applicant must give written or electronic consent before any screening conducting (whether in-house or by a third party company like CRI Group™) any criminal record search, credit history check or reference interview, etc.

How Long Does it Take to Conduct a Background Check?

Background checks typically take 2 to 3 days to process and receive back from the outside contracted agency. A few exceptions may take up to 2 weeks. A background check may rarely take longer than 3 to 4 weeks. Please allow additional processing time for each background check in the event of a delay. A delay can occur for any of the following reasons:

- The information has been entered incorrectly by the applicant or the requestor into the vendor’s system.

- The county or district listed for a background check in researching whether the applicant has any criminal felony or misdemeanour charges is delayed in responding to the vendor.

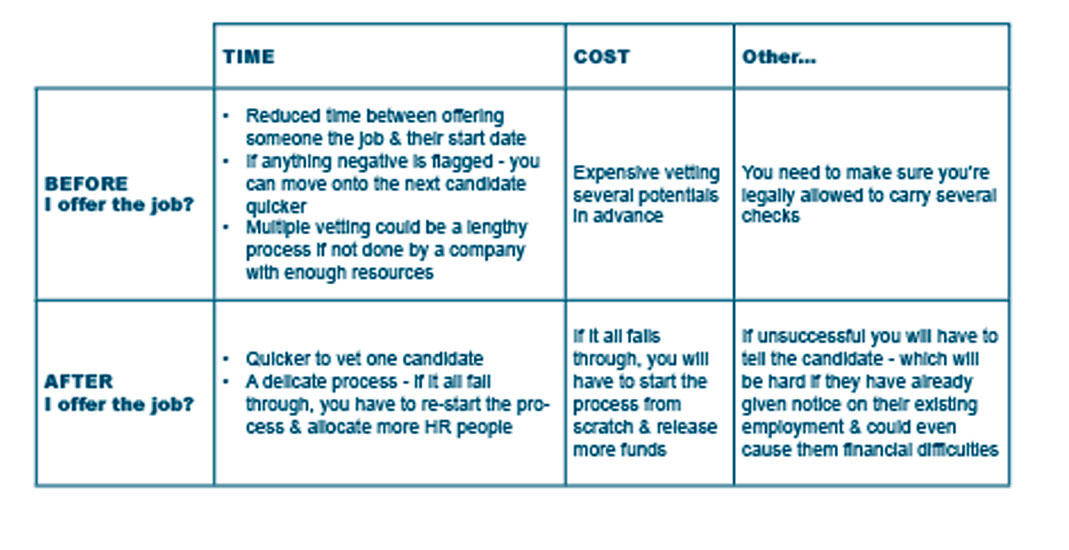

When Should I Conduct Pre-Employment Checks?

Pre-employment screening services can help you avoid adding potential fraudsters and other bad actors to your staff. These checks can be implemented before or after a job offer (with each having its pros and cons).

How Often Should I Screen Employees?

Employees should be screened regularly to reveal any new information relevant to the business. That’s why our background investigations services also include:

- Employee monitoring & risk management

- Data protection compliance

- Employee testing & confidentiality

- Employee risk management

- Post-employment background checks

How to Collect References and What to Ask?

Because it is impossible to know how your candidate will work daily from just one interview, you will need references. References are a great way to find out whether your candidates are suitable for the role or will fit with your company culture. A primary reference check asks for:

- Employment dates

- Employment main responsibilities

- Attendance record

- Any disciplinary actions against them

- Any reasons why they shouldn’t be employed

These references will help you back up their CV – however, many candidates tend to exaggerate or misrepresent themselves. Third-party vendors such as CRI® Group can go beyond to get a fuller picture for you:

- Greatest strengths?

- Are they suitable for the role they’ve applied for?

- Would they rehire the candidate?

- Suitable management style?

- Do they have any leadership skills?

- Situations in which they have excelled at?

Note: Some companies have policies not giving references and just providing necessary employment details, while others direct you towards HR.

How Much Does it Cost to Conduct a Background Check?

That will depend on the scope. Please contact the team for a free consultation.

What are Employment References?

CRI Group’s comprehensive and detailed reference checks have been carefully designed for senior-level positions. Our highly skilled researchers probe extensively across a range of performance and behavioural attributes that have been specifically targeted to meet the information and management requirements of hiring senior-level executives.

We also verify any restrictive covenants, disciplinary actions or warnings; attendance or reliability issues; claims by or their former employer; acts of dishonesty, and eligibility for rehire in a comparable role. We provide a valuable perspective of an individual’s past performance and behaviours by conducting professional, impartial references.

What is the Difference Between Employment History Verification & Employment Reference?

CRI Group™ verifies who the individual reported to and their dates of employment, positions held, remuneration, responsibilities and reason for leaving. This is different to an Employment Reference as it verifies quantitative information such as employment dates, salary packages etc.

Media Search

An individual’s media profile can encompass both professional and personal activities. This check can provide the client with a unique insight into an individual’s public activities and reputation. Our broad-based press search encompasses electronically available national newspapers and regional media sources from states where an individual has worked, helping to ensure that there are no hidden surprises. The search can be conducted by country, region or globally, where it can be of immense value in the uncovering of omissions made by the candidate (note: additional charges apply).

How do I Check on Entitlement to Work?

It is an employer’s responsibility to ensure that every individual they hire is legally eligible to work in certain Jurisdictions. CRI Group™ uses copies of the candidate’s passport or birth certificate to verify entitlement to work in the respective Jurisdiction. Where the candidate is not a local citizen, we have an online verification process set up with the Department of Immigration and Citizenship, as the case may be, to confirm eligibility to work. We will confirm whether or not the candidate is entitled to work in Australia and provide details of any limitations attached to a work visa. This search verifies and appropriately documents the individual’s entitlement to work in accordance with DIMIA requirements.

How do You Conduct Identity Checks?

The availability of identity checks varies from nation to nation, depending on centralised databases and legislation. In essence, these checks are designed to ensure the person is who they claim to be. Where there is a recognised legislated identity card system, CRI Group™ will collect this card, ensure the details are reflected on the background check form submitted and upload the identity card to the candidate file to allow for the requestor to sight.

Identity theft is on the rise, and validating an individual’s identity is essential to making an informed hiring decision. CRI® Group verifies an individual’s identity details via a comparison with details held in the electoral roll, online telephone directory and the National database registration authorities.

Passport Check

This passport verification solution enables the client to verify a person’s identity and whether their passport is forged. Passport Check verifies the authenticity of machine-readable passports and identity documents by simply entering the passport/ID data.

CV Comparison Check

Curricula Vitae (CV) are increasingly being used as a sales tool rather than a factual account of a person’s work history. This check will compare information supplied by the candidate to CRI Group™ with details supplied to an organisation in a candidate’s CV. This check aims to provide a thorough review of the candidate’s background and reveal any misrepresentations that may exist through a candidate omitting or overstating information on their CV.

Supply Chain Due Diligence Act: New Risk Management & Reporting Duties for German Businesses

This article looks at the Supply Chain Due Diligence Act (LkSG) that applies to companies operating or trading in Germany and will enter into force on 1 January 2023.

The new German law, known as the Supply Chain Due Diligence Act (LkSG, short for Lieferkettensorgfaltspflichtengesetz in German) imposes due diligence obligations on environmental protection and on human rights, with all businesses having to introduce iterative and ongoing, or in certain circumstances ad hoc, due diligence processes specified by the Act.

Identification and management of an organisation’s supply chain and the risks that come with it require the implementation of due diligence processes.

The term “supply chain” refers to all products/services of a business, including all manufacturing and services, in Germany and/or abroad, from the extraction of raw materials to their delivery to the end customer.

Furthermore, due diligence processes should implement the following criteria:

- type and scope of the business activities of the company subject to the due diligence obligations,

- the ability of the company subject to the due diligence obligations to exert influence (so-called leverage),

- typically expected severity of the violation, and

- type of contribution by the company subject to the due diligence obligations to cause a violation.

More details can be had in our FREE Supply Chain Due Diligence Act (LkSG) eBook.

Who is Affected by the Supply Chain Due Diligence Act?

- As of 1 January 2023: Companies with at least 3,000 employees that have their head office, administrative seat or statutory seat in Germany OR companies that have a branch in Germany and usually employ at least 3,000 employees in this branch;

- As of 1 January 2024: Companies with at least 1,000 employees that have their head office, administrative seat or statutory seat in Germany OR companies that have a branch in Germany and usually employ at least 1,000 employees in this branch.

From 2024, the law will apply to businesses with more than 1,000 employees.

Even if companies with fewer employees are not addressees of the Supply Chain Act, they may still be indirectly affected. This is because the companies directly affected would be obliged to enforce compliance to the best of their ability with human rights in their supply chain. The measures necessary for this can have a direct impact on their suppliers, for example, through the implementation of a code of conduct. In addition, the directly affected companies will often be dependent on the active support of their suppliers and thus have this support be contractually assured, e.g. in the form of reporting obligations as part of their risk analysis.

DOWNLOAD THE SUPPLY CHAIN DUE DILIGENCE ACT (LkSG) EBOOK.

Due Diligence Investigations: Mitigate Critical Risks

At CRI®, we provide corporate reporting and due diligence services wherever you are. Use our DueDiligence360™ reports to help you comply with anti-money laundering, anti-bribery, and anti-corruption regulations ahead of a merger, acquisition, or joint venture. You can also use them for third-party risk assessment, onboarding decision-making, and identifying beneficial ownership structures.

Due Diligence helps you Identify key risk issues clearly and concisely using accurate information in a well-structured and transparent report format. Our comprehensive range of reports includes specialised reports that support specific compliance requirements. Protect your reputation and the risk of financial damage and regulator action using our detailed reports. They enhance your knowledge and understanding of the customer, supplier, and third-party risk, helping you avoid those involved with financial crime.

The CRI® Group invites you to schedule a quick appointment with them to discuss in more detail how conducting due diligence and compliance can help you and your organisation.

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, TPRM, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

FREE eBook | Supply Chain Due Diligence Act (LkSG)

In January 2023 a new German law, known as the Supply Chain Due Diligence Act (LkSG, short for Lieferkettensorgfaltspflichtengesetz in German), becomes effective and applies to companies operating or trading in Germany. This eBook looks at the key issues in the Supply Chain Due Diligence Act.

The Supply Chain Due Diligence Act requires businesses to undergo significant efforts in order to achieve compliance. The law introduces a legal requirement for businesses to manage social and environmental issues in their supply chains, through more responsible business practices. We’ve compiled more details on the act in our FREE ebook that can be downloaded now!

What is The Supply Chain Due Diligence Act All About?

In Part 1 of this eBook, we will provide a first outline of the Act’s material contents and an in-depth analysis of the applicability of the Act to various corporate structures.

The eBook is the collection of a series of articles in which we will take a closer look at key issues. It addresses the question of what you can do to adequately prepare yourself at this early stage rather than wait till later in the year. We would be happy to provide you with individual advice, as well. Please do not hesitate to contact us.

Preparatory Actions for Supply Chain Due Diligence Act

In Part Two of the Playbook, we’ll explore what preparatory actions you can take and how an effective risk management plan can be achieved and implemented through several services including due diligence.

Global integrity due diligence investigations provide your business with the critical information it needs in making sound decisions regarding mergers and acquisitions, strategic partnerships and the selection of vendors and suppliers. The level of due diligence will ensure that working with a potential i.e. trade partner will ultimately achieve your organisation’s strategic and financial goals.

Operating in the international market requires organisations to establish partnerships with numerous third parties, which supply raw materials, run business operations abroad and/or act as agents. At the same time, third parties are considered as the greatest area of bribery risks for international enterprises. Under the Bribery Act 2010, British-based organisations have to conduct due diligence on their third parties as the core principle of meeting the adequate procedures requirement.

IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

Subscribe now to our monthly newsletter, and receive more ebooks just like these one!

Employee Background Screening FAQs – PART I: What, Why and Who?

How do you know the candidate you just offered a role to is the ideal candidate, when it comes to Employee Background Screening? Are you 100% sure that everything they’re telling you is the truth? Or are you 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process? Who Performs Background Screening? What’s Involved in Background Checks covering History Around the Globe? Why do Employers Check Criminal History?

Employee Background Screening: What, Why & Who?

This three-part series of articles looks at employee background screening FAQs.

Part One of the series, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this ebook on employee background screening FAQs developed by the CRI® Group is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS TO DO WITH BACKGROUND SCREENING. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI Group™, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates. Simply investing in sufficient screening systems can save you time, money and heartbreak.

Why Conduct Pre-employment Background Checks?

To protect the company from various potential risks, a background check is considered an imperative pre-employment screening step before hiring. Companies often assume that the applicants are telling the truth on their resumes – what if they are not?

These checks are essentially an investigation into a person’s character – inside and outside their professional lives. Some checks you probably already carry out in-house, such as the candidate’s qualifications (documents provided), work history (with a reference check), right to work in the country and even a quick social media presence scan.

A Pre Employment Background Check: Who conducts it?

Permanent, temporary, benefit-eligible, non-benefit eligible, full-time and part-time staff require an acceptable background check.

Former employees, including retirees, are also subject to a background check if a contract breach occurs.

You could have an in-house HR team or contract with a third party vendor like CRI Group™.

Why Should I Contract a Third Party Vendor if I have an In-House Team?

You may have the capabilities to carry out the above services; however, to perform a full in-depth background screening service for candidates and employees at all levels, you need a considerable amount of manpower and skills – and it can be all-consuming work.

A third party vendor such as CRI Group™, with a global network that works with companies across the Americas, Europe, Africa, and Asia-Pacific, is a one-stop international Risk Management, Background Screening and Due Diligence solutions provider that brings true value to you and your team.

By contracting, you can benefit from the following:

- Cost Control & Savings

- Time Savings / Response Time

- Customer Service / Quality Control

- Expertise & Core Competency

- Technology & know-how

What Other Checks Can a Third Party Vendor Execute Better Than My In-House Team?

From checks on senior executives through to shop-floor employees, a full in-depth background check should include:

- Address Verification (Physical Verification)

- Identity Verification

- Previous Employment Verification

- Education & Credential Verification

- Local Language Media Check

- Credit Verification & Financial History (where publicly available)

- Compliance & Regulatory Check

- Civil Litigation Record Check

- Bankruptcy Record Check

- International Criminal Record Check

- Integrity Due Diligence…

and more.

Why is it Important?

These checks can reduce the risk of hiring someone who could cause irrevocable damage. Firms spend years, thousands, even millions to brand their products and services and one bad hire can cause a loss of capital and reputation to the extent that may cause a business to fail. A robust pre-employment check can help you and your company:

- Reduce turnover & training costs

- Gain a competitive edge through the hiring of better people

- Increase productivity – help your employees be more productive knowing that everyone employed by your company has been screened

- Set your company apart & win more business

- Reduce employee-related problems

- Protect company reputation/brand & customer relations

- Comply with mandates created by state or federal law for certain industries

- Increase retention

- Reduce negligent hiring claims

- Avoid violence in the workplace (threats of violence & actual violence)

- Reduce theft & espionage

- Avoid lawsuits & the costs associated with the defence

- Avoid loss of goodwill

- Various industry studies indicate escalating costs for worker replacement, loss of production, re-recruitment/interviewing, and training – the learning curve can cost you significant money.

DOWNLOAD THE EMPLOYEE BACKGROUND SCREENING FAQs FREE EBOOK HERE

WEBINAR RECORDING | “Remote Work & Other Trends Shaping Workplace Cultures”

CRI Group™ hosted a free webinar on August 31st. Our intention was to be able to provide resources on workplace cultures in organisations around the globe that will aid them in expansion and an positive employee environment. Take advantage of this free recording on employee wellness, remote work, pre-employment screening and workplace cultures.

The live training session was conducted by senior certified HR professional and member of CRI’s expert team, Nilofar A. Gardezi.

Improving Workplace Cultures

Workplace trends are dictating major shifts and becoming new norms in the workplace. These trends are expected to grow in the coming years. Examples of this include hybrid work, employee wellness, and ongoing education. Adapting to workplace trends will help employers improve company culture, boost employee retention and defeat workplace complacency. This will help companies stay competitive within the industry and remain relevant in the wider world.

With over nine years of experience in HR, Nilofar A. Gardezi is a HRBP & an Associate Director with the CRI Group™. She is a gold-certified Trainer from DWE with a Certification in Psychology and serves as a Certified Professional Counsellor. She has worked with renowned organisations like Attock Group, British Council and Standard Chartered Bank.

Struggling with Employee Screening?

Get answers to frequently asked questions about background checks / screening cost, guidelines, check references etc. This eBook is a compilation of all of the background screening related questions you ever needed answers to:

- Does a candidate have to give consent to process a background check / screening?

- How long does it take to conduct a background check?

- When should I conduct pre-employment checks?

- How often should I screen employees?

- How to collect references and what to ask?

- How much does it cost to conduct a background checks?

- What is he difference between employment history verification and employment reference?

- How do I check on entitlement to work?

- How to conduct identity checks?

- What will a financial regulatory check show?

- Is it possible to identify conflict of interest during checks?

- What is a bankruptcy check?

- What about directorships and shareholding search?

- Can I have access to a criminal watch list?

- Anti-money laundering check?

- Can we conduct FACIS (fraud and abuse control information system) searches?

- … and MORE!

Taken as a whole, is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions.

Download your “Employee Background Screening FAQ” FREE ebook now!

The CRI Group™ has been safeguarding businesses from fraud, bribery and corruption since 1990. We are a global company based in London, United Kingdom. Our experts and resources are located in key regional marketplaces. These are across the Asia Pacific, South Asia, the Middle East, North Africa, Europe, North and South America. Our global team can support your organisation anywhere in the world. For more details about the CRI Group™ or to schedule a meeting with us, click here.

IPR Infringement Report Says IP Infringement is Getting Worse!

Intellectual property can be a business’s most valuable asset. So when outside parties threaten to steal your ideas, copy your products or disrupt your marketing channels, corrective action on your part can become tedious, time-consuming and expensive. Also, because of the high value associated with Intellectual Property Right (IPR), infringement of those rights is a lucrative criminal activity, which generates significant costs to the rights owners and to the economy in general. In fact around 12,000 IP infringement cases are filed each year.

Now, a study conducted by the European Union Intellectual Property Office (EUIPO) in partnership with the European Patent Office (EPO) found that the total contribution of IPR-intensive industries to the EU economy accounts for approximately 42% of GDP (€5.7 trillion) and 28% of employment plus another 10% in indirect employment effects in non-IPR intensive sectors. Those sectors also generate a trade surplus of approximately €96 billion with the rest of the world and pay their workers 46% higher salaries than other sectors.

The economic Value of IPRs

This IP infringement report brings together the findings of the research carried out in recent years by the EUIPO, through the European Observatory on the Infringement of Intellectual Property Rights, on the extent, scope and economic consequences of IPR infringement in the EU. Evidence on the economic value of IPRs in the EU economy, the extent to which this value is exploited, the infringement mechanisms used to capture that value and the actions being taken in response to these challenges are outlined and discussed in the report as well.

According to a study carried out by EUIPO and the Organization for Economic Co-operation and Development (OECD) in 2019, estimates of IPR infringement in international trade in 2016 could reach as much as 3.3% of world trade. Up to 6.8% of EU imports, or €121 billion per year, consist of fake goods. Both sets of figures are significantly higher than those found in study by the two organisations published in 2016, indicating that the problem has grown even more serious in recent years.

Annual Losses of €92 Billion During 2012-16 Due to Counterfeiting

In a series of sectorial studies, the EUIPO fears it has lost sales in 11 sectors in the EU, as a result of counterfeiting. These losses have occurred directly in the industries being analysed and across their associated supply chains and totalled more than €92 billion per year during 2012-16.

Abundant value, lenient sentences and high returns on investment together make it attractive for criminal gangs to engage in counterfeiting activities. The modus operandi of such gangs is becoming increasingly complex as technology and distribution channels evolve, hand in hand with the breadth of products being counterfeited.

How Legitimate Brands Can Suffer Due to Advertising!

The business models adopted by counterfeiters make significant use of the internet to distribute their products and to promote the distribution and consumption of illegal digital content. Internet sites selling counterfeit goods benefit from additional advertising revenues from both “high risk” ads (adult, gaming, and malware) and, paradoxically, also from legitimate brands, which then suffer in two ways from advertising on such sites: damage to their own brand and provision of credibility to the hosting website.

In addition to analysing the supply of counterfeit goods and pirated content, the EUIPO has also studied the demand side, that is, the attitudes of EU citizens towards IPR and their willingness to consume IPR-infringing goods and services. The incentives for consumers to purchase counterfeit goods and to access copyright-protected content illegally include lower prices, easy accessibility and a low degree of social stigma associated with such activities.

In response to these developments the EUIPO, together with public and private partners, is undertaking and supporting a number of actions to meet these challenges.

The Economic and Social Impact of IPR Infringements

The actions by the EUIPO range from providing rights owners with information on the changing infringement landscape and working with Europol on wider responses to IP crime. It also included participating in the funding of a specialised IP crime unit within Europol, supporting the European Commission’s efforts to address the supply of counterfeit goods in third countries and to help Small and Medium-Sized Enterprises (SMEs) protect their IPRs. This was done by providing citizens with information on the availability of legally accessible digital content and on the economic and social impact of purchasing counterfeit goods or accessing digital content illegally.

How the CRI Group™ Can Help You Tackle IPR Infringement

CRI Group’s Intellectual Property Investigations team helps companies identify threats to IP and confidential information internally and throughout their supply chain, develop the appropriate mitigation strategies and investigate suspected infringements.

For further information on IPR infringement or to book a meeting with our experts, click here.

CONTACT US

Headquarter: +44 7588 454959

Local: +971 800 274552

Email: info@crigroup.com

Headquarter: 454959 7588 44

Local: 274552 800 971

Email: info@crigroup.com

NEWSLETTER SUBSCRIPTION