Background Checks: An Essential Process

There are inherent risks in the hiring process, including deception by individuals seeking to gain an advantage over other candidates. Thorough pre- and post-employment background checks are critical in mitigating these risk factors, helping any organisation stay better protected from fraudulent candidates or unqualified employees.

The advantages of using an expert third-party service to conduct background checks are many. Comprehensive background checks are best performed by industry experts who understand where to find and confirm employee information, from criminal, education and employment history records checks to verification of credentials, training, certifications and other important info claimed by the employee or candidate. An international firm can access resources in geographic regions not serviced or accessible by typical “out-of-the-box” screening services.

Taking this approach puts protection in the hands of agents who are specially trained to use every resource available to provide timely and thorough pre- and post-employment background checks, adding a level of due diligence that allows you to focus on your core business needs. This is why any pre-employment background checks should dig deep enough (within all local laws and regulations) to assess every detail of a job candidate’s claims and credentials, to confirm that the claims match with the facts. An expert team should examine all of the following details of a potential employee:

- Identity: Some job candidates will actually fabricate a new identity, especially if they have something to hide. Proper screening can verify name, addresses, phone numbers, national ID numbers and other identifying information to confirm that they are who they claim to be.

- Credit checks and bankruptcy checks. As permitted by local laws, financial and credit history should be reviewed, as fraud statistics have shown financial distress to be a key red flag for fraudulent behaviour. Has the candidate claimed bankruptcy? Have they dissolved prior companies or are they faced with debtor filings?

- Previous employment verification. Background checks will verify past employers, locations of past employment, dates employed, salary levels, reasons for leaving, position titles, gaps in employment history and pertinent contact information.

- Education and credentials verification. Verification is needed to confirm school grades, degrees and professional qualifications.

- Criminal history. International criminal records searches are critically important, and should include any convictions for the applicant in the requested jurisdictions.

- … and more.

What gets uncovered serve both as cautionary tales and success stories. One client in the medical industry was hiring for a critical management-level position. After finding what appeared to be an exemplary candidate, they engaged thorough pre-employment

The candidate claimed to be a holder of a university degree, which, upon verification, turned out to be ‘fake and forged.’ The applicant also provided a reference letter, which turned out to be fake as well. In short, there was nothing legitimate about the candidate’s educational background. This person would have been a risk on all levels, including patient safety. The client dodged a very real bullet by applying proper background checks, and not hiring someone who was unqualified and untrustworthy.

Don’t take unnecessary risks with your business, assets, investments and reputation. Whenever you are hiring a new employee, conduct a thorough pre-employment background check, best implemented and administered by a third party. After all, a team that specialises in background checks will have a full bank of resources and experienced personal to do the job properly. Hiring new employees should be an occasion marked by excitement, not risk and uncertainty.

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Hiring Process: the 10 Top Risks

10 Top Risks Faced in the Hiring Process

Hiring new employees is an essential part of operating, and growing, a successful business. It is also a process that presents an inherent risk to any organisation. Company insiders often commit fraud and other criminal acts; the very people trusted to work for the business’s best interests. While most employees might be honest and trustworthy, it only takes one to cause major unforeseen problems that can be hard to predict and even more difficult to undo.

Companies that don’t perform pre-employment background checks, or conduct insufficient background checks, are at a particularly high level of risk. According to popular employment site CareerBuilder.com, “Fifty-eight per cent of hiring managers said they’d caught a lie on a resume; one-third (33 per cent) of these employers have seen an increase in resume embellishments post-recession.” Even more staggering, 50% of workers know someone else has lied on their resume (BestLife, 2018). This shows an uptick in recent years and should alarm any business owner or hiring manager/human resources professional as a wake-up call that there is a serious problem.

So what are the most common areas of resume fraud? The following is a rundown of the top 10 ways candidates might show deception in the hiring process:

1. Stretching Dates of Employment:

Someone who can only stay at each job for a few months at a time is likely to be a concern for a prospective employer. For that reason, they might fudge their employment dates to make it look like they have longer ranges of employment in certain positions.

2. Inflating Past Accomplishments and Skills:

The candidate might claim major successes; for example: “implemented new CRM process company-wide” – when in reality, they only played a small role in this achievement.

3. Enhancing Job Titles and Responsibilities:

Perhaps they were managers, but refer to themselves as a director. Or it might be something subtle, such as calling themselves “senior sales managers” when in fact, they were “assistant sales managers.”

4. Education Exaggeration and Fabricating Degrees:

Claiming a degree that was never earned is one of the most common fabrications. Several executives at large corporations have been exposed to this type of deception.

5. Unexplained Gaps and Periods of “Self-employment:”

A candidate who was simply unemployed (or worse … such as incarcerated, for example) might claim to have been running their own business to explain their employment gap(s) when in fact they were just not working.

6. Omitting Past Employment:

A prospective employee might leave out previous jobs if they were terminated for cause or don’t want that particular employer to be contacted for any other reason.

7. Faking Credentials:

Certifications, assessments, awards – all of these can be fabricated or fraudulently claimed by candidates to make themselves look more qualified for a position than they are.

8. Fabricating Reasons for Leaving the Previous Job:

Being terminated from a job, especially for a serious transgression, is not something most job candidates want to tell a prospective employer. For that reason, they might make up a different scenario, such as “I resigned to pursue better opportunities.”

9. Providing Fraudulent References:

A candidate provides an employment reference who gives a shining recommendation. However, the contact turns out to be a friend of the candidate. This type of deception can hide the true nature and work record of the candidate.

10. Hiding a Criminal Background:

This is one of the most serious omissions. Depending on their history, your business and employees could be at risk from a bad actor who intentionally hides their criminal past.

Several consequences can occur from the above deceptions. Fraud and criminality are possible. Having employees in place who are underqualified to do the job they’ve been hired for is another. This can lead to safety risks and obvious harm to business on every level. That’s why smart business leaders take a proactive approach toward minimising risk with thorough background checks and proper due diligence in the hiring process.

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI Group™ has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group™ launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC™ for more on ISO Certification and training.

Reference checking, 6 keys in the hiring process

Why Reference Checking?

Hiring more people within a company no matter the size can be a lot of effort, waste a lot of time and cost a lot of money so it is important to do it right, which means reference checking. As a large company, it is often the case that there will be an in-house HR team or outsourced company to deal with new employment and reference checking. As a smaller company, it is likely the managing director or office managers handle the process themselves. Companies are at risk of losing a great deal of money from not following the correct employment process. Below are a few recommendations on how you can create and run an effective pre-employment screening process.

1) Understand your risk profile

While lots of businesses have the brand and reputational risk among the leading reasons to conduct background checks, but all organisations have different types of risk. While organisations understandably wish to avoid bad publicity, risk profiles inevitably vary between companies and industry sectors. Other risk-profile considerations include whether the company has regulatory responsibilities to demonstrate due diligence in hirings, such as financial institutions and those working with sensitive or vulnerable people.

2) Implement a strong policy

A background check policy is important because it streamlines the collection, storage and dissemination of employee or applicant background information. When established protocols are in place, incidents of people making mistakes because they had to make a judgment call are reduced.

3) Make It Company-Wide

Create and apply background check policies across the whole company, even for senior management. On average, supervisors spend 17% of their time managing poorly performing employees. In the same survey, 95% of employers said that a poor hiring decision affects the morale of the whole team. Ensuring that the people you hire have the correct qualifications saves time and effort while preserving company spirit.[1]

4) Be Consistent

Pre-employment background screening must be consistent. Most negligence issues start from inconsistency in applying HR policies. Inconsistent enforcement opens the door to discrimination charges, and background screening is no exception.

5) What information can I search for?

Creating pre-defined service packages ensures that your screening policy will be consistently applied. Best practices basic packages includes the following:

• Address Verification

• Identity Verification

• Previous Employment Verification

• Education and Credential Verification

• Reference Check

• Media Check

• Criminal Record Check

6) Understand local and regional screening variance

When building your pre-employment screening program, it is critical to understand that not all countries take the same view of the availability and use of certain types of pre-employment screening information. Creating compliant data and background screening processes is a complex and evolving challenge for all organisations and one that is multiplied by every country involved. As an essential means to ensure the safety and quality of staff, employers need to ensure that their screening programs are right for their organisation and their candidates; transparent, consistent and proportionate by design; and capable of handling an increasingly globalised workforce and disparate regulatory requirements.

References:

Let’s Talk!

If you have any further questions or interest in implementing background screening solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Demonstrating Adequate Procedures with ISO 37001 ABMS Certification and Training

As the international outcry on bribery and corruption practices continues to tighten its grip around rogue players in the private and public business sectors, global organisations continue to ramp up their efforts to develop effective frameworks to prevent, detect and report bribery and corruption. And by fortifying their anti-bribery management systems, such organisations are further helping their cause as such systems can play a pivotal role in establishing “adequate procedures” as a compliance defense in the event of a bribery accusation.

“Adequate procedures” is a term made popular through the UK Bribery Act of 2010, which poses the potential of a company avoiding liability for failing to prevent bribery if that organization can demonstrate sound and established policies and procedures that deter individuals (inside and outside of the organisation) from partaking in questionable or corrupt conduct. A key challenge, though, is that “adequate procedures” takes on different meanings, depending on what country or jurisdiction one may reside. Further, most enforcement agencies and government authorities offer little guidance that pinpoints what exactly “adequate procedures” means when considered as a possible defense in a legal proceeding.

Consider two international legislative provisions that offer “adequate procedures” as a possible legal defense consideration along with the most recent National Anti-Corruption Plan of the Malaysian Government, and discover how a newly adopted international standard can offer multi-national organisations specific guidelines in developing a globally accepted anti-bribery management system that may support most “adequate procedures” defenses.

UK Bribery Act of 2010

Under the UK Bribery Act, an “adequate procedures” defense would be considered during an investigation into a corporate failure to prevent bribery. The Act provides commercial organisations with a defense to liability when commercial organizations can prove and demonstrate that they had in place proper procedures designed to prevent persons associated with them from undertaking bribery related conduct.

Consequently, corporations that are otherwise liable for violating the corporate failure to prevent bribery provision can escape criminal liability from the provision if they can prove that they had in place “adequate procedures” to prevent the relevant illegal conduct from occurring. This defense is unique in that it contends that corporations are acting in good faith and taking proper precautions throughout the organization in implementing adequate compliance procedures, and subsequently can avoid being held criminally accountable for the failure to prevent bribery. This defense is significant in that there is no such defense under the FCPA (see below) or most other foreign anti-bribery laws.

FCPA (U.S. Dept. of Justice)

While corporate compliance procedures are not considered in the liability phase of the FCPA, they are taken into account during the sentencing phase by the U.S. DOJ relevant to the FCPA. The United States Sentencing Commission outlines through its Federal Sentencing Guideline Manual six factors — four aggravating and two mitigating — that a sentencing court must consider in determining the appropriate penalty on organizations convicted under the FCPA. The existence of an effective compliance program is one of the two mitigating factors. Subsequently, an organization convicted of FCPA violations can use the existence of an effective compliance program to potentially reduce a penalty against it.

Malaysian National Anti-Corruption Plan 2019-2023

Under Section 17A (3) of the Malaysian Anti-Corruption Commission act, if the commercial organisation is found liable under the corporate liability provisions, a person who is the director, controller, officer or partner of the organization, or a person who is concerned with the organization’s management affairs at the time of commission of an offense, is deemed to have committed that offense unless such person can prove that the corrupt act was committed without his consent or connivance and that he exercised due diligence to prevent that commission of the offense as he ought to have exercised with regard to the nature of his function in that capacity and the circumstances.

Hence, there is a need for the company to put in place “adequate procedures” as a defense in case there is proven corruption by the associated individual. The Malaysian Anti-Corruption Commission MACC has issued guidelines which constitute “adequate procedures.” In the National Anti-Corruption Plan, Tun Dr. Mahathir bin Mohamad, Prime Minister of Malaysia on 29th January 2019 developed initiative number 2.1.3 which seeks “To introduce Anti-Bribery Management System (ABMS)MS ISO 37001 certification in all Government agencies” within two years (Jan 2019-Dec 2020). The guidelines further state in initiative 6.2.4 “To propose Anti-Bribery Management System (ABMS) MSISO 37001 certification as a requirement for State-Owned Enterprises (SOEs), Company Limited By Guarantee (CLBG) and the private sector to bid for Government contracts”.

In complying with these guidelines and to prove “adequate procedures”, public and private sector organizations should implement the ISO 37001 certification process which would provide proper assurance that the organization has succeeded in establishing, implementing, maintaining, reviewing and improving its Anti-Bribery Management System.

Demonstrating “Adequate Procedures” through ISO 37001 Certification

ISO 37001 Anti-Bribery Management System is an internationally accepted standard that specifies the procedures by which an organization should implement in preventing bribery while detecting and reporting any bribery incident that occurs.

The standard requires organizations to implement these procedures on a reasonable and proportionate basis according to the type and size of the organization, and the nature and extent of bribery risks faced. It applies to small, medium and large organizations in the public and private sector and can be implemented in any country. Though it will not provide absolute assurance that bribery will completely cease, the standard can help establish that the organization has in place reasonable, proportionate and adequate anti-bribery procedures.

ABAC® Center of Excellence Limited is fully accredited as a Conformity Assessment Body (Certification Body) to assist your organization in attaining ISO 37001 certification through a thorough bribery risk assessment and audit covering the entire scope of the standard The audit methodology is evidence-based, meaning any issues raised will be confirmed through adequate evidence that the ABAC Certification team has discovered during the audit.

Auditing techniques take a risk-based approach to examining your organization’s Anti-Bribery Management System (ABMS), and the ABAC Certification team will increase the scale of the investigation if they determine that a specific process presents on a higher risk side. Factors such as Impact, Negligence, Minor, Major, and Critical are taken into consideration during the audit.

A separate audit method is a process-based approach where the ABAC Certification examines the organization’s processes while considering the interaction between those processes. Finally, there is a sampling-based audit approach where ABAC Certification incorporates an appropriate sampling plan utilizing samples from different ABMS processes to conclude and support the audit findings and results.

The audit is extremely thorough in its approach, which results in an accredited certification for the scope of the ISO 37001 Anti-Bribery Management System. Because of the standard’s international acceptance and the thoroughness of the audit process, such certification can provide a valuable safeguard in demonstrating an “adequate procedures” compliance defense in cases posing a liability for a company’s failure to prevent bribery.

Indeed, from an FCPA perspective, certification may provide tangible evidence that a compliance program was in place at the time of the alleged bribery actions. And from a UK Bribery Act perspective, the certification could provide the company with tangible prima facie evidence presented by an accredited certification body attesting to the establishment and effectiveness of the organization’s compliance program. Notably, per Section 17A of the Malaysian Anti-Corruption Commission act, the Prime Minister’s National Anti-Corruption Plan 2019-2023 has declared ISO 37001 certification a requirement for companies operating in Malaysia.

There is a strong likelihood that ISO 37001 Anti-Bribery Management System will continue to set the pace for a globally recognized “adequate procedures” standard for corporations embroiled in corruption litigation proceedings. But for now, the most powerful “insurance” tool that public and private sector organizations can use in their defense strategy is ISO 37001 ABMS certification.

ABAC Certification is an accredited conformity assessment body in issuing ISO 37001:2016 certification, and an independent component of CRI® Group’s Anti-Bribery Anti-Corruption Center of Excellence, which was created to educate, equip and support the world’s leading business organizations with the latest in best-practice processes and procedures, providing world-class anti-bribery and anti-corruption solutions to organizations seeking to validate or expand their existing compliance frameworks to maintain a competitive edge in the world marketplace.

Zafar Anjum, MSc, MS, LLM, CFE, CIS, MICA, Int. Dip.(Fin. Crime), CII, MIPI, MABI | CRI® Group & ABAC® CEO

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@CRIGroup.com

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI® Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI® Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Human Capital can make (or break) your business – mitigating employee risk!

Most organisations manage some of their risks via an insurance policy and risk retention. However, this is a reactive strategy when it comes to risk. If you are one of these organisations, then you are missing the riskiest part of the equation: people risk.

People risk IS…

- having the wrong people in the right positions;

- the failure to understand brand;

- having a weak tone at the top that sets a little precedent;

- a leadership failure that trickles down;

- the uncontrollable side of what people do.

At CRI Group we see people risk as a hidden, budget-busting risk. We know that people and culture can influence (very negatively) your strategy. In other words, human capital can make — or break — your organisation. This risk directly affects your culture, brand, operational efficiency, and ultimately your profitability. In our view, effective leaders of people risk squash organisational inconsistency by living the brand.

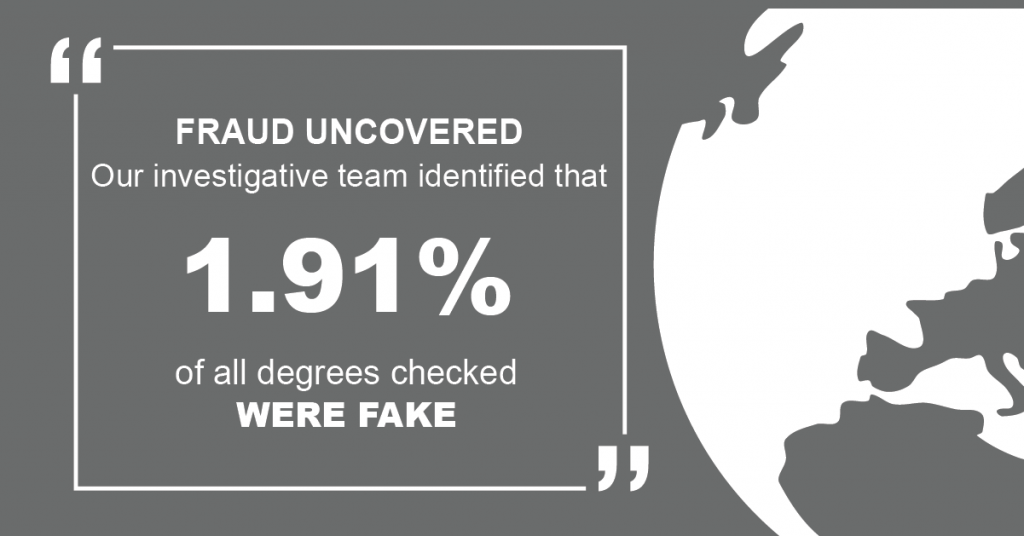

Employee investigative analysis findings expose employee risk

Between February and March 2019, CRI Groups’ investigative analysis team found 3.6% of all requested degree checks to be fake. This is followed by the statistics from January-June 2020, indicating that claiming a fake degree occurred in nearly 2% of cases. Our investigative operations team also found this year that providing incorrect education degree details resulted in 2.33% of all checks. Overall, providing incorrect employment details is the most common red flag, as it was uncovered in about 4.5% of background screenings. Learn more statistics in our article, titled “Background Screening Red flags: Numbers Don’t Lie“.

With degree fraud becoming more common and sophisticated in style globally, comes an increased necessity for pre-employment degree checks to deter potential candidates from fabricating their level of experience and qualification, and to prevent the harmful consequences that employing such applicant’s can have on the company. With job seeking becoming more competitive, many employers are looking for degree level candidates to fill their positions and this means that for some candidates, falsely claiming the existence of their degree is an attractive idea[1]. This can come in the form of referencing to their bogus degree in their CV, or potentially even buying a false certificate from a fake or real university under a site which creates these certificates later down the line if the candidate’s fraudulent activity is not initially flagged up.

Of course, using these websites with the purpose to deceive employers, rather than for “novelty use” which the websites so often claim is the purpose of their product, is a criminal offence and can result in 10 years in prison within the UK, under the Fraud Act of 2006[2]. However, this seemingly hasn’t deterred the thousands of UK nationals who have purchased fake degree certificates with one person spending nearly £500,000 on the certificate[3]. According to a study conducted in 2014, one in three employers do not verify the candidate’s degree qualification upon their hiring, meaning that people are hired into positions they are neither qualified nor educated in, so also pushing those who are degree standard out of the chance of reaching the position[4].

One fake degree holder in a sensitive position can ruin the organisation due to significant irreparable reputational damage. Our pre-employment background checks capability thus acts as an effective employee risk mitigation strategy, so protecting your company from the “human factor”.

Mitigating Employee Risk

Where there are people, there are risks. There are factors in employee-related risk management that are out of a company’s control. But just because you can’t prevent them from occurring doesn’t mean you can’t be prepared for them when they do occur. CRI Group has developed this playbook to help you understand how to mitigate employee risk. This playbook defines the risks, explains and identifies each and their impact. “Where there are people, there are risks: mitigating employee risk” provides actionable advice on how to take control within your organisation including information on background screening (pre-employment screening and post-employment background checks).

You secure their future. We secure their past.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure you know that everything they’re telling you is the truth? 90%? They showed you a diploma, how do you know it’s not photoshopped? Did you follow the correct laws during your background checks process?

Mitigating employee risk is vital to avoid horror stories and taboo tales that occur within HR, your business or even your brand – simply investing in sufficient screening can save you time, money and heartbreak. CRI Group’s EmploySmart service provides in-depth background screening services of employees and candidates at all levels, from senior executives t

o shop-floor employees. Outsource your employee background screening to one of our experienced providers, trusted by the world’s largest corporations, and you will only ever have to look forward, never back.

[accordion_father][accordion_son title=”About CRI Group” clr=”#ffffff” bgclr=”#1e73be”]Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.[/accordion_son][accordion_son title=”Sources & Credits” clr=”#ffffff” bgclr=”#1e73be”][1] https://www.theguardian.com/education/2002/apr/06/students.schools1

[2] https://luminate.prospects.ac.uk/7-ways-to-spot-a-fake-degree-certificate

[3] https://www.bbc.co.uk/news/uk-42579634

[4] https://www.agencycentral.co.uk/articles/2017-04/why-fake-degrees-are-destroying-recruitment.htm

How to handle the “Human Factor”: Top 3 risks when hiring

Talent acquisition in the hiring process requires a great deal of investment in both time and effort for the hiring manager and would involve even greater repercussions if the chosen candidate turns out to be a bad hire. Due to the ever-growing competitive nature of job seeking, it is becoming increasingly likely that a prospective employee may embellish their CV, making themselves appear more attractive to the employer. When hiring new employees, the company becomes vulnerable to human capital risk, which is often thought as the most damaging threat to an organisation yet is also the least well-managed. Hence, performing the appropriate background screening before confirming the hire can save the company from unnecessary costs later down the line.

Top 3 risks when hiring new talent

1. False Credentials

It is thought that generally, around 40% of all job applications contain some fraudulent information, and such a high percentage hence displays the necessity for thorough background checks in the hiring process[1]. One of the most common lies tend to be extending dates of employment to hide a suspicious employment gap which the candidate wants to cover up. Similarly, claims of fraudulent degrees found are on the rise which is a great indicator that the candidate is in fact not qualified for the role. Other false credentials may include exaggerating daily activities in job roles or improving the job title. Other times you may expect to find fraudulent references, or at least references that are not suitable[2].

2. Breach of Trust

In addition to the risks that a hire with false credentials may impose on the company in terms of being unqualified for the role, the candidate’s willingness to lie on their résumé can be a strong indicator of an untrustworthy candidate. If they are willing to lie to reach their desired position, then what else may they lie about within the company?

With access to sensitive company information and documents, and company reputation on the line, hiring a person that can be trusted to perform their role is critical. For example, theft within a company is estimated at roughly 5% of revenues each year[3]. Hence, pre-employment background checks can also act as a judgment of character of the prospective employee for the hiring manager.

3. Negligent hiring and employer liability

As well as having a background screening process in place having the power to discourage untrustworthy candidates, pre-employment background screening conveys that the employer has exercised the necessary due diligence as a preventative measure to protect the company from legal harm. Pre-employment background checks can also check for criminal checks, social media checks and right to work checks; all areas in which an employer can become liable if the correct due diligence process hasn’t been conducted. An employer who hires a candidate without the right to work “can now be subject to a maximum civil fine of £20,000 per individual and/or a criminal sanction of an unlimited fine or imprisonment of up to 6 months”, Ben Mason- employment law associate at Aaron & Partners LLP[4]. Hence, background checks can reduce the likelihood of encountering risk later on.

A cost-effective risk-management tool?

According to the US Department of Labor, a bad hire can cost the company at minimum 30% of that employees first-year salary[5], whilst Fast Company says that one quarter of companies surveyed estimated that a bad hire cost them at least $50,000 in the past year[6]. Hence, pre-employment background screening is a cost-effective risk-management tool to help deter fraudulent candidates, mitigate risk to the company and protect the company from liability in the future. This keeps the company safe and acts as an effective risk management tool in providing integrity and confidence in hiring new talent.

Let’s Talk!

If you have any further questions or interest in implementing background screening solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

References:

[1] https://www.forbes.com/2006/05/20/resume-lies-work_cx_kdt_06work_0523lies.html#5fd1c99c78b5

[2] https://www.thebalancecareers.com/do-you-know-who-you-re-hiring-1919148

[3] http://www.greenhouse.io/blog/4-risks-your-company-takes-when-background-checks-are-not-a-part-of-your-hiring-process

[4] https://www.personneltoday.com/hr/background-screening-eight-key-checks-employers-must-make/

[5] https://www.forbes.com/sites/falonfatemi/2016/09/28/the-true-cost-of-a-bad-hire-its-more-than-you-think/#652e877b4aa4

[6] http://www.greenhouse.io/blog/4-risks-your-company-takes-when-background-checks-are-not-a-part-of-your-hiring-process

CRI™ Malaysia celebrates Anti-Corruption Day

Anti-bribery and anti-corruption efforts are a huge priority in the South Asia Region, with many governments trying to strengthen laws and enhance enforcement in both their private and public sectors. As recent high-profile corruption cases in the region have demonstrated, today’s regulators are seeing the issue as a societal problem as much as a legal one. That’s why CRI™ Malaysia celebrates Anti-Corruption Day partnered with the Malaysian Anti-Corruption Commission (MACC), Transparency International Malaysia (TI-M), the Malaysian Anti-Corruption Foundation and the Malaysian Youth Council for International Anti Corruption Day to raise awareness throughout Malaysia and beyond of the risks posed by bribery and corruption. Themed “United Against Corruption,” the event, held 9 Dec. in Kuala Lumpur, placed the focus squarely on stepping up the fight against corruption and helping position Malaysia a leader against fraud in the South Asia region.

United Against Corruption received extensive coverage in the press – including articles in the The Borneo Post, The Sun Daily, The Edge Markets and other outlets, and a video posted on MACC’s YouTube channel – helping to fulfil the goal of increasing awareness among the general public. As reported in The Borneo Post (“International Anti-Corruption Day celebrated nationwide,” 10 Dec. 2018), the event was held in conjunction with the Premier Walk-About Program and “celebrated simultaneously throughout the country to raise public awareness on the dangers of corrupt practices”.

Efforts increase following 1MDB scandal

The high-profile push against bribery and corruption comes just a few years after the 1MDB scandal first hit the news cycles in Malaysia and, eventually, across the world. Malaysia’s state-owned investment fund, 1MDB, was created to attract foreign investment, but instead it triggered a scandal that led to criminal and regulatory investigations that continue today. “A Malaysian parliamentary committee identified at least $4.2 billion in irregular transactions related to 1MDB. In May, Najib was ousted from power in a general election as the scandal fuelled a voter backlash that ended his party’s 61 years of rule. As the investigations continue, Najib faces trial on corruption charges and U.S. prosecutors have implicated at least three senior Goldman Sachs Group Inc. bankers in a multiyear criminal enterprise” (Bloomberg, 2018).

After-effects from the 1MDB case spread far beyond Malaysia and the South Asia region. In the U.S., federal prosecutors announced that one of the implicated former Goldman Sachs bankers had pleaded guilty, with bribery and money laundering charges lodged against a second banker as part of the investigation.

With eyes on Malaysia due to the breadth of the 1MDB scandal, the Malaysian Anti-Corruption Commission (Amendment) Act 2018 was passed in April of this year – with a provision on corporate liability. The amended act gives more power to the MACC in fighting corruption in the private sector, with penalties for firms that can now be held liable if their employees commit bribery.

On 25 Sept. 2018, Mohd Nur Lokman bin Samingan, Assistant Commissioner at Malaysian Anti-Corruption Commission, spoke in Kuala Lumpur at CRI Group’s Anti-Bribery Anti-Corruption (ABAC) Summit 2018, where he explained some of the key objectives of the 2018 Amendment Act. Among them, the new provisions are meant “to encourage business and commercial activities being carried out in a corruption-free environment; to encourage all commercial organisations to take adequate measures in order to prevent corruption in their respective organisations; and to promote better corporate governance and legal compliance by requiring corporations to take proactive roles in preventing corruption”. Mr. Mohd Nur Lokman went on to explain that punishment for bribery and other corrupt acts under the amendment can include fines “of not less than 10 times the sum of value of the gratification which is the subject matter of the offence”, or one million ringgit (whichever is higher) – and can also include imprisonment for a term not exceeding 20 years.

What is clear to everyone, however, is that governments cannot fight the war on corruption alone. It is critical for government organisations to work hand-in-hand with private sector corporations, non-governmental organisations (NGOs) and nonprofits to change the culture and tolerance level of bribery and corruption along with the legal framework for prosecuting it. In today’s business landscape, companies have found that it is far better to be proactive in the fight against fraud rather than to try to sweep problems under the rug. The problem in years past was a lack of a consistent framework for organisations to follow in efforts to increase their compliance and decrease risk on their own.

ISO 37001 Anti-Bribery Management System

That’s why the International Organization for Standardization (ISO) issued the ISO 37001 Anti-Bribery Management System standard in 2016: to help organisations worldwide increase and measure their efforts against bribery and corruption. As an accredited provider of ISO 37001 training and certification, CRI Group has been helping organisations at every level through measures that include adopting an anti-bribery policy, appointing a person to oversee anti-bribery compliance, training, risk assessments and due diligence on projects and business associates, implementing financial and commercial controls, and instituting reporting and investigation procedures. Experts in CRI Group’s ABAC Centre of Excellence help walk clients through specific requirements and provide guidance for establishing, implementing, maintaining, reviewing and improving an anti-bribery management system. The system can be stand-alone or can be integrated into an overall management system.

ABAC Group’s ISO 37001 training and certification process helps companies or government organisations reduce the risk of bribery by establishing, implementing, maintaining and enhancing internal anti-bribery and anti-corruption systems. This comprehensive protocol can:

- Provide needed tools to prevent bribery and mitigate related risks

- Help an organisation create new and better business partnerships with entities that recognise ISO 37001 certified status, including supply chain manufacturing, joint ventures, pending acquisitions and co-marketing alliances.

- Potentially reduce corporate insurance premiums

- Provide customers, stakeholders, employees and partners with confidence in the entity’s business operations and ethics

- Provide a competitive edge over non-certified organisations the organisation’s industry or niche

- Provide acceptable evidence to prosecutors or courts that the organisation has taken reasonable steps to prevent bribery and corruption.

Which organisations need ISO 37001?

ISO 37001 can be used by any organisation, large or small. It specifies a series of common-sense measures to help prevent, detect and address bribery that can benefit organisations of any industry or type. These include adopting an anti-bribery policy, appointing a person to oversee anti-bribery compliance, training, risk assessments and due diligence on projects and business associates, implementing financial and commercial controls, and instituting reporting and investigation procedures.

United Against Corruption helped to bring to the forefront an issue that must remain near or at the top of the priority list for most organisations in the South Asia region. With anti-bribery and anti-corruption laws and regulations changing at a rapid pace, organisations must keep up with the latest compliance requirements. In fact, many South Asia governments are trying to improve on spotty records of prevention and enforcement when it comes to bribery and corruption in both their private and public sectors. That’s why implementing a standard like ISO 37001 – Anti-bribery Management System can be invaluable to organisations that aim to have a comprehensive approach to compliance in this area.

Who is CRI Group™?

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group™ launched Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC™ for more on ISO Certification and training.

3 ways to protect your Company’s Reputation

In today’s connected business world, there are very few secrets. United Airlines, for example, recently learned the hard way that one ugly incident can go viral and spread around the world in a matter of minutes – not hours, days or weeks. protect company reputation

United initially faced criticism over the rough treatment of a passenger being removed from one of their planes. Then, the company learned a second lesson when its CEO’s response to the crisis seemed somewhat disconnected and uncaring. United was in the middle of a reputational crisis, and its first official response to angry consumers only added more fuel to the fire. Later, the CEO offered an apology and a more compassionate statement – but the damage was done.

There are lessons to be taken from this and other high-profile cases where companies have seen their reputation, which they’ve worked hard to cultivate, trashed in the public spotlight. The fact is, things happen, and no company has a guaranteed way to safeguard their reputation from ever being dinged or facing scrutiny, whether fair or not. But there are ways to mitigate the damage and help ensure your company survives the crisis, and can rebuild its reputation in a positive way.

Know that people are talking about you

In the age of Twitter, Facebook, Yelp and other social engagement sites, people are keen to talk about what they like, dislike, what they wish would be better, and anything else on their mind. That includes your company and your products or services. Accept this and embrace it. Engage with people who post on social media when appropriate, and always in a polite and respectful manner. When there is a legitimate problem, communicate that you are taking the matter seriously and looking to resolve it, and then do so.

1. Be transparent

A way to be proactive in your engagement with others is to ask for feedback. Then be prepared to address it, good or bad. Consumers, stakeholders and even your own employees will be impressed by the open lines of communication and an honest dialog. In this way, you can strive to improve your services and offerings and show that you are receptive to your client’ needs.

2. Protect your customers’ data

Nothing can destroy your reputation among your clients and customers quicker than having to tell them their personal information, which was entrusted to you to remain private and protected, is now in the hands of hackers or criminals because you suffered a security breach. Even worse is when they learn that your company did not take all the measures necessary, or even the most basic ones, to prevent such a breach from occurring. Not only might you be criminally liable, but customers will run from you, not wanting to take a risk that something like that could happen again in the future. In today’s high-risk environment, you must have the most sophisticated and up-to-date security measures in place to protect your date – and your reputation.

3. Conduct due diligence

How much do you know about your third-party partners – those suppliers and contractors that you’ve trusted for years, or new ones with whom you seek to engage? An unethical partner can have serious effects on your own company’s reputation – bribery, corruption, supply chain problems are all issues that can end up tainting your own business and causing your customers to lose trust in your products or services. Conducting thorough due diligence, with background checks and full risk assessments, is the only way to help protect your reputation from potential harm.

It may feel sometimes like your company’s reputation is out of your control. However, there are steps you can take to help manage your reputation and help steer the conversation. It becomes more difficult when you wait, and try to undo later the damage that has already been done. That’s why being proactive in maintaining a positive reputation is the best strategy. Contact CRI Group today and let us help you stay on the path to managing your message and your reputation.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Why should you want your partners to be ISO 37001 certified?

We at the CRI Group believe that businesses that are being run free of corruption accomplish their vision and mission sooner and easier. They bring good to the world more effectively than others. When a business has a clearly set vision and a detailed plan on how to reach it, all it takes to accomplish it is to stick to the plan. However, since companies have to cooperate with other companies in their regular work, they don’t have a choice but rely on someone else’s ethics and principles of doing business. But we all know that business partners are not always reliable. Starting cooperation with one requires conducting thorough due diligence of their work before doing any serious business with them.

The risks could be enormous when your potential partners are involved in criminal activities. Unfortunately, white-collar crimes are not eradicated from the business world, especially when it comes to corrupt activities. Many acts of corruption are often in some kind of gray area – maybe they are legal, maybe not, but certainly are not ethical. In such circumstances, some businessmen don’t hesitate to reach for methods that don’t comply with your legal and ethical standards. If you are cooperating with such partners, you know that risks for your companies are huge. Not only because unknowingly you could be involved in corrupt practices and be investigated by law enforcement authorities, but also because they ruin your reputation and make other potential partners avoid working with you. You are aware that a mistake in choosing business partners can be very costly for your business. Sometimes these risks are easy to mitigate, but some of them could bring your company on the edge of shutting down.

This is where the ISO 37001 standard helps. If you get certified, that would mean implementing numerous anti-bribery standards that will protect your business from bribery. By requiring your partners be certified as you are, you show your preference to cooperate with partners who tackle bribery as well. That speaks of your values as a company. It will let the world know that your anti-bribery values don’t serve just to take space on the Values section on your company’s website, but you are dedicated to putting them in practice as well.

What is required of ISO 37001 certified companies?

Certifying with ISO 37001 means that a third-party such as ABAC® has checked out on the company and confirmed that your partners have implemented the following anti-bribery standards:

- Annual and continuous risk-assessment

- Anti-bribery policies and procedures, including those for hospitality, gift-giving, and donations

- Anti-bribery training for employees

- Procedures for reporting and investigating cases of bribery in the company

- A compliance team to oversee implementation of anti-bribery measures

- Policies and procedures for mitigating the risk of bribery

- Safe channels for reporting bribery by whistleblowers

- The proper due diligence of third parties

- Continuous corrections of anti-bribery policies and procedures

- The commitment of top management to tackle bribery in their own company

- Risk-rating system for third parties

What does this mean for you when you cooperate with others?

Requiring your partners to be ISO 37001 certified will bring the following benefits for you:

It will protect you from potential bribery practices. Although implementing the ISO 37001 standard doesn’t necessarily mean that no one will ever try to ask or offer bribes, the mere implementing of the standards will make that very difficult to occur. If both you and your partners are certified, it’s unlikely that corrupt practices related to bribes will happen in your cooperation.

It will be easier to onboard new partners. Starting cooperation with a new company for which you don’t know how reliable it actually is will require doing a thorough due diligence analysis. If both of you are ISO 37001 certified by a third party, at least for the anti-bribery part, you’ll be sure from the start that the other party operates by the same standards as you.

You’ll have peace of mind when cooperating with your partners. You’ll know that someone knowledgeable of anti-bribery standards has confirmed that your new partner is ethical and doesn’t pose a threat to your company.

If you haven’t certified your company with the ISO 37001 Anti-bribery Management Systems standards yet, but you want to show your potential partners that you are serious about running a bribery-free business, contact us by filling this form. We will answer your certification inquiries as soon as possible.

Protect Your Business from Money Laundering Activities

How to Protect Your Business from Money Laundering Activities?

Today, having anti-money laundering processes in place is more than a matter of smart business. In most jurisdictions, it is also a legal necessity.

Organisations large and small are at risk of falling prey to unscrupulous business dealings and other threats posed by seemingly legitimate business partners. Governments and regulatory agencies are now placing the responsibility of avoiding these pitfalls on the owners and directors of the organisations themselves.

Take Citibank, for example. The banking giant has been fined $70 million in the U.S. “for failing to address shortcomings in its anti-money laundering policies.” According to an article by Reuters, titled “Citibank fined $70 million for anti-money laundering compliance shortcomings” (2018):

The Office of the Comptroller of the Currency fined the bank in late December and announced it on Thursday. The regulator assessed the civil penalty because the bank had failed to address concerns it had first flagged in 2012.

The case is notable because it isn’t linked to a specific new allegation of money laundering per se. It is the alleged lack of compliance and efforts to enhance prevention policies that placed Citibank in hot water (you can read additional commentary on this case in the Bloomberg opinion piece).

Citibank isn’t alone. Western Union just settled a case for nearly as much ($60 million) for allegedly failing to deter and report transactions related to money laundering. Rather than the federal government, this settlement is with the New York Dept. of Financial Services. According to an article by Reuters, titled “Western Union settles New York money laundering probe for $60 million” (2018):

DFS alleged that from 2004 to 2012, Western Union failed to implement and maintain an effective anti-money laundering program aimed to deter criminals’ use of its electronic network to facilitate fraud and money laundering.

The regulator said senior Western Union executives and managers also ignored suspicious transactions to Chinese Western Union locations by several high-volume agents, including money transfers linked to human trafficking.

DFS Superintendent Maria Vullo said in a statement Western Union’s executive “put profits ahead of the company’s responsibilities to detect and prevent money laundering and fraud.”

CRI Group can help

The best way to prevent and detect money laundering is to have a robust set of anti-money laundering (AML) processes in place. CRI Group’s Investigative Due Diligence services provide clients with the specialised intelligence needed to guarantee complete compliance with anti-money laundering regulations and AML legislation involving trans-national implications.

The impact of not remaining in compliance can be severe, and might include the following:

- Damaged corporate reputation and brand devaluation

- Eroded employee moral

- Potential consumer boycotts

- Negative investor perceptions

- Possible legal action

- Fines and potential jail terms for directors

Anti-money laundering laws and regulations are constantly being strengthened as governments come under pressure to protect their economy and taxpayers from the damage caused by this widespread crime. Today, organisations must be diligent in protecting themselves, their investments, their reputations – and they must be fully compliant with the law. Contact CRI Group and be better protected against the risks of money laundering today.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

CONTACT US

Headquarter: +44 7588 454959

Local: +971 800 274552

Email: info@crigroup.com

Headquarter: 454959 7588 44

Local: 274552 800 971

Email: info@crigroup.com

NEWSLETTER SUBSCRIPTION