Your company’s security begins at the hiring process

It’s an exciting time for a company when business is growing and there is a need add more employees and start a hiring process. One organisation t…

Read MoreEmployee Background Screening is Taking the Middle East Region by Storm!

The success of any organization lies in its people—the driving force behind innovation, productivity, and growth. Hiring the right individuals who not only possess the required skills but also align with the organization’s values and culture is crucial for long-term success. Moreover, in an era where data privacy and security take center stage, the need for trustworthy and reliable employees has become paramount. That’s why businesses in the Middle East are embracing a powerful trend that is sweeping the region: employee background screening.

In the United Arab Emirates (UAE), background checks have gained significant attention and recognition, backed by the guidelines outlined in the UAE Labour Law. Employers are now held accountable for any negligence in the employee background verification (BGV) process. With the UAE’s diverse workforce consisting of expatriates from various countries and professional backgrounds, the complexity of employee screening is heightened, making it a critical step for businesses operating in the region.

This blog will unravel the explosive trend of employee background screening in the Middle East. Discover how organizations in the region are recognizing the significance of thorough screening processes and leveraging them to build high-performing teams. Learn about the legal framework surrounding background checks in the UAE and the implications of negligence in this crucial aspect of the hiring process.

Why Background Checks in the Middle East Are Needed?

Background checks have become an essential element of the hiring process in the Middle East. The region has witnessed a growing need for comprehensive background screenings, driven by the rise in terrorism, financial fraud, and other criminal activities. As a result, employers in the Middle East are recognizing the importance of thorough vetting to ensure the safety and success of their organizations.

A Diverse Workforce with Unique Challenges

Saudi Arabia, in particular, stands out as a hub for both native and non-native families, attracting a significant number of foreign nationals. According saudi census 2022, foreign nationals accounted for more than 40 percent of Saudi Arabia’s total population of 32.2 million. This diverse workforce presents unique challenges for employers, necessitating meticulous background checks as part of the work visa application process.

Increased Security Concerns

With the rise in terrorism and other crimes in the Middle East, background checks have become a crucial tool for businesses to ensure the safety and security of their employees and operations. By conducting thorough background checks, companies can identify potential risks and mitigate the chances of hiring individuals with questionable backgrounds.

Protection Against Fraud and Misrepresentation

Background checks help businesses verify the authenticity of a candidate’s qualifications, work history, and other relevant information provided in their resumes or job applications. This helps prevent instances of fraud and misrepresentation, ensuring that candidates possess the necessary skills and experience for the job.

Compliance with Legal Requirements

Background checks in the Middle East are not only a best practice but are also mandated by labor laws. Employers are responsible for ensuring the integrity of their workforce and can be held liable for any negligence in the hiring process. Conducting background checks helps businesses fulfill their legal obligations and demonstrate their commitment to hiring qualified and trustworthy employees.

Safeguarding Reputation and Brand Image

Hiring individuals with a history of misconduct or criminal behavior can have severe repercussions on a company’s reputation and brand image. By conducting thorough background checks, businesses can minimize the risk of hiring individuals who may engage in unethical or illegal activities that could tarnish their reputation.

Mitigating Financial and Legal Risks

Hiring the wrong person can result in significant financial and legal consequences for businesses. Employee misconduct, fraud, or other illegal activities can lead to financial losses, litigation, and damage to business relationships. Background checks help mitigate these risks by providing insights into an individual’s background, reducing the likelihood of making costly hiring mistakes.

Who Can Benefit from Background Screening in the Middle East?

Let’s explore the key beneficiaries of background checks in the Middle East:

Employers in All Industries:

Background checks are essential for employers across various industries in the Middle East. Regardless of the sector, employers need to maintain a safe and secure workplace environment, safeguard their assets, and protect their brand reputation. Background checks help employers ensure that potential employees have the necessary qualifications, skills, and experience to perform their roles effectively and meet the organization’s standards.

Companies Hiring Expatriate Workforce:

The Middle East attracts a significant number of expatriate workers from different countries. For employers hiring expatriates, background checks play a crucial role in assessing the credibility and trustworthiness of individuals coming from various regions. Conducting thorough background checks can help identify any potential risks associated with hiring foreign candidates, such as criminal records, financial irregularities, or fraudulent activities.

Government Organizations and Public Sector:

Government entities and public sector organizations in the Middle East have a responsibility to ensure transparency, accountability, and public trust. Background checks are particularly important for positions involving sensitive information, public safety, or handling public funds. By conducting rigorous background screenings, government organizations can mitigate the risk of hiring individuals with a history of misconduct or unethical behavior.

Financial Institutions and Banks:

The financial industry is highly regulated, and compliance with stringent regulations is paramount. Background checks are critical for financial institutions and banks to verify the integrity and reliability of individuals being considered for roles involving financial transactions, access to sensitive customer information, or positions of authority. Screening for financial integrity, including credit checks and verification of previous employment, helps mitigate the risk of fraudulent activities or potential breaches of confidentiality.

Educational Institutions:

Background checks are equally important for educational institutions in the Middle East, as they strive to provide a safe and secure learning environment for students. Conducting thorough background checks on teachers, administrators, and support staff helps ensure that individuals interacting with students have the necessary qualifications, certifications, and ethical standards. It also helps protect against potential risks such as previous criminal offenses or misconduct.

Healthcare and Pharmaceutical Organizations:

In the healthcare and pharmaceutical sectors, where patient safety and well-being are of utmost importance, background checks are critical. Employers in these industries need to ensure that healthcare professionals, including doctors, nurses, and pharmacists, possess the necessary qualifications, licenses, and credentials. Background checks help identify any discrepancies in educational qualifications, regulatory compliance issues, or previous malpractice allegations.

Security and Defense Agencies:

Security and defense agencies play a vital role in safeguarding national interests and public safety. Background checks are essential in recruiting personnel for security and defense agencies to ensure individuals have a clean record, loyalty to the country, and the necessary skills and qualifications. Thorough screenings can help identify potential risks, including links to criminal organizations, terrorist activities, or conflicts of interest.

Why Middle East Businesses Choose CRI™ for Employee Background Checking Services

At CRI™, we understand the critical importance of comprehensive employee background checks in the Middle East. With our certified pre-employment screening service, EmploySmart™, we provide comprehensive background verification solutions tailored to meet the specific requirements of Middle East businesses. Here’s why Middle East businesses choose us for their employee background checking needs:

Extensive Scope of Services:

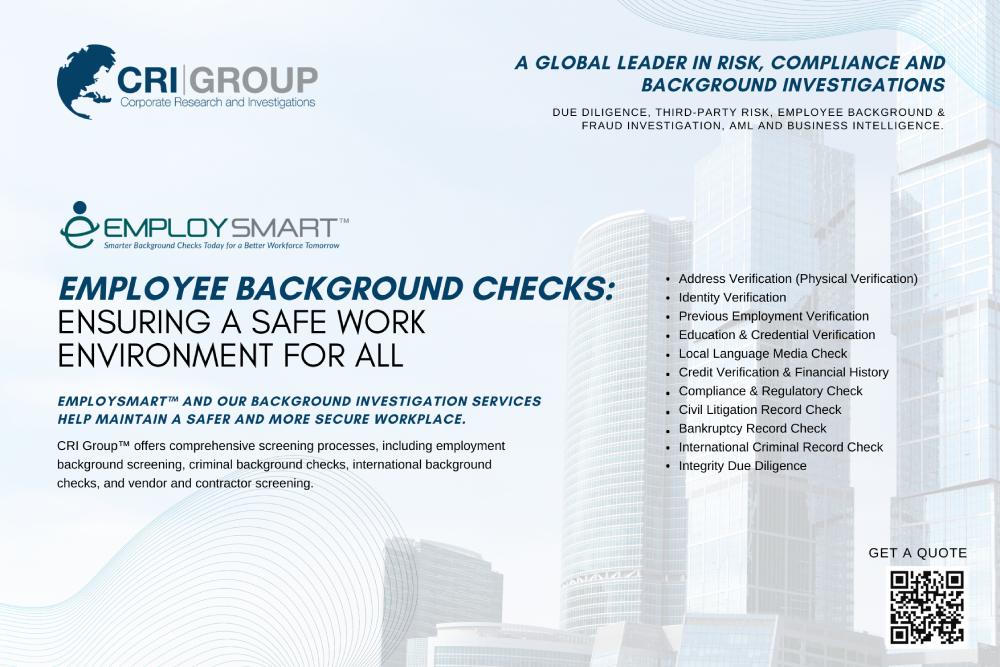

We provide a comprehensive range of background screening services, covering various aspects of an individual’s background. Our services include address verification, identity verification, previous employment verification, education and credential verification, local language media checks, credit verification, compliance and regulatory checks, civil litigation record checks, bankruptcy record checks, international criminal record checks, integrity due diligence, and more. Our extensive scope ensures that businesses receive a thorough and detailed analysis of a candidate’s background.

Background Vetting Expertise (BS 7858):

Our team has specialized expertise in background vetting, including compliance with BS 7858 standards. We adhere to the highest industry standards to ensure accurate and reliable results. With our experience and knowledge, we can efficiently handle background checks for candidates and employees at all levels, from senior executives to shop-floor employees.

Direct Access to Senior Staff:

As a valued partner, CRI™ ensures that our clients have direct access to senior members of our staff throughout the background checking process. This direct communication allows for seamless collaboration, efficient information exchange, and timely resolution of any queries or concerns that may arise during the screening process. We prioritize client satisfaction and ensure a personalized and responsive approach to meeting their needs.

Trusted Partner with Global Reach:

CRI™ has established itself as a trusted partner to HR and recruiting managers across the world. Our integrity due diligence teams are highly experienced and well-trained, equipped to handle domestic and international screenings. We have a flat organizational structure, ensuring direct access to senior staff members throughout the background checking process. Our multi-lingual teams operate in over 80 countries, enabling us to provide global coverage and insights. Middle East businesses value our expertise, global network, and commitment to maintaining the highest standards.

Customizable Solutions and Quick Turnaround:

We understand that each business has unique concerns and risk areas. Our solutions are easily customizable and flexible to address specific requirements. Whether it’s tailoring the scope of the background check or accommodating specific timelines, we work closely with businesses to deliver personalized solutions. With our efficient processes and dedicated team, we provide quick turnaround times without compromising on the quality and accuracy of the screenings.

Extensive Global Network and Local Knowledge:

CRI™ has a team of over 50 full-time analysts spread across Europe, the Middle East, Asia, North and South America. Our analysts possess in-depth local knowledge and expertise, enabling us to serve the diverse needs of Middle East businesses with a global perspective. We leverage our extensive network and resources to provide reliable and up-to-date information for informed decision-making.

Conclusion:

When it comes to employee background checking services in the Middle East, businesses choose CRI™ for our comprehensive scope of services, industry expertise, global reach, and commitment to quality. Our solutions are tailored to address the specific needs and risk areas of businesses, enabling them to make informed hiring decisions, mitigate risks, and protect their interests. By partnering with CRI™, Middle East businesses can benefit from reliable and accurate background checks that ensure the integrity and safety of their workforce.

Secure Your Workforce with EmploySmart™ Employee Background Checks! Ensure Peace of Mind with BS7858 Certified Pre-Employment Screening Services Tailored to Your Company’s Needs. Don’t Gamble on Hiring, Trust CRI™ for Thorough Employee Background Checks. Contact Us Today for a Safer and More Reliable Hiring Process!

Drake & Scull International (DSI) Plunges $857.5 Million Due to Employee Background Check Failure

What Businesses Can Learn from This Case?

Employee background checking is an indispensable process for organizations, upholding integrity, ensuring trustworthiness, and validating qualifications. Statistics reveal that background check failures can have severe financial repercussions for companies. In the United States alone, negligent hiring claims have resulted in verdicts ranging from $1 million to over $40 million in certain cases.

This blog delves into the repercussions faced by Drake & Scull International (DSI), a prominent Dubai-based company, due to failures in employee background checking. It underscores the paramount importance of comprehensive screening practices, highlighting the tangible consequences of insufficient vetting procedures.

Background:

Following a management transition, DSI launched an intensive investigation into the actions of its preceding leadership. The probe unearthed a series of criminal complaints lodged against former executives, members of the board of directors, and even certain family members. The company’s new management exhibited an unwavering commitment to safeguarding shareholder rights and vowed to pursue those found culpable for jeopardizing the organization’s best interests.

Hidden Losses and Mismanagement:

The internal investigation brought to light a disconcerting revelation: DSI had been grappling with substantial annual losses concealed from shareholders from 2009 to 2017. These losses mounted from $255.6 million in 2015 to a staggering $380 million by 2017, aggregating to a cumulative sum of $857.5 million. The fact-finding committee attributed these covert losses to the previous management’s lamentable failure to adhere to corporate governance and transparency protocols, compounded by inadequate managerial and financial standards.

Importance of Employee Background Checking:

According to estimates from the U.S. Department of Labor, making a bad hiring decision can come at a steep price, equivalent to a staggering 30% of the potential earnings in the first year. This eye-opening statistic highlights the significant financial impact that businesses can face when they fail to conduct thorough employee background checks. Discover the crucial reasons why employee background checking is vital for businesses’ success and security.

· Safeguarding Shareholder Trust

The case of DSI aptly exemplifies the criticality of upholding shareholder trust. Diligent background checks enable organizations to identify individuals with a history of misconduct or fraudulent activities, preventing them from occupying positions of influence within the company. This bolsters shareholder confidence and preserves the credibility of the enterprise.

· Mitigating Financial Losses

Insufficient background checking can inadvertently lead to the recruitment of individuals lacking the requisite qualifications or possessing a track record of poor financial management. Such employees can significantly contribute to financial losses, as evidenced by DSI’s clandestine financial setbacks, which amounted to three times the organization’s total paid-up capital.

· Preserving Reputation and Rebuilding Trust

An organization’s reputation is its lifeblood—a testament to its values, competence, and reliability. Failure to conduct rigorous background checks can engender scandals, legal entanglements, and irreparable damage to the company’s image. Rebuilding trust and restoring reputation in the aftermath of such incidents demands protracted efforts and resources.

· Compliance with Governance and Transparency Regulations

Meticulous employee background checking ensures compliance with corporate governance and transparency regulations. By verifying that employees meet the requisite standards and exhibit an untainted record, organizations minimize the risk of regulatory non-compliance, safeguarding the interests of all stakeholders.

Mitigating Risks and Safeguarding Your Business: CRI Group™’s EmploySmart™ Background Check Service

CRI Group™ understands the importance of mitigating risks associated with negligent hiring liabilities. That’s why our employee background check service called EmploySmart™ is certified for BS7858, a recognized standard for security screening within the industry. We adhere to rigorous compliance measures to ensure that our background checks align with legal requirements and industry best practices. By partnering with us, businesses can rest assured that their employee screening processes are conducted in a meticulous and lawful manner.

We are also excited to announce our participation and exhibition at the highly anticipated SHRM 2023 Annual Conference, the largest HR solutions event in the world. By attending SHRM 2023, participants can connect with CRI Group™’s experts at their booth, gain insights into the latest industry trends, and explore how EmploySmart™ can enhance their organization’s hiring processes and overall risk mitigation strategies.

EmploySmart™: A Robust Pre-Employment Screening Service

Are you ready to revolutionize your pre-employment screening process? Look no further than EmploySmart™, the certified solution that takes the guesswork out of hiring and helps you mitigate negligent hiring liabilities. With EmploySmart™, organizations can create a safer workplace and bolster their risk management strategies like never before.

Say goodbye to sleepless nights worrying about the potential risks of hiring the wrong candidates. EmploySmart™ is specifically designed to comply with BS7858 standards, ensuring the highest level of screening accuracy and reliability. We leave no stone unturned, conducting comprehensive checks to provide you with a holistic view of your applicants.

Tailored Screening Packages for Every Position

EmploySmart™ provides flexible screening packages tailored to the specific requirements of each position within a company. CRI Group™’s comprehensive screening services cover a wide range of areas, including education and employment history verifications, criminal record checks, reference checks, and much more.

Our expert team will guide you through the screening process, helping you select the right package that aligns with your industry regulations and job requirements. We take pride in our attention to detail, ensuring that every aspect of the screening process is conducted accurately and efficiently.

Ensuring Truth and Validating Credentials

EmploySmart™ helps organizations address the challenge of determining whether the information provided by candidates is accurate and truthful. CRI Group™’s background checks verify educational qualifications, employment history, and other crucial details, ensuring transparency and minimizing the risk of fraudulent claims.

Our expert team meticulously examines each candidate’s educational qualifications, leaving no room for doubt or uncertainty. We delve into their employment history, cross-checking the details to ensure accuracy. With EmploySmart™, you can rest assured that the claims made by candidates are thoroughly vetted, promoting transparency, and reducing the risk of encountering fraudulent credentials.

Compliance with Laws and Regulations

By partnering with CRI Group™ and utilizing EmploySmart™, organizations can confidently navigate the complex landscape of background check regulations. CRI Group™ ensures that its screening processes comply with local and international laws, reducing legal risks and reinforcing due diligence.

Saving Time, Money, and Heartbreak

Investing in comprehensive employment screening services like EmploySmart™ can save organizations valuable time, financial resources, and potential heartbreak. By proactively identifying potential risks and red flags during the hiring process, businesses can avoid costly legal battles, reputational damage, and negative impacts on employee morale.

CRI Group™’s EmploySmart™ background check service serves as a powerful tool for industries to prevent losses, safeguard their business, and ensure a safe work environment for all. Don’t miss the chance to learn more about EmploySmart™ at the SHRM 2023 Annual Conference and discover how CRI Group™ can assist your organization in creating a brighter and more secure future.

Ultimate Employer’s Guide to Pre-Employment Background Checks

McLane Foodservice paid $40,000 to settle the lawsuit due to a lack of pre-employment background checks on job applicants. Yes, that’s right! In 2017, McLane Foodservice, a Texas-based company, made headlines after settling a discrimination lawsuit filed by the Equal Employment Opportunity Commission (EEOC) for $40,000. The lawsuit claimed that the company violated federal law by hiring an applicant with a criminal record without conducting a proper background check. The applicant had a criminal history, including a conviction for aggravated assault with a deadly weapon, and was hired to work as a delivery driver without a background check that would have revealed their criminal record.

This case serves as a crucial reminder for businesses of all sizes that neglecting to conduct proper background checks can put their companies at risk of legal action and create potential safety risks. In this blog, we will delve deeper into the importance of employee background checks and how to conduct them effectively to reduce hiring risks and improve the hiring process.

Why Conducting Pre-Employment Background Checks is Crucial for Businesses?

As an essential tool for many businesses, conducting background investigation on potential employees is critical to ensure that employers are hiring the best and most qualified candidates for their organizations. Neglecting to conduct background checks can lead to a range of issues, including increased risks to the business, legal repercussions, and damage to the company’s reputation. In this section, we will discuss the reasons why conducting background checks is crucial for businesses.

Improved Hiring Decisions

One of the primary reasons for conducting background screening is to improve the quality of hiring decisions. A background check can reveal critical information about a candidate’s history that may take time to be apparent from their resume or job interview. Information such as employment history, education, and criminal records can provide valuable insights into a candidate’s qualifications and suitability for the position.

Reduced Hiring Risks

Conducting background checks can help businesses reduce hiring risks by identifying potential issues that could impact the safety and security of the company. For example, a background verification may reveal that a candidate has a criminal record or a history of violent behaviour. This information can help employers make informed decisions about whether or not to hire a candidate.

Compliance with Legal Requirements

Many industries have specific legal requirements for conducting background checks on potential employees. For example, employers in the healthcare industry are required to conduct criminal background checks on employees who will have access to patients. Failing to comply with these requirements can result in legal action and potential damage to the company’s reputation.

Protecting the Company’s Reputation

Employing individuals with a history of criminal behaviour or other problematic issues can significantly damage a company’s reputation. Conducting background checks helps businesses avoid these situations by identifying potential issues before they become problems. By hiring qualified candidates with a clean record, businesses can protect their reputation and maintain the trust of their customers and clients.

Types of Pre-Employment Background Screening

Many companies turn to pre-employment background checks to ensure comprehensive screening of potential employees. These checks can provide valuable insights into a candidate’s employment history, qualifications, and character, allowing employers to make informed hiring decisions. This section will discuss the types of pre-employment background checks that businesses can use to mitigate hiring risks.

Address Verification

Address Verification confirms the accuracy of a candidate’s address and provides a physical verification of their location. This check can help businesses ensure that they are communicating with the correct candidate and that the individual resides in the location stated in their application.

Identity Verification

Identity Verification confirms the authenticity of a candidate’s identity. This check can include verification of a candidate’s Social Security Number (SSN), driver’s license, passport, and other identification documents to prevent fraudulent activity during the hiring process.

Previous Employment Verification

Previous Employment Verification confirms a candidate’s employment history, job title, duties performed, and reasons for leaving. This check can help businesses confirm a candidate’s employment history and determine if they have the necessary experience to perform the job.

Education & Credential Verification

Education & Credential Verification confirms a candidate’s educational background and any professional licenses or certifications they hold. This check can help businesses ensure that candidates possess the required qualifications for the position and have the necessary skills to perform the job.

Local Language Media Check

Local Language Media Check is a comprehensive search of local media sources in the candidate’s language of origin. This check can help businesses identify any potential negative media coverage of a candidate that may affect their suitability for the position.

Credit Verification & Financial History

Credit Verification & Financial History investigates a candidate’s financial history, including their credit score, public records, bankruptcies, and liens. This check can help businesses evaluate a candidate’s financial responsibility and identify any potential financial issues that may impact their job performance.

Compliance & Regulatory Check

Compliance & Regulatory Check helps businesses ensure that their hiring process complies with federal and state regulations. This check can help businesses avoid legal and financial repercussions by identifying potential compliance issues during hiring.

Civil Litigation Record Check

Civil Litigation Record Check searches for any civil litigation records against a candidate. This check can help businesses identify any potential legal issues that may affect their job performance.

Bankruptcy Record Check

Bankruptcy Record Check investigates a candidate’s bankruptcy history, including any current or past bankruptcies. This check can help businesses assess a candidate’s financial stability and identify any potential issues that may affect their job performance.

International Criminal Record Check

International Criminal Record Check searches for any criminal records outside of the United States. This check can help businesses identify any potential safety risks and ensure compliance with international regulations.

Integrity Due Diligence

Integrity العناية الواجبة 360° investigates a candidate’s integrity and reputation, including any potential conflicts of interest, political affiliations, or involvement in unethical behaviour. This check can help businesses assess a candidate’s character and ensure that they align with the company’s values and culture.

Choose CRI Group™ For Pre-Employment Background Checks in 2023

Are you looking to hire new employees for your business? Do you want to ensure that you are hiring the best and most qualified candidates for the job? Look no further than CRI Group™ for pre-employment background screening. Here are some reasons why:

- EmploySmart™ Certified: Our pre-employment checks service is certified for BS7858, which ensures that we provide thorough background checks that are compliant with industry standards.

- Tailored Packages: We offer tailored pre-employment screening packages to meet the specific requirements of each position within your company, ensuring that you conduct comprehensive screenings for all candidates.

- Local and International Coverage: We are a leading worldwide provider of employee background checks, including pre-employment background checks. We specialize in local and international coverage, so you can hire confidently, no matter where your candidates are from.

- Avoid Negligent Hiring Liabilities: With our EmploySmart™ service, you can avoid negligent hiring liabilities and ensure that you are creating a safe work environment for all employees.

- Save Time, Money, and Reputation: By investing in comprehensive pre-employment background checks, you can avoid costly hiring mistakes that can lead to legal liabilities, financial losses, and damage to your brand reputation.

Background Screening and Vetting Services by CRI Group™: Ensuring Secure Hiring in Specific Industries

CRI Group™ is a leading background screening and vetting services provider, duly certified by the British Standard Institute for the scope of BS 7858:2019 Screening of individuals working in a secure environment, Code of Practice and BS 102000:2018 Code of Practice for the provision of investigative services. We specialize in providing services to specific industries, including:

British Standard (BS 7858):

Our background screening services for the UK market are in compliance with the Scope of BS 7858:2019 revised standard. This includes various checks such as Identity, address, and Right to Work in The UK verification in line with the DBS (Disclosure & Barring Service) document guidance, covering:

- Identity and address verifications.

- Right to Work (The UK verification).

- DBS (Disclosure & Barring Service, The UK verification).

- Previous Employment, Unemployment, and Self-employment verification (covering the last five years and auditing any gap periods if greater than 31 days).

- Educational Verifications.

- Financial Integrity Verifications (bankruptcy and insolvency checks).

- CCJ’s Record up to £10,000 (The UK verification).

- Civil Litigation Checks.

- Directorship Checks.

- Criminal History Record Checks

- Global Sanctions/Watchlist check.

- Social Media Background Checks (Depending on roles, such as senior or public relations roles – Recommended).

Choose CRI Group™ for pre-employment background screening and vetting services to ensure secure hiring in specific industries. Our comprehensive and customizable services can help you mitigate hiring risks, ensure compliance with legal requirements, and protect your reputation. Contact us today to learn more about our services and how we can assist your organization.

Case Study: Lessons Learned from Employee Fraud

The most popular type of fraud is misappropriation of assets, including theft of cash and inventories. The motivation to commit fraud include a lack of understanding about fraud behaviour, opportunity to commit fraud and lifestyle and financial pressure.

The motivation for employee to commit fraud stems from three conditions:

- Need

- Opportunity &

- Rationalisation

Let us look at this case from 2019 which resulted in the conviction of a UK solicitor for fraud.

UK Solicitor, Andrew Davies Jailed for Defrauding His Firm of £2.3m

A former senior partner, the UK solicitor, has been jailed for four years after defrauding his firm out of a total of £2.3m. Andrew Davies, 59, paid personal invoices to himself from the business and under-declared £1.1m in stamp duty land tax to HM Revenue and Customs (HMRC) for over nine years.

Davies pleaded guilty to one count of fraud by false representation at Reading Crown Court in 2019 and was sentenced to four years imprisonment in January this year. As a senior partner at the firm, Andrew Davies managed to defraud it out of the money by paying personal invoices to himself from the business account.

The 59-year-old also under-declared £1.1m in Stamp Duty Land Tax to HMRC over nine years, over-declaring tax to clients and then taking money from the solicitor’s firms account for himself, both defrauding the company he worked for and HMRC at the same time.

Davies also raised invoices to pay over £1.6 million to his friend Stephen Allan, who worked as a property developer and was a firm client. The 62-year-old from Bishop’s Stortford was convicted at Reading Crown Court on one count of money laundering and jailed for three years.

In a statement, police mentioned the convictions and sentencing of a solicitor’s firm in Berkshire defrauded out of £2.3m between 2010 and 2017.

Allan then made smaller payments into Davies’ account and also pocketed around £400,000 himself. The solicitor extracted funds from the firm’s client account, paying it to Allan in transactions described as ‘fees’, but there was no known work for this.

Davies of The Street, West Clandon, Guildford, and Allan of Thornberry Road, Bishops Stortford, Hertfordshire, was charged by police officers in August 2019.

The statement did not name the firm, but a Solicitors Regulation Authority notice has previously stated that Davies worked for Reading firm Pitmans LLP, which has since become part of another practice. Davies has already been struck by the Solicitors’ Disciplinary Tribunal and ordered to pay £17,000 in costs.

Investigating officer Detective Constable Katie Taylor of Thames Valley Police’s Economic Crime Unit said: ‘In this case, a solicitor trusted to safeguard client funds abused this position and systematically defrauded his firm of large sums of money for his benefit.

‘He then used a corrupt relationship to launder the proceeds of his crime through a property developer. These professional enablers of organised crime represent a significant risk, and we hope that the conviction and sentence, in this case, will act as a deterrent to others.’

Source: Financial Crime News & The Law Society Gazette

Protecting Your Company From Employee Fraud

Employee background check and employment history check is vital to avoid horror stories and taboo tales within HR, your business, or your brand. Simply investing in sufficient employment screening services can save you time, money and heartbreak.

Get exclusive insights curated for subscriber-only when you join our mailing list.

About CRI Group™

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, ذكاء الأعمال, العناية الواجبة 360°, حلول الامتثال and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, the CRI Group launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations.

EU: Can IP Infringements Cost You Your Life?

The Intellectual Property Commission estimates that IP infringements in the form of counterfeit goods, trade secret theft, and pirated software costs the US economy $225 billion to $600 billion.

Following the outbreak of the COVID-19 pandemic in late 2019 and its subsequent spread around the world, counterfeiters have turned their attention to producing fake testing kits, counterfeit personal protection equipment and, even before the authorities have approved treatments, fake medicines purporting to cure the disease, according to the 2020 status report by the European Union Intellectual Property Office (EUIPO) and the Organisation for Economic Co-operation and Development (OECD).

The joint report on counterfeit medicines showed that not only ‘lifestyle’ medicines but also medicines to treat serious diseases, including antibiotics, cancer therapies or heart disease medications, are subject to being counterfeited, with potentially deadly consequences for the patients who consume those medicines.

This report underlines the importance of IP rights to the EU economy and, therefore, to any recovery from the Covid-19 crisis, which has dominated the first half of 2020 and threatens to have long-lasting effects. It brings together the findings of the research carried out in recent years by the EUIPO, through the European Observatory on the infringement of Intellectual Property Rights, on the extent, scope and economic consequences of Intellectual Property Right (IPR) infringement in the EU.

The Status Report also contains research on the volume of counterfeit and pirated goods in international trade and the economic contribution of intellectual property-rights intensive industries to economic growth and jobs.

IP Rights and your employees

Depending on the type of business you are involved in, it is likely that your employees will create certain types of intellectual property in the course of their employment with you. This is especially true if they are involved in compiling databases, creating marketing material and training brochures. Since the IP rights here belong to the company they work for, an employee contract will serve to protect you here.

It is also vital here to run background checks on employees before you hire them.

السابقة واللاحقة لعملية التوظيف

Simply investing in sufficient employment screening services can save you time, money and heartbreak. The CRI Group is a leading worldwide provider, specialising in local and international employee background check, including pre employment background check.

Our employee background checks services, also known as EmploySmart™, is a robust new pre employment screening service certified for BS7858 to avoid negligent hiring liabilities and prevent horror stories and taboo tales within HR, your business, or your brand.

How the CRI Group™ can help you tackle IP infringement

CRI Group’s Intellectual Property Investigations team helps companies identify threats to IP and confidential information internally and throughout their supply chain, develop the appropriate mitigation strategies and investigate suspected infringements.

For further information on IPR infringement or to book a meeting with our experts, click here.

The mandatory Corporate Sustainability Due Diligence: How to comply?

The European Commission on 23 February 2022 adopted a long-awaited proposal for a Directive on mandatory corporate sustainability due diligence for widely-defined specified “companies”. The proposals cover obligations throughout the value chain and also attach to non-EU companies which meet specific criteria.

Companies need to prepare now both across their own business operations and their value chain to comply with the proposed Directive. While 2024 is the earliest the Directive will come into effect, the lead time will be needed to put compliant measures in place, or to face civil liabilities and significant fines based on turnover.

How does the mandatory corporate sustainability due diligence directive work?

The proposed Directive establishes a corporate sustainability due diligence duty requiring specific companies to identify and, where necessary, prevent, end or mitigate the potential or actual adverse impacts of their activities on human rights and the environment. Companies will have to publicly communicate their findings in an annual report and there are express directors’ duties. A European Network of Supervisory Authorities will be created to ensure coordination and alignment between Member States, as per a report on cms-lawnow.com

The proposal recognises the important role that directors will play in this process, such that new directors’ duties are proposed to set up and oversee the implementation and integration of sustainable due diligence into the corporate strategy, and a remunerative incentivisation used to ensure climate change is incorporated within the scope of the corporate plan. A director’s duty to act in the best interest of a company will now include expressly taking into account the human rights, climate change and environmental consequences of their decisions in the near, medium and long term.

Accompanying Measures

Although SMEs are not directly in scope of the proposal, the Commission proposes accompanying measures to support all companies that may be indirectly affected by the broad application of the draft Directive.

Member States are required to ensure that natural and legal persons are entitled to submit substantiated concerns to any supervisory authority when they have reasons to believe, on the basis of objective circumstances, that a company is failing to comply with the national provisions adopted pursuant to the Directive. They are also obliged to establish civil liability regimes where companies are liable for damages if they fail to comply with the due diligence rules and as a result of this failure an adverse impact that should have been identified, prevented, mitigated, brought to an end or its extent minimised through appropriate measures occurs and leads to damage.

Implications of the corporate sustainability due diligence directive

Once the final version of the Directive is transposed, procedures and training will be required to ensure that companies have the requisite systems in place to be able to comply with the obligations and provide such reports. This will involve dialogue throughout the value chain and changes to existing contractual arrangements. Those not directly in scope should also consider their position and potential new requests for information to assist in the due diligence process by others. Once legislation is implemented, non-compliance can result in fines or orders issued requiring the company to comply with the due diligence obligation. Victims could also obtain compensation for damage due to non-compliance with this legislation, says cms-lawnow.com

The way forward

The proposal will be presented to the European Parliament and the Council for debate. Once a text is agreed, approved, and then adopted, Member States will have two years to transpose it into national law. This initiative is part of a wider corporate sustainability package intended to advance the European Green Deal which also announced an agreed Council position on the Commission’s proposal for a Corporate Sustainability Reporting Directive.

The German Supply Chain Due Diligence Act

In January 2023 a new German law, known as the Supply Chain Due Diligence Act, becomes effective and applies to companies operating or trading in Germany. The law introduces a legal requirement for businesses to manage social and environmental issues in their supply chains, through more responsible business practices.

The Act requires businesses to undergo significant efforts in order to achieve compliance. In this eBook, we will provide a first outline of the Act’s material contents and an in-depth analysis of the applicability of the Act to various corporate structures.

This eBook is the collection of a series of articles in which we will take a closer look at key issues, especially addressing the question of what you can do to adequately prepare yourself at this early stage. We would be happy to provide you with individual advice, as well. Please do not hesitate to contact us. If you cannot find what you are looking for, please feel free to get in touch with the team! Let’s talk

Newsletter

Join over 2000+ HR, Risk and Compliance communities around the world. Subscribe now to our monthly newsletter, and receive more articles like this!

IP infringement: The Intellectual Property and Youth Scoreboard 2022 is ut!

IP infringement by way of buying counterfeit goods online and accessing digital content from illegal sources, intentionally or by accident, remain a common practise among youth, says the 2022 edition of the Intellectual Property and Youth Scoreboard.

Released by the European Union Intellectual Property Office (EUIPO), the study provides an update on the behaviours of youth towards purchasing fake products and intellectual property infringement. It is based on a survey of young people between the ages of 15 and 24 in all 27 member states of the European Union (EU) and highlights the factors driving young people to purchase counterfeit goods or access digital content from illegal sources.

Key drivers behind purchasing fakes and accessing pirated content are mostly the price and availability. Peer and social influence such as the behaviour of family or friends also affect the decisions of European youth, says a report of the study on IP Helpdesk.

The Increasing Dangers of IP Infringement

Counterfeit goods pose a significant threat to consumers’ health and safety and is detrimental to the environment. Pirated wares also have a wide range of negative consequences for global economies, the report finds.

Fact: Young Europeans buy more fake products and continue to access pirated content

- 37% of young people bought one or several fake products intentionally in the last 12 months

- 21% of 15 to 24 year olds say they intentionally use illegal sources of digital content in the last 12 months

- 60% of young Europeans said they prefer to access digital content from legal sources, compared to 50% in 2019

- Price and availability remain the main factors for buying counterfeits and for digital piracy

The EUIPO is based in Spain and among one of the most innovative intellectual property offices globally. The European Observatory on Infringements of Intellectual Property Rights is a network of experts and specialist stakeholders. It was established in 2009, with a mission to fight the increasing danger of IP Infringement in Europe and to protect the rights of online property.

CRI Group™ Announces Webinars on Key Aspects of Due Diligence Investigations

The CRI Group™ is hosting a series of webinars on Due Diligence Investigations. The insightful webinars will help you go deep into crucial aspects of Due Diligence Investigations with lessons learned by industry leaders in various areas of business and best practices that you should adopt.

Details:

Webinar 1: Web-based or On-site Due Diligence Investigation: When and Why Do You Need it? And Who’s Going to Need it?

- Duration: 1h 15 min (1h sharing followed by 15 min Q&A)

- Date: 15 September 2022, Thu

- Time: 11.00am – 12.15pm UAE

- Speaker: Ashelea + Kevin (TBC)

- Format: Webinar

- Platform: MS Teams

Learning points:

- Web-based or on-site, or both? Which methods provide robust validity and trust to the information being investigated?

- How is a web-based due diligence investigation conducted?

- How is an on-site due diligence investigation conducted?

- How extensive does the due diligence investigation be with the web-based and on-site?

- When is a web-based due diligence investigation adequately required? And who will need it?

- When is on-site due diligence investigation adequately required? And who will need it?

- When are both web-based and on-site due diligence investigations required? And who will need it?

- What are the types of due diligence investigation offered on the current market

- Current Laws and Legislation around the world that are mandating businesses to conduct due diligence investigations

Webinar 2: The A-Z on How the Examiner Conducts Adequate Due Diligence Investigation

- Duration: 1h 15 min (1h sharing followed by 15 min Q&A)

- Date: TBC

- Time: 11.00am – 12.15pm UAE

- Speaker: Ashelea Arzadon

- Format: Webinar

The first webinar will be on “The A-Z on how the examiner conducts due diligence investigation” while the topic for the second webinar/podcast is “Web-based or On-site due diligence investigation. When and why do you need it? And who’s going to need it?”

The webinars will be addressed by CRI Group experts and will be of one-hour duration followed by a 15 minutes Q&A session. The dates for these webinars will be confirmed shortly. It is recommended that you register your interest here so that you are kept updated on the webinars.

Our Speaker

Ashelea is the Investigations Manager, leading the due diligence, C-level background screening, insurance claim and corporate investigations for multinational clients across various key industry sectors: public relations and advertising agencies of global brands, international law firms, aerospace and defence, and nuclear and energy companies. Her work includes multi-jurisdictional investigations in MENA, Europe and the Americas.

Before joining CRI Group™, she leveraged her knowledge of international law and politics as part of diplomatic and consular practices after working with the Department of Foreign Affairs in Manila. She graduated from Lyceum of the Philippines University with a bachelor’s degree in International Relations with a major in Diplomacy – and currently pursuing her master’s in Corruption and Governance at the University of Sussex. She became a Certified Fraud Examiner in 2018.

Due Diligence Investigations: Mitigate Critical Risks

At CRI™, we provide due diligence services where ever you are. Use our DueDiligence360™ reports to help you comply with anti-money laundering, anti-bribery, and anti-corruption regulations ahead of a merger, acquisition, or joint venture. You can also use them for third-party risk assessment, onboarding decision-making, and identifying beneficial ownership structures.

Due Diligence helps you Identify key risk issues clearly and concisely using accurate information in a well-structured and transparent report format. Our comprehensive range of reports includes specialised reports that support specific compliance requirements. Protect your reputation and the risk of financial damage and regulator action using our detailed reports. They enhance your knowledge and understanding of the customer, supplier, and third-party risk, helping you avoid those involved with financial crime.

The CRI Group™ invites you to schedule a quick appointment with them to discuss in more detail how conducting due diligence and compliance can help you and your organisation.

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, ذكاء الأعمال, TPRM, العناية الواجبة 360°, حلول الامتثال and other professional Investigative Research solutions provider.

We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

Employee Background Screening FAQs – PART II: Pre-Employment Check

This three-part series of articles looks at employee background screening FAQs.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling you is the truth? Or are you just 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process?

Simply investing in sufficient screening systems can save you time, money and heartbreak.

Part One of the series of articles on employee background screening FAQs, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this employee background screening FAQs ebook developed by the CRI Group™ is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS TO DO WITH BACKGROUND SCREENING. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI® Group, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

Does a Candidate Have to Give Consent to Process a Background Check?

A job applicant must give written or electronic consent before any screening conducting (whether in-house or by a third party company like CRI Group™) any criminal record search, credit history check or reference interview, etc.

How Long Does it Take to Conduct a Background Check?

Background checks typically take 2 to 3 days to process and receive back from the outside contracted agency. A few exceptions may take up to 2 weeks. A background check may rarely take longer than 3 to 4 weeks. Please allow additional processing time for each background check in the event of a delay. A delay can occur for any of the following reasons:

- The information has been entered incorrectly by the applicant or the requestor into the vendor’s system.

- The county or district listed for a background check in researching whether the applicant has any criminal felony or misdemeanour charges is delayed in responding to the vendor.

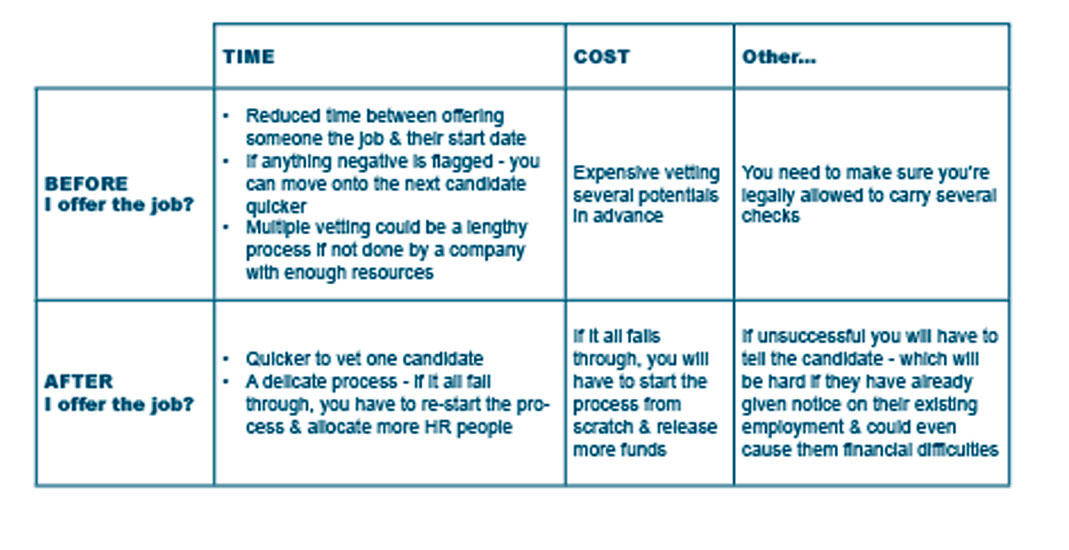

When Should I Conduct Pre-Employment Checks?

Pre-employment screening services can help you avoid adding potential fraudsters and other bad actors to your staff. These checks can be implemented before or after a job offer (with each having its pros and cons).

How Often Should I Screen Employees?

Employees should be screened regularly to reveal any new information relevant to the business. That’s why our background investigations services also include:

- Employee monitoring & risk management

- Data protection compliance

- Employee testing & confidentiality

- Employee risk management

- Post-employment background checks

How to Collect References and What to Ask?

Because it is impossible to know how your candidate will work daily from just one interview, you will need references. References are a great way to find out whether your candidates are suitable for the role or will fit with your company culture. A primary reference check asks for:

- Employment dates

- Employment main responsibilities

- Attendance record

- Any disciplinary actions against them

- Any reasons why they shouldn’t be employed

These references will help you back up their CV – however, many candidates tend to exaggerate or misrepresent themselves. Third-party vendors such as CRI® Group can go beyond to get a fuller picture for you:

- Greatest strengths?

- Are they suitable for the role they’ve applied for?

- Would they rehire the candidate?

- Suitable management style?

- Do they have any leadership skills?

- Situations in which they have excelled at?

Note: Some companies have policies not giving references and just providing necessary employment details, while others direct you towards HR.

How Much Does it Cost to Conduct a Background Check?

That will depend on the scope. Please contact the team for a free consultation.

What are Employment References?

CRI Group’s comprehensive and detailed reference checks have been carefully designed for senior-level positions. Our highly skilled researchers probe extensively across a range of performance and behavioural attributes that have been specifically targeted to meet the information and management requirements of hiring senior-level executives.

We also verify any restrictive covenants, disciplinary actions or warnings; attendance or reliability issues; claims by or their former employer; acts of dishonesty, and eligibility for rehire in a comparable role. We provide a valuable perspective of an individual’s past performance and behaviours by conducting professional, impartial references.

What is the Difference Between Employment History Verification & Employment Reference?

CRI Group™ verifies who the individual reported to and their dates of employment, positions held, remuneration, responsibilities and reason for leaving. This is different to an Employment Reference as it verifies quantitative information such as employment dates, salary packages etc.

Media Search

An individual’s media profile can encompass both professional and personal activities. This check can provide the client with a unique insight into an individual’s public activities and reputation. Our broad-based press search encompasses electronically available national newspapers and regional media sources from states where an individual has worked, helping to ensure that there are no hidden surprises. The search can be conducted by country, region or globally, where it can be of immense value in the uncovering of omissions made by the candidate (note: additional charges apply).

How do I Check on Entitlement to Work?

It is an employer’s responsibility to ensure that every individual they hire is legally eligible to work in certain Jurisdictions. CRI Group™ uses copies of the candidate’s passport or birth certificate to verify entitlement to work in the respective Jurisdiction. Where the candidate is not a local citizen, we have an online verification process set up with the Department of Immigration and Citizenship, as the case may be, to confirm eligibility to work. We will confirm whether or not the candidate is entitled to work in Australia and provide details of any limitations attached to a work visa. This search verifies and appropriately documents the individual’s entitlement to work in accordance with DIMIA requirements.

How do You Conduct Identity Checks?

The availability of identity checks varies from nation to nation, depending on centralised databases and legislation. In essence, these checks are designed to ensure the person is who they claim to be. Where there is a recognised legislated identity card system, CRI Group™ will collect this card, ensure the details are reflected on the background check form submitted and upload the identity card to the candidate file to allow for the requestor to sight.

Identity theft is on the rise, and validating an individual’s identity is essential to making an informed hiring decision. CRI® Group verifies an individual’s identity details via a comparison with details held in the electoral roll, online telephone directory and the National database registration authorities.

Passport Check

This passport verification solution enables the client to verify a person’s identity and whether their passport is forged. Passport Check verifies the authenticity of machine-readable passports and identity documents by simply entering the passport/ID data.

CV Comparison Check

Curricula Vitae (CV) are increasingly being used as a sales tool rather than a factual account of a person’s work history. This check will compare information supplied by the candidate to CRI Group™ with details supplied to an organisation in a candidate’s CV. This check aims to provide a thorough review of the candidate’s background and reveal any misrepresentations that may exist through a candidate omitting or overstating information on their CV.

Supply Chain Due Diligence Act: New Risk Management & Reporting Duties for German Businesses

This article looks at the Supply Chain Due Diligence Act (LkSG) that applies to companies operating or trading in Germany and will enter into force on 1 January 2023.

The new German law, known as the Supply Chain Due Diligence Act (LkSG, short for Lieferkettensorgfaltspflichtengesetz in German) imposes due diligence obligations on environmental protection and on human rights, with all businesses having to introduce iterative and ongoing, or in certain circumstances ad hoc, due diligence processes specified by the Act.

Identification and management of an organisation’s supply chain and the risks that come with it require the implementation of due diligence processes.

The term “supply chain” refers to all products/services of a business, including all manufacturing and services, in Germany and/or abroad, from the extraction of raw materials to their delivery to the end customer.

Furthermore, due diligence processes should implement the following criteria:

- type and scope of the business activities of the company subject to the due diligence obligations,

- the ability of the company subject to the due diligence obligations to exert influence (so-called leverage),

- typically expected severity of the violation, and

- type of contribution by the company subject to the due diligence obligations to cause a violation.

More details can be had in our FREE Supply Chain Due Diligence Act (LkSG) eBook.

Who is Affected by the Supply Chain Due Diligence Act?

- As of 1 January 2023: Companies with at least 3,000 employees that have their head office, administrative seat or statutory seat in Germany OR companies that have a branch in Germany and usually employ at least 3,000 employees in this branch;

- As of 1 January 2024: Companies with at least 1,000 employees that have their head office, administrative seat or statutory seat in Germany OR companies that have a branch in Germany and usually employ at least 1,000 employees in this branch.

From 2024, the law will apply to businesses with more than 1,000 employees.

Even if companies with fewer employees are not addressees of the Supply Chain Act, they may still be indirectly affected. This is because the companies directly affected would be obliged to enforce compliance to the best of their ability with human rights in their supply chain. The measures necessary for this can have a direct impact on their suppliers, for example, through the implementation of a code of conduct. In addition, the directly affected companies will often be dependent on the active support of their suppliers and thus have this support be contractually assured, e.g. in the form of reporting obligations as part of their risk analysis.

DOWNLOAD THE SUPPLY CHAIN DUE DILIGENCE ACT (LkSG) EBOOK.

Due Diligence Investigations: Mitigate Critical Risks

At CRI®, we provide corporate reporting and due diligence services wherever you are. Use our DueDiligence360™ reports to help you comply with anti-money laundering, anti-bribery, and anti-corruption regulations ahead of a merger, acquisition, or joint venture. You can also use them for third-party risk assessment, onboarding decision-making, and identifying beneficial ownership structures.

Due Diligence helps you Identify key risk issues clearly and concisely using accurate information in a well-structured and transparent report format. Our comprehensive range of reports includes specialised reports that support specific compliance requirements. Protect your reputation and the risk of financial damage and regulator action using our detailed reports. They enhance your knowledge and understanding of the customer, supplier, and third-party risk, helping you avoid those involved with financial crime.

The CRI® Group invites you to schedule a quick appointment with them to discuss in more detail how conducting due diligence and compliance can help you and your organisation.

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, ذكاء الأعمال, TPRM, العناية الواجبة 360°, حلول الامتثال and other professional Investigative Research solutions provider.

We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

اتصل بنا

المقر الرئيسي: +44 7588 454959

المحلي: +971 800 274552

:البريد الإلكتروني info@crigroup.com

المقر الرئيسي: 454959 7588 44

المحلي: 274552 800 971

:البريد الإلكتروني info@crigroup.com

الاشتراك في النشرة الإخبارية