Address Risk with Employee Background Checks

Employee Background Checks

We have all heard of the term “employee background checks”, but what is the exact function of this process? There are inherent risks in the hiring process, including fraudulent claims by candidates. These include everything from relatively minor transgressions, like stretching employment dates, to severe and concerning deceptions, such as claiming unearned degrees or credentials or hiding one’s criminal record. Being aware of these risks is only the first step, and companies that don’t take steps to address them, such as thorough, comprehensive background checks as part of their hiring policies, are putting themselves in peril. Several case studies have shown companies learning this lesson the hard way.

In one recent case, a semiconductor manufacturing company noticed that its finances weren’t adding up. Auditors traced the discrepancies to around the time when a company had hired a new CFO – and so the investigation began. When contacted, the CFO’s previous employers reported that the individual had been terminated due to cash embezzlement, harassment and workplace violence. In the end, the case proved costly to the semiconductor company. The CFO was terminated and prosecuted, but nearly $200,000 had been embezzled, and most of it could not be recovered (it was already spent, as the fraud had been taking place over four years).

Proper background checks and a thorough vetting of references would have exposed the fraudster before he had ever set foot in his office as a CFO. The proactive approach would have saved the company in lost revenues, human resources investment (extensive auditing and investigation) and damage to reputation.

When an organisation is ready to add a critical layer of security to its hiring process, Organisation should consider the following:

- Evaluate the current process: What is the company’s existing, written policy for hiring new employees? How does it address background checks, due diligence, and other issues? Is the process followed in every case?

- Risk areas: Some positions are more sensitive than others. For example, the CFO at the semiconductor company was well-placed to commit fraud. What are some other job positions and responsibilities that have a heightened risk factor?

- Ownership of the process: Ultimately, who has the responsibility of vetting new hires? Is it ownership? Human resources? Individual managers? It might be a collaborative process. All of those involved in hiring should also be involved in implementing a due diligence solution that includes background checks.

- The current workforce: Proper due diligence doesn’t just apply to prospective new hires. The organisation should also use it to evaluate your current workforce periodically. Examine the various roles and personnel at your organisation. Consider a policy that addresses risk areas with background checks to ensure that you don’t have any employees among your ranks that might have criminal backgrounds or other issues that your company is unaware of.

After performing a thorough evaluation of the organisation’s needs in terms of effective pre-and post-employment background checks, it’s time to consider whether to conduct such checks in-house or use an outside expert firm.

Some larger corporations might already have access to dynamic resources for background checks and a team of trained staff to conduct them. Most businesses, however, do not. In such cases, enlisting the services of a firm that conducts background checks as part of its main course of business makes sense. Investing in proper due diligence can save severe problems down the road.

Managing Your People through COVID-19

The COVID-19 pandemic is undeniable, affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses have to adapt quickly to survive, i.e. cutting steps in their hiring process, and no one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook. Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. Read the answers to the following questions:

- How to turn the tide’ on coronavirus crisis?;

- COVID-19 Action point checklist;

- Background Screening: Essential Checks;

- 6 steps for good practice in connection with COVID-19;

- 11 Steps to Reduce Personnel Costs;

- COVID-19 General advice;

- How to remove any danger to your business during COVID-19;

> Download your “Employee Screening during COVID-19: everything you need to know and more!” FREE ebook here!

Frequently Asked Questions about Background Checks.

Get answers to frequently asked questions about background checks/screening cost, guidelines, check references etc. This eBook is a compilation of all of the background screening related questions you ever needed answers to:

-

Does a candidate have to give consent to process a background check/screening?

-

How long does it take to conduct a background check?

-

When should I conduct pre-employment checks?

-

How often should I screen employees?

-

How to collect references, and what to ask?

-

How much does it cost to conduct background checks?

-

What is the difference between employment history verification and employment reference?

-

How do I check on entitlement to work?

-

How to conduct identity checks?

-

What will a financial regulatory check show?

-

Is it possible to identify a conflict of interest during checks?

-

What is a bankruptcy check?

-

What about directorships and shareholding search?

-

Can I have access to a criminal watch list?

-

Anti-money laundering check?

-

Can we conduct FACIS (fraud and abuse control information system) searches?

-

… and MORE!

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

About CRI Group™

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS102000:2013, and BS7858:2019 Certifications is an HRO certified provider and partner with Oracle.

In 2016, CRI Group™ launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification.

ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC™ for more on ISO Certification and training.

CRI®, the only company with BS102000 & BS7858 certifications in Middle East

What is BS7858 & BS102000? The BS7858:2019 standard, “Screening of Individuals Working in a Secure Environment – Code of Practice,” places emphasis on the risk assessment of secure environment workers. The code focuses on the need for tighter controls over the pre-employment screening – and periodic re-screening – of individuals, who in their positions could potentially benefit from illicit personal gain, become compromised, or take advantage of other opportunities for creating breaches of confidentiality, trust or safety. Read more here.

When it comes to providing information security, financial audits, risk assessments, background checks, due diligence and a wide range of anti-fraud related services, maintaining the highest levels of training and expertise is an absolute must. That’s why CRI® Group achieves critical certifications from the British Standards Institute (BSI), the National Association of Background Screeners (NAPBS) and other preeminent groups in the security and anti-fraud field as part of the company’s commitment to its clients.

CRI® Group is the first and only investigative research company in the Middle East to receive the certifications BS102000:2013, Code of Practice for the Provision of Investigative Services, and BS7858:2019, screening of individuals working in a secure environment, from internationally recognised training and certification body BSI. CRI® Group also holds other BSI certifications (more on those within this article).

Founded in 1901, BSI is the UK national standards body that works with thousands of organisations in more than 150 countries. BSI is accredited by 20 local and international bodies. We sat down with CRI® Group President and CEO Zafar I Anjum, CFE, to discuss these certifications and what they mean:

CRI® Group is the only firm of its kind in the Middle East to hold the BS102000:2013 and BS7858:2019 certifications. What led you to embark on gaining these and other certifications from BSI?

Anjum: Just a few years ago, we announced that CRI® Group would be engaging BSI for training and certification on many levels, and these and other certifications are direct results of that initiative. Earning multiple certifications from a distinguished standards body like BSI is a mark of pride for us as it demonstrates expertise in our core services.

BS102000:2013 is the “Code of Practice for the Provision of Investigative Services.” What does this mean?

Anjum: This certifies CRI® Group’s proficiency in providing services regarding fraud risk assessment and investigations, forensic accounting, intellectual property (IP) investigations, due diligence and background investigations, debt collections, corporate security consulting and investigation, pre-and post-employment screening and fraud and crime investigations.

BS7858:2019 denotes “Security Screening of Individuals Employed in a Security Environment.” Please tell us more about this certification.

Anjum: This recognises CRI® Group’s expertise in screening services including identity checks, financial checks, employment checks and criminal records checks. CRI® Group implemented this standard with regular external audits conducted by BSI and adhered to recommendations specifically vetting and conducting employment background screening of security personnel seeking affiliations with security companies.

How does this relate to CRI® Group’s EmploySmart program?

Anjum: Background screening professionals must be on the cutting edge of industry technology and resources – while also staying educated on the changing laws and regulations that govern the field. At CRI® Group, we are proud to provide the most extensive and thorough background screening services as part of our EmploySmart program.

CRI® Group also holds the certifications ISO/IEC 27001:2013, Information Security Management System and you are a credentialed NAPBS (National Association of Professional Background Screeners) Research Provider. Congratulations on these distinguished credentials!

Anjum: Thank you. We are pleased to have our expertise in these areas recognized by BSI, NAPBS and other leading bodies, and we will continue to strive to provide the top level of service for businesses to help them prevent and detect fraud.

BS7858:2019, a new way to mitigate employee risk during COVID-19

The far-reaching impact of the COVID-19 outbreak has affected virtually every business and economic sector worldwide, and depending on the global region, has hampered (on various levels) the ability to conduct proper and thorough background screening investigations. In the United Kingdom and the United Arab Emirates, the countrywide lockdowns forced leaders to close sites and send their workforce home. Many are having to learn how to manged people working from home (WFH) or remotely for the first time. The previous concerns about productivity, privacy and protecting sensitive information only grew more with the practice of WFH. They highlighted the vital importance of pre-employment background screening and background investigations. BS7858:2019: the revised standard for screening individuals working in secure environments offers a complete solution.

Find out how you can mitigate employee risk during this pandemic with BS7858:2019

The revised BS7858:2019 standard enables organisations to demonstrate a commitment to safeguarding their businesses, employees, customers and information utilising widely accepted methods that focus on risk assessment and top-down management involvement in the company’s employment policies and practices. In establishing policies and practices around the standard, organisations can show that they place a high value on hiring individuals who possess integrity. Organisations can then task them with responsibilities designed to keep their co-workers, customers and information safe from the negative forces that have become more prevalent in today’s ever-changing COVID-19 world.

BS7858:2019, everything you need to know and more!

The price of a bad hire has far-reaching consequences for any business, including productivity loss, decreased employee morale, risks to employee safety and increased exposure to costly negligent hiring claims and potentially devastating litigation. The premise behind the standard is to safeguard employers from bad or fraudulent hires. Cases of organisations that forego conducting due diligence on a new hire – especially a hire with high-risk exposure – often end badly for those organisations. At CRI Group we know how important is your background screening to your company’s success and to give you an idea of what is new we have produced this playbook detailing the differences between BS7858:2012 standard and the new BS7858:2019 standard.

Download your “BS7858:2019, everything you need to know and more!” playbook here…

Managing your people through COVID-19

The COVID-19 pandemic is undeniable affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses are having to adapt quickly in order to survive, i.e. cutting steps in their hiring process, and no-one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook. Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to effectively stay ahead of COVID-19. Read the answers to the following questions:

- How to turn the tide’ on coronavirus crisis?;

- COVID-19 Action point checklist;

- Background Screening: Essential Checks;

- 6 steps for good practice in connection with COVID-19;

- 11 Steps to Reduce Personnel Costs;

- COVID-19 General advice;

- How to remove any danger to your business during COVID-19;

- … and more!

Download your “Employee Screening during COVID-19: everything you need to know and more!” FREE ebook here!

Frequently asked questions about background checks

Get answers to frequently asked questions about background checks/screening cost, guidelines, check references etc. This eBook is a compilation of all of the background screening related questions you ever needed answers to:

- Does a candidate have to give consent to process a background check/screening?

- How long does it take to conduct a background check?

- When should I conduct pre-employment checks?

- How often should I screen employees?

- How to collect references and what to ask?

- How much does it cost to conduct background checks?

- What is the difference between employment history verification and employment reference?

- How do I check on entitlement to work?

- How to conduct identity checks?

- What will a financial regulatory check show?

- Is it possible to identify a conflict of interest during checks?

- What is a bankruptcy check?

- What about directorships and shareholding search?

- Can I have access to a criminal watch list?

- Anti-money laundering check?

- Can we conduct FACIS (fraud and abuse control information system) searches?

- … and MORE!

About us…

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI® Group also holds BS102000:2013 and BS7858:2019 Certifications is an HRO certified provider and partner with Oracle.

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organizations. Contact ABAC® for more on ISO Certification and training.

MEET THE CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

BS7858:2019 – everything you need to know and more!

The recent update of the BS7858 standard, “Screening of Individuals Working in a Secure Environment – Code of Practice,” places emphasis on the risk assessment of secure environment workers. The code focuses on the need for tighter controls over the pre-employment screening – and periodic re-screening – of individuals, who in their positions could potentially benefit from illicit personal gain, become compromised, or take advantage of other opportunities for creating breaches of confidentiality, trust or safety.

What is BS7858?

BS7858 stands for “Screening of Individuals Working in a Secure Environment – Code of Practice,” The BS7858 is a code of practice released by BSI (British Standards Institution), a business standards company which supports companies in achieving excellence within their field, and continuously boosting performance. Introduced in 2013, the standard was updated in September 2019 and is now considered to be the industry standard for all screening in employment, despite its original intention for use in security environments only. This code was meant to provide a critical security standard that guided employers on the screening process for security staff before offering full employment. However, the new update has widened the scope of this code.

This British Standard helps employers to screen personnel before they employ them. It gives best-practice recommendations, sets the standard for the screening of staff in an environment where the safety of people, goods or property is essential. This includes data security, sensitive and service contracts and confidential records. It can also be applied to situations where security screening is in the public’s interest. It sets out all the requirements to conduct a screening process. It covers ancillary staff, acquisitions and transfers, and the security conditions of contractors and subcontractors. It also looks at information relating to the Rehabilitation of Offenders and Data Protection Acts. CRI Group is the first and only investigative research company in the Middle East to receive the certifications BS7858:2019 and BS102000:2013, Code of Practice for the Provision of Investigative Services from internationally recognised training and certification body BSI.

Change of scope

The change of scope is possibly the biggest change of the standard. In the old document, the standard concerned the security sector only. However, the scope has been amended to allow organisations in all environments to adopt the standard when employee screening. And due to the current pandemic, this update is more significant than ever. There is a specific section of the standard that relates to risk management which states: “An integral part of risk management is to provide a structured process for organisations to identify how objectives might be affected. It is used to analyse the risk in terms of consequences and their probabilities before the organisation decides what further action is required”.

BS 7858:2019 lays out the scope of “obtaining personal background information to enable organisations to make an informed decision, based on risk, on employing an individual in a secure environment.” Those workers include business owners, directors, partners, silent partners and shareholders holding more than 10% of the business; managers, area managers, department managers, screening managers and staff; installers and service crew; security personnel; and office supervisors and staff with access to customer and system records.

The amended guidelines of the standard put the onus on the organisation’s top management to demonstrate that they are focused on the aspects of the business where the most risk lies, and the particular personnel roles that are involved within those risks areas. This is particularly important because, as the standard states, the “organisation retains ultimate responsibility for an outsourced screening process and is required to review the completed screening file.” Risks assessment includes examining specific roles that involve financial tasks, data security, management of goods, property risks or any number of “people risks” such as roles with direct access to vulnerable adults and children.

To that end, management is charged with ensuring that the organisation has proper and adequate resources and infrastructure in place to manage the adequate vetting of high-risk personnel. Management is tasked with the response and that there is a firm commitment at the top level to manage and support the coordination required to execute the screening process. Finally, management is tasked with ensuring that such responsibilities are correctly assigned and communicated throughout the organisation. The guideline also eliminates from its original text in 2012, a requirement to produce character references as part of the screening process. This decision was based on the supposition that such references are now deemed as potentially weak and difficult to verify. Managing risk effectively is essential to ensure businesses succeed and thrive in an environment of constant uncertainty. ISO 31000 aims to simplify risk management into a set of clearly understandable and actionable guidelines, that should be straightforward to implement, regardless of the size, nature, or location of a business.

BS7858:2019, a new way to mitigate employee risk during COVID-19

The far-reaching impact of the COVID-19 outbreak has affected virtually every business and economic sector worldwide, and depending on the global region, has hampered (on various levels) the ability to conduct proper and thorough background screening investigations. In the United Kingdom and the United Arab Emirates, the countrywide lockdowns forced leaders to close sites and send their workforce home. Many are having to learn how to manged people working from home (WFH) or remotely for the first time. The previous concerns about productivity, privacy and protecting sensitive information only grew more with the practice of WFH. They highlighted the vital importance of pre-employment background screening and background investigations. BS 7858:2019: the revised Standard for screening individuals working in secure environments offers a complete solution.

The revised BS7858 standard enables organisations to demonstrate a commitment to safeguarding their businesses, employees, customers and information utilising widely accepted methods that focus on risk assessment and top-down management involvement in the company’s employment policies and practices. In establishing policies and procedures around the standard, organisations can show that they place a high value on hiring individuals who possess integrity. Organisations can then task them with responsibilities designed to keep their co-workers, customers and information safe from the opposing forces that have become more prevalent in today’s ever-changing COVID-19 world. Find out more on how you can mitigate employee risk during this pandemic with BS7858:2019.

Playbook BS7858:2019, everything you need to know and more!

| The price of a bad hire has far-reaching consequences for any business, including productivity loss, decreased employee morale, risks to employee safety and increased exposure to costly negligent hiring claims and potentially devastating litigation. The premise behind the standard is to safeguard employers from harmful or fraudulent hires.

Cases of organisations that forego conducting due diligence on a new hire – especially a hire with high-risk exposure – often end badly for those organisations. At CRI Group we know how important is your background screening to your company’s success and to give you an idea of what is new we have produced this playbook detailing the differences between BS7858:2012 standard and the new BS7858:2019 standard. |

|

Managing your people through COVID-19

The COVID-19 pandemic is undeniable affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses are having to adapt quickly to survive, i.e. cutting steps in their hiring process, and no-one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook.

Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. Read the answers to the following questions:

|

|

Frequently asked questions about background checks

Get answers to frequently asked questions about background checks / screening cost, guidelines, check references etc.

This eBook is a compilation of all of the background screening related questions you ever needed answers to:

|

Taken as a whole, is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions. |

Let’s Talk!

BS7984:2008 accredited companies (such CRI Group) highlight to their clients that their security personnel are staff that can be trusted and relied upon to complete a high-quality job as the screening process highlights the level of conduct that they have presented in the past. This reassures the safety of the people, goods and property that they have been hired to protect. If you have any further questions or interest in implementing compliance solutions, please contact us.

About the Author

Zafar I. Anjum, is Group Chief Executive Officer of Corporate Research and Investigations Limited “CRI Group” (www.crigroup.com), a global supplier of investigative, forensic accounting, integrity due diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center-QFC, and the Abu Dhabi Global Market-ADGM, CRI Group safeguards businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, USA, and the United Kingdom.

Zafar Anjum, MSc, MS, LLM, CFE, CII, MABI, MICA, Int. Dip. (Fin. Crime), Int. Dip. (GRC)

CRI Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA, United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

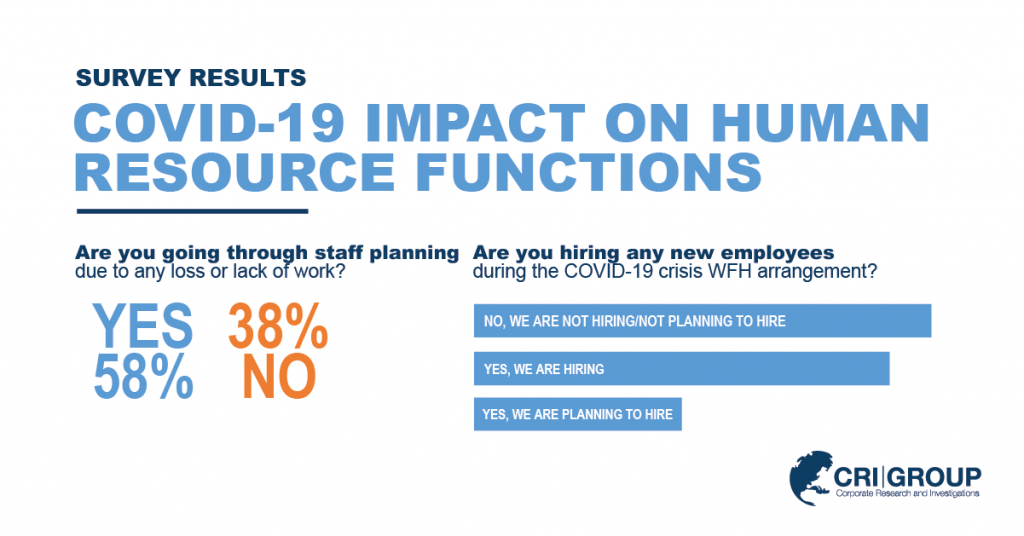

Background Screening Survey: COVID-19 is Impacting HR

An overwhelming number of COVID-19 background screening survey respondents said that the COVID-19 pandemic is affecting human resources at their company. There are also concerns about fraud, and the protection of confidential information as a large percentage of the workforce has gone virtual in work-from-home (WFH) arrangements. CRI® conducted the survey to measure the pulse of human resources during a challenging time in business worldwide. The largest number (38 per cent) of survey participants were human resources professionals, but respondents also included managers (19 per cent), executives, directors, administrators (27 per cent) and other roles.

Survey results

Questions ranged from the impact of COVID-19 on the workforce to issues surrounding fraud and data protection. Most respondents said they are having to approach human resources issues in new ways with the changed landscape of conducting business during a pandemic. The following are a few of the major takeaways from the survey:

- Few in the HR world are untouched by COVID-19: More than 88 per cent of respondents said that the pandemic is having an impact on their HR operations, and 65 per cent are considering new ways to retain employees during the crisis.

- While there have been layoffs, some companies are hiring during the pandemic: 57 per cent of respondents said they are either currently hiring, or planning to hire, new employees under a work-from-home arrangement. This makes employee background screening a crucial issue that cannot be put on hold during COVID-19.

- They’ve developed ways to ensure that work-from-home policies are being followed: Organizations do this through “observations from supervisors, response rate, time consumption in assignment completion” and “by having frequent video calls on Zoom,” among other methods.

- Employee background screening is lacking: When asked if all of the employees who are authorized to access sensitive information (e.g., IT department) have been screened from criminal, media, employment history perspective prior to any work-from-home arrangement, 54 per cent answered that they were not.

- On the other hand, most companies do conduct background screening of some type: In fact, 85 per cent do so, which is important because many companies have learned that trust can be misplaced. While an overwhelming 92 per cent said they trust their employees with confidential data, background screening can help verify that your employees aren’t hiding anything in their backgrounds that might put your company at risk.

- Companies understand the fraud risk factor during the pandemic: Nearly 77 per cent of HR professionals accept that there is a risk that employees can initiate fraudulent activity because of the work-from-home arrangement.

- They identified the most critical background checks for employees: These include employment verification, identity checks, reference checks, education verification and criminal background screening.

- Getting the best employees is their highest motivation: When asked what the most important factors are for conducting background screening, the top responses were to improve quality of hires (73 per cent), protecting employees, customers (54 per cent), mandated by law/regulations (38 per cent) and protect company reputation (also 38 per cent).

- HR challenges persist in conducting background screening: The biggest hurdle, according to respondents, is the length of time to get results (69 per cent). Other top challenges include data accuracy (46 per cent) and cost (38 per cent). This is why finding a provider that can deliver quality checks in the shortest timeframe and reasonable cost possible is of the utmost importance for companies dealing with background screening uncertainty during the pandemic (and beyond).

Most organizations represented in the survey were privately held, but the participants also included publicly-held companies and nonprofits. They ranged from under 100 employees to 5,000 or more. The survey provides valuable information for companies, employees, and human resources professionals and teams who serve them. It also sheds light on the critical need for increased employee background screening and data protection during a tumultuous time.

Take part of this survey

Your opinion matters! Participate in the background screening survey now and let us know how COVID-19 and WFH have affected your business.

COVID-19 background screening guide

CRI® has developed EmploySmart™, a robust pre-employment background screening service to address the concerns and issues discussed in the survey. While businesses have changed and adapted during COVID-19, the risks posed to companies remain – and in some cases, are increased. Fraudsters are opportunists who take advantage of vulnerabilities, and a time of crisis presents many changes and deviations from usual business practices.

The rise in recruitment fraud is creating a number of challenges – last year it cost £23 Billion just in the UK. The COVID-19 is set to cost even more. And what is particularly worrying for any HR professional is that fraud in recruitment regularly sees genuine businesses used to add legitimacy to illegal behavior. CRI® developed the complementary COVID-19 Background screening guide. Taken as a whole, this eBook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to effectively stay ahead of COVID-19.

Read more on how to manage the hiring risks during COVID-19. Read the answers to the following questions:

- How to turn the tide’ on coronavirus crisis?;

- COVID-19 Action point checklist;

- Background Screening: Essential Checks;

- 6 steps for good practice in connection with COVID-19;

- 11 Steps to Reduce Personnel Costs;

- COVID-19 General advice;

- How to remove any danger to your business during COVID-19;

- … and more!

Download your “Employee Screening during COVID-19: everything you need to know and more!” FREE ebook here! Stay protected during COVID-19 so that when the crisis passes, your company is whole and in a position to thrive, while mitigating any risks that might occur. This eBook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to effectively stay ahead of COVID-19.

Ethics & Compliance Hotline

We would like to introduce a new Ethics & Compliance Hotline. This hotline is available to all employees, as well as clients, contractors, vendors and others in a business relationship with CRI® and ABAC® Group. If you find yourself in an ethical dilemma or suspect inappropriate or illegal conduct, and you feel uncomfortable reporting through normal channels of communication, or wish to raise the issue anonymously, use CRI® Group’s Compliance Hotline in below mentioned ways or provide us with your complaint online on the form below.

REPORT HERE!

Ethics and Compliance Hotline is an anonymous reporting mechanism that facilitates reporting of possible illegal, unethical, or improper conduct when the normal channels of communication have proven ineffective, or are impractical under the circumstances. The Compliance Hotline is a secure and confidential reporting channel managed by an independent provider. When reporting a concern in good faith, you will be protected by CRI® Group’s Non-Retaliation Policy. At CRI®, we are committed to having an open dialogue on ethical dilemmas regardless. Speak up – report any illegal, unethical, or improper behavior.

READ MORE!

About CRI® Group

Based in London, CRI® works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI® also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI® launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organizations. Contact ABAC® for more on ISO Certification and training.

#InTheNews: Employee Background Screening

Macy’s Reaches Agreement in Lawsuit Involving Employee Background Screening

ESR News reported that “an agreement has been reached in the case of The Fortune Society v. Macy’s brought under Title VII of the Civil Rights Act of 1964 and Fair Chance Act (FCA) of the New York City Human Rights Law (NYCHRL) that sought to address criminal background checks by Macy’s in New York City, according to a press release from the National Association for the Advancement of Coloured People (NAACP) Legal Defence and Educational Fund (LDF).” The case is concerned with Macy’s (a popular American retail store) unlawful practices concerning employee background screening and the discrimination against job applicants who have old, irrelevant, or minor criminal offences.

New Artificial Intelligence Social Media Background Screening Product

In society, online presence has become more prominent, social media checks and background screening have become increasingly important.“Peopletrail, a leading US-based consumer reporting agency, providing advanced background checks and pre-employment screening solutions globally, announces a new AI-powered social media background screening product for small and medium-sized businesses”. “It can be very easy to violate state and/or federal laws if you are unaware of compliance rules and regulations”, so it is very important to do in-depth background checks while adhering to compliance regulations.

Anti-Discriminatory Laws in Background Screening

In the midst of a global pandemic, with low employment rates, there is increased competition for job roles that are available. This means that with background screening being essential to make sure that those qualified and suitable are attaining job roles, it is easy for discrimination to take place. Benzinga reported, “discrimination continues to be a concern in the hiring process, even as municipalities and states pass Ban-the-Box legislation in an effort to create a more equal hiring process. However, challenges remain in times of higher job loss, as witnessed during the recent Covid-19 pandemic”

Sign up for risk management, compliance, corporate and background investigations, business intelligence and due diligence related news, solutions, events and publications.

Employee Background Screening during COVID-19

The COVID-19 pandemic is undeniable affecting the world. And the situation is changing at an hourly rate. Businesses are having to adapt quickly in order to survive, i.e. cutting steps in their hiring process, and no-one knows how this will play out. However, there are ways you can mitigate the impact, EmploySmart™ is a full in-depth (and fast) background screening service of employees and candidates at all levels, and industries.

The virus is, unsurprisingly, having a huge impact on businesses and the recruitment industry is certainly not immune to that. Businesses are having to adapt quickly in order to survive and it is very possible that the legacy of COVID-19 may forever change the nature of recruitment and the workplace landscape. The rise in recruitment fraud is creating a number of challenges – last year it cost £23 Billion just in the UK. The COVID-19 is set to cost even more. And what is particularly worrying for any HR professional is that fraud in recruitment regularly sees genuine businesses used to add legitimacy to illegal behaviour.

Employee Background screening survey: Take part now!

As all organisations respond to the threat of the coronavirus (COVID-19), human resource management functions have important roles to play. CRI Group is conducting this research to find out HR operations in the COVID-19 situation and how did it affect daily HR activities, including monitoring, hiring new employees, and managing employee risks, etc. We would be very thankful if you could take a few minutes to fill a questionnaire. This survey should take just 4-5 minutes to complete.

Your survey responses will remain completely confidential and your name will not be given to any external parties and no personal details will be disclosed publicly. Once you submit your answers, you will be able to freely download “The best practices of Employee Background Screening” presented by CRI Group’s CEO Z. Anjum and an infographic of the “Top 10 things every organisation should know about employee background checks”. Thank you for taking the time to help us with your answers.

9 ways COVID-19 impacted background checks

The COVID-19 pandemic has disrupted business as we know it. How is the crisis still affecting your organization? Are you still experiencing a temporary decline in hiring, or does hiring seem to be non-stop? No matter your industry, the hiring environment has changed because of COVID, probably forever. Workforces are still restricted mainly in the way they can work, and many are still in some form of lockdown or self-isolation. This poses a lot of challenges when it comes to recruitment, such as:

1. Navigating the new realm of virtual recruitment;

2. High demand for recruitment in specific sectors (e.g. pharmaceuticals, retail supermarkets, delivery companies, transportation, retail banks, healthcare);

3. Accommodating for existing staff working from home;

4. The need to hire employees (in high demand) with a specific skill set (e.g. digital marketing, IT teams, customer service);

5. The overwhelming amount of applicants without the right qualifications due to industries struggling;

6. Delayed hiring processes;

7. The need to expand candidate reach because of the lack of appropriate applicants;

8. Losing applicants to competitors;

9. Considering the long-term and short-term economic impact of hiring during the uncertainty of the pandemic.

The number one challenge companies will face as they restart hiring is that their people and financial resources may be dramatically limited. They’ll have to think about efficiencies in the way they hire and the people they bring on.When they post positions, they’re going to be flooded by applicants. How will a limited HR staff sort through 400 online applications to find the best two?

Companies are faced with the difficult task of hiring quickly and economically whilst managing the day to day risks and challenges. And the situation is changing at an hourly rate. Businesses have to adapt rapidly to survive, i.e. cutting steps in their hiring process, and no one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook. Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively.

Regardless of the industry, you work in, and the likelihood is that your normal hiring processes and background checks would have been affected by the COVID-19 pandemic forever.

Key Impacts of COVID-19

Lockdown drastically reduced the data sources needed to carry out checks for incoming employees, and many vital workers would have been affected by this. As the lockdown restrictions are being lifted, sources are slowly becoming available, but the uncertainty of a second wave could put them under threat again. The economic impact of Covid-19 resulted in many employees being furloughed. This would have also restricted the availability of accessing data sources.

Did you know that 1 in 3 furloughed UK employees was pressured to work? Read more about furlough fraud and how it looks like.

Employsmart™: background checks during COVID-19 and more

As a background screening provider, CRI® Group can support you by proactively monitoring the data sources and working with them to understand when and how to carry out verification requests. By working with a background screening partner, we can tailor your screening needs to the challenging times we’re facing. EmploySmart™ is CRI® Group’s robust pre-employment background screening service that helps companies of any size and industry avoid negligent hiring liabilities. We know you have lots of questions. We compiled a FAQ ebook, read now or download your FREE ebook.

During the COVID-19 pandemic, it’s imperative to ensure a safe work environment for all of your employees. EmploySmart™ can be tailored to meet the requirements of each specific position within your company. As a leading worldwide provider of specialised local and international employment background screening, CRI® Group’s services are second-to-none in providing risk mitigation and peace of mind in the hiring process.

Learn more about how EmploySmart™ can help your company stay protected during these strange and uncertain times. Contact CRI® Group today.

Who is CRI® Group?

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI® Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body that provides education and certification services for individuals and organisations on a wide range of disciplines and ISO standards, including ISO 31000:2018 Risk Management- Guidelines, ISO 37000:2021 Governance of Organisations, ISO 37002:2021 Whistleblowing Management System, ISO 37301:2021 (formerly ISO 19600) Compliance Management system, Anti-Money Laundering (AML) and ISO 37001:2016 Anti-Bribery Management Systems.

FAQ: Employment Screening

Want to know what red flags are most often found on résumés and employment applications? CRI® Group’s EmploySmart™ experts provided some statistics on their latest pre-and post-employment screening engagements, giving insights into where companies are most vulnerable in the hiring process. The operations team found that providing incorrect employment details is the most common red flag, as it was uncovered in about 4.5 per cent of background screenings. This is followed by providing incorrect education degree details and having adverse media (unfavourable news or online mentions), both at 2.33 per cent.

Most employers would probably say that when it comes to educational background, the only thing worse than providing incorrect degree information would be outright claiming a fake degree – which occurred in nearly 2 per cent of cases. Other red flags included:

- Having a criminal record (1.5 per cent).

- A civil litigation record (1.27 per cent).

- Providing a fake address (also 1.27 per cent).

To round out the findings, the operations team found bankruptcy records, fake certificates and negative references among 0.85 per cent of those screened.

Get answers to frequently asked questions about background checks/screening cost, guidelines, check references etc. This eBook is a compilation of all of the background screening related questions you ever needed answers to:

- Does a candidate have to consent to process a background check/screening?

- How long does it take to conduct a background check?

- When should I conduct pre-employment checks?

- How often should I screen employees?

- How to collect references, and what to ask?

- How much does it cost to conduct background checks?

- What is the difference between employment history verification and employment reference?

- How do I check on entitlement to work?

- How to conduct identity checks?

- What will a financial regulatory check show?

- Is it possible to identify conflict of interest during checks?

- What is a bankruptcy check?

- What about directorships and shareholding search?

- Can I have access to a criminal watch list?

- Anti-money laundering check?

- Can we conduct FACIS (fraud and abuse control information system) searches?

- … and MORE!

Taken as a whole, it is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions.

Download your “Employee Background Screening FAQ” FREE ebook now!

Responsible Management and CEOs

As of 13 August 2020, COVID-19 has affected more than million people globally, including 744,385 deaths, reported to WHO. The virus has also had severe economic implications, leaving organizations facing a unique set of new challenges that can only be summed up in one word: uncertainty. And the only way to navigate these uncertain times is through leadership. This is critical right now, as COVID-19 has magnified societal vulnerabilities. Good leaders can and should lead society into a new “normal”. However when Harvard economist Greg Mankiw argued in a New York Times opinion piece that CEOs are qualified to make profits, not lead society this is somewhat inadequate to the times we live in now. Furthermore, Doug Sundheim, contributor at Forbes, has argued in his article “CEOs Have A Responsibility To Help Lead Society” that Greg’sc arguments just simply do not fit today’s business models. This “shareholder-first business model” originated from 1970, however 50 years on a lot has changed and at a time when over 70% of the largest entities on earth are corporations, not nations, Mankiw’s view is troubling.

The sheer number of corporations around the world should make us understand that business impacts societies on a global scale; therefore, business leaders have the responsibility to at least consider those societies and how they impact them. The singular management goal of CEOs is no longer about maximizing returns to shareholders, but to support society as business has grown more interconnected and complex. Today, business and society are weaved together in an intricate way, both depending on the other for stability and success.

The COVID-19 pandemic has also changed businesses and created a surge in the number of positive collaborations between companies, institutions and governments. Our article “COVID-19 prompted innovative leadership” reflects how Mankiw fails to grasp the world in which CEOs are now in fact leading communities and helping societies.

Mankiw asks the reader to imagine having to make an executive decision and how effective and simplier it is when your only priority is profits, and not the wider set of stakeholders – i.e., employees, suppliers, communities, and shareholders. Mankiw defends the idea that corporate management’s mandate should be the narrow self-interest of achieving greater profits for shareholders, not broad social welfare. He goes on to list several additional hypothetical questions. A social-driven leader would have to consider:

- How do you weigh those losses against the gains to the would-be workers at the new plant?

- How much will the closure of the old plant hurt its workers and their community?

- Does it matter whether the new plant is in South Carolina, providing jobs for American workers, or in Mexico, providing jobs for Mexican workers?

- How should you weigh the benefit of electric cars in mitigating climate change?

- How should you balance these concerns against the interests of shareholders, who entrusted you to invest their savings?

However, the above questions are now part of the many new demands from consumers, talent and governments.

Consumers have changed; they are no longer only interested in the end product. Consumers are demanding more from companies for their buy-in. And every corporate leader has to include some version of the above questions in their considerations if they want to succeed. Top CEOs say social responsibility should be prioritised over profits proving that social responsibility planning; it’s officially basic business planning. Last year the bosses of 181 Leading US’s biggest companies dropped the shareholder-first principle – they changed the official definition of “the purpose of a corporation” (from making the most money possible for shareholders) to “improving our society.”

Most successful CEOs and corporate leaders have profit in mind, and they always will; but they are also considering the needs of a variety of stakeholders, including the communities they impact. In this day and age, CEOs and corporate leaders are rising up to social expectations and are balancing the demands of multiple stakeholders.

Mankiw questioned CEOs’ and corporate leaders’ ability to be broadly competent social planners. Paul Polman (former Unilever CEO) talks about creating collective courage. He rightly argues that it’s difficult for one industry player to impact an issue like reducing greenhouse gases because of the loss of competitiveness. However, if 20% of industry players come together, they can begin tipping the scales. It’s starting to happen. In this way, by unifying their efforts, corporations, governmental agencies, and NGOs can partner to lead society.

CEOs and other leaders now find themselves in a changed world … they can and should play a variety of leadership roles that move beyond narrow profit maximization. This is a social responsibility, not broad social planning. Short-term earnings no longer feature in the top of the mission statement for most successful companies. We’re starting to find our way back to a more balanced view, and we need CEOs’ leadership in the process.

Mankiw admits that the world needs people to look out for the broad well-being of society – elected leaders who are competent and trustworthy – but those people are not CEOs. However, Mankiw fails to acknowledge just how much influence CEOs and corporate leaders have over our elected officials and the legislative process. Today, large corporations and their associations outspend labour and public interest groups 34 to 1 on lobbying efforts in the US.

In today’s high-risk environment, businesses have to pay attention to their social and environmental roles not only due to demand, but out of responsibility for the damage they (can) cause. For example, companies that contribute to, but then deny, climate change – the attorneys general of several American states launched investigations into ExxonMobil and whether they had committed fraud by sowing doubts about climate change – even as its own scientists knew it was taking place to firms involved in botched Grenfell Tower revamp refusing to accept responsibility for tragedy. Then there is Chamath Palihapitiya, former Facebook executive, who expressed regret for his part in building tools that destroy ‘the social fabric of how society works’. Companies are responsible for causing great damage on a human scale. We have to hold companies, CEOs and brands accountable for their destructive impact in today’s society; while they have a responsibility to support and help lead society.

CEOs and corporate leaders are exerting immense influence behind the scenes; therefore, qualified CEOs and corporate leaders should step up and help lead on the thorny economic issues of the day. However, with great power comes great social responsibility. Not all of the corporate leaders are equipped to lead societies; therefore, they should take a significant weight off the scale. Contrary to what Mankiw and others of his mindset might think, we must continue to demand more from our corporations, their boards, and their CEOs and leaders. Corporate leaders can make a unique and lasting positive impact, too.

About us…

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI® Group also holds BS102000:2013 and BS7858:2019 Certifications is an HRO certified provider and partner with Oracle.

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organizations. Contact ABAC® for more on ISO Certification and training.

MEET THE CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

7 Traits of a Resilient Leader

Every successful leader has encountered a challenging scenario at some point in their career. The unprecedented COVID-19 pandemic, however, has forced leaders to face unforeseen new challenges. With the pandemic’s colossal impact on operations, workforces, profits and supply chains across the globe, all eyes are on leadership to guide their businesses through this crisis. Resilient Leader

Resilient leaders are generally seen as more effective, making them an asset to any business; but what is resilience and how can it be applied to your management skills?

What is Resilience?

Resilience is the capacity to recover quickly from difficulties; it is a further evolution of stress management. This makes it a “no brainer” as to why resilience is such a popular concept in today’s business environment. Many businesses are pushing the concept of resilience as a way of helping workers better cope with the stresses and strains of the modern-day office and unlock their performance potential.

In this article, we look at seven essential qualities that characterise resilient leaders, and how to increase your resilience. In general, resilient leaders:

- Show empathy

- Are adaptable and able to improvise

- Are self-aware and open to feedback

- Take calculated risks

- Keep a positive attitude

- Develop others

- Communicate effectively

1. Resilient Leaders Show Empathy

COVID-19 has generated one of the greatest challenges and, simultaneously, one of the greatest opportunities for resilient leaders – at all levels. According to a Gallup U.S poll, six in 10 people are “very” or “somewhat worried” that they or a family member will be exposed to COVID-19 (Gallup, 2020). During this crisis, emotional management is even more crucial than ever. According to studies carried out by Development Dimensions International (DDI), empathy is the most critical leadership skill. Leaders who display compassion, authenticity and vulnerability – and are capable of apologising when they’re wrong and handle criticism without blame – create strong emotional bonds with their teams (DDI, 2020).

The most resilient (and effective) leaders can demonstrate empathy and a high level of emotional intelligence. When your team feels understood, they feel more motivated and more confident to contribute cultivating stronger conversations, ideas and debate. As Mark Cuban shared in a recent interview: “How you treat your employees today will have more impact on your brand in future years than any amount of advertising, any amount of anything you literally could do” (Just Capital, 2020).

2. Resilient Leaders Are Adaptable

With COVID-19 infecting approximately 311,641 people in the UK alone, health officials suggested using hand sanitiser as the easiest way to prevent the spread of the disease. Consequently, these announcements led to panic buying (Euronews, 2020). In this type of situation, a resilient leader should be able to visualise this action as an opportunity – for example, dozens of spirit manufacturers across the UK started to produce hand sanitisers (i.e. BrewDog and Leith Gin). This is a classic example of an instant attitude adjustment – looking at what they can do as opposed to what they can’t (Telegraph, 2020).

When faced with change, resilient leaders can focus on the things within their business that they can still control. Whether impacted by new technologies, environmental challenges or even ethical dilemmas, the modern business landscape is always changing. A resilient leader needs to be flexible and adaptable to succeed. Is flexibility part of your leadership style?

3. Resilient Leaders Are Self-Aware and Coachable

According to Health Care Business Today, self-awareness and coachability are “The Two Most Important Leadership Traits” (Health Care Business Today, 2019). We think so, too. Resilient leaders are self-aware, confident, and most of all, able to recognise their strengths and overcome their weaknesses. Resilient leaders are open to feedback, ask for feedback and are always demonstrating a real effort to improve.

4. Resilient Leaders Take Calculated Risks

Successful leaders earned their success through taking calculated risks. When Amazon CEO Jeff Bezos launched AmazonFresh, he was scrutinised by others because he didn’t choose a successful delivery or supermarket executive to run the venture. Instead, Bezos selected a team that had previously run a web-based food delivery service in the ‘90s (which collapsed after two years in business). Why? Bezos knew that the team had learned from their failure, which made them the perfect choice to succeed with a new project.

Resilient leaders like Bezos take calculated risks while accepting that failure is a by-product of innovation and success. They learn to become comfortable with being uncomfortable, and flourish as the world changes around them.

5. Resilient Leaders Can Keep a Positive Mindset

The impact of COVID-19 is tough to manage. It is vital to have a positive mindset that can influence fellow professionals and raise team morale while maintaining business momentum.

Under the challenging circumstances posed by the COVID-19 crisis, a resilient leader needs to be enthusiastic, offer praise for success, and give credit when it’s due. American psychologist Carol Dweck has stated in her book “Mindset: The New Psychology of Success” that “a change of mindset must happen before other positive transformation can occur.”

Resiliency is needed when we encounter failure. As a resilient leader, you shouldn’t view failure as final, but as a necessary step to move further along your journey.

6. Resilient Leaders Develop Others

The most resilient leaders are concerned about the development of their teams. Developing others helps everyone to learn from their mistakes. We continue to find that leaders who want and accept honest feedback for themselves are more likely to give productive feedback and coaching to others.

7. Resilient Leaders Communicate Effectively

Effective communication helps teams understand changes, expectations and new directions. This understanding is the key to the success of any team. The most resilient and best leaders always communicate their intentions effectively to others and are willing to help their teams understand a new strategy or direction.

The COVID-19 pandemic is proving to be the ultimate test for business leadership. In times of crisis, only certain individuals can adapt and stand tall amongst the crowd. When it comes to leaders, being able to implement resilience tools and strategies will not only make you a better leader but help the company overall.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Background Screening Red flags: Numbers Don’t Lie

Want to know what types of red flags are most often found on résumés and employment applications? CRI® Group’s EmploySmart™ experts provided some statistics on their latest pre- and post-employment screening engagements, and they give insights into where companies are most vulnerable in the hiring process. background screening red flags

The operations team found that providing incorrect employment details is the most common red flag, as it was uncovered in about 4.5 per cent of background screenings. This is followed by providing incorrect education degree details as well as having adverse media (unfavorable news or online mentions), both at 2.33 per cent.

Most employers would probably say that when it comes to educational background, the only thing worse than providing incorrect degree information would be outright claiming a fake degree – which occurred in nearly 2 per cent of cases. Other red flags included having a criminal record (1.5 per cent), a civil litigation record (1.27 per cent), and providing a fake address (also 1.27 per cent). To round out the findings, the operations team found bankruptcy records, fake certificates and negative references among 0.85 per cent of those screened.

Deception Among Job Seekers is Real

Anytime someone intentionally provides false information in their résumé, they are committing résumé fraud – usually in the hopes of gaining a competitive edge in the hiring process. “There are even business services out there that will knowingly assist candidates with changing their résumé in this way, such as offering advice on how to hide employment gaps or how to add false information that looks realistic. Some will even provide fake transcripts and fake letters of recommendation” (HR Daily Advisor, 2018).

The same goes for fabrications on an application. It can occur anywhere in the process, and the candidate will likely continue to misrepresent themselves in the interview process to maintain their fraud. As mentioned above, helping candidates embellish or even fabricate credentials has become a business unto itself. “On the surface, these appear to be candidates taking desperate measures. But the candidates themselves may not be the only ones at fault. As recruitment has migrated online and become automated … opportunities for scammers have arisen. Professional recruiters, who get placement fees when they land candidates in jobs, have a clear incentive to game the system, Zhao says. They are ‘middlemen who can make significant profit by misrepresenting clients’” (Inc.com, 2019).

There is only one clear remedy and protection method to combat this type of fraud: thorough and comprehensive background checks. Most organisations, however, don’t have the time, resources, or the expertise to conduct the needed level of background screening on their own. This is where CRI® Group’s EmploySmart™ comes in. The robust pre-employment background screening service helps organizations worldwide avoid making uninformed and potentially harmful hiring decisions. As a leading provider of specialised local and international employment background screening, CRI® Group’s uses EmploySmart™ to provide risk mitigation and give business leaders confidence in their hiring process. EmploySmart™ includes a thorough menu of screening that fulfills your organization’s risk management needs. These checks include the following:

- Address verification – one of the red flags discussed above.

- Identity verification – what are they hiding? Falsifying one’s identity is a major red flag.

- Previous employment verification – candidates might claim false employment to beef up their résumés.

- Education & credential verification – screeners check degrees and education history.

- Local language media check – what is uncovered about the candidate in news reports?

- Credit verification & financial history – candidates who conceal financial problems can be a fraud risk (local privacy laws apply).

- Civil litigation record check – lawsuits can indicate red flags, background screening will uncover the details.

- Bankruptcy record check – when hiring someone for a financial or leadership position, it’s important to know if they have bankruptcy filings.

- International criminal record check – checking criminal records is essential for the safety of your employees and your business.

These are just a few of the essential checks that are part of the EmploySmart™ process. CRI® Group’s network spans the Americas, Europe, Africa, and Asia-Pacific for providing international risk management, background screening and due diligence solutions provider. Don’t tempt fate and invite red flags into your business by making risky hires. The proper pre-and post-employment screening will uncover those hidden things that a candidate might not want you to know. Contact CRI® today and learn more about how EmploySmart™ will help provide your organisation with that extra layer of protection you need. Get a FREE QUOTE now!

CONTACT US

Headquarter: +44 7588 454959

Local: +971 800 274552

Email: info@crigroup.com

Headquarter: 454959 7588 44

Local: 274552 800 971

Email: info@crigroup.com

NEWSLETTER SUBSCRIPTION