Middle East Background Screening: Compliance With Privacy Laws

It’s a fact that some of the most talented and promising job candidates possess the most disturbing pasts. Such deception can lead to a perilous future for an employer. This is the primary reason businesses are strongly advised to conduct background screening investigations before hiring seemingly well-qualified managerial candidates. background screening Privacy Laws Compliance

In every region and jurisdiction in the world, there are different regulations that govern what background screeners can and can’t do in regards to providing pre- and post-employment screening services. The laws in the United States, for example, are not the same as those that affect investigations in the Middle East. The concern over individual privacy and data protection are hot discussion items globally. Companies that engage background screening firms for the Middle East need to make sure those investigators are following all rules and regulations in regards to privacy – or else they might face liability along with the screening provider.

Examples of Privacy Laws in the Middle East

While reputable screening firms in the U.S. comply closely with the Fair Credit Reporting Act to conduct domestic background investigations, foreign investigations are much more complex.

Middle East countries have no prohibitive legislation that governs the employment screening process. At the same time, there is no cooperative legislation and regulation to support background screening services for employee due diligence. However, background screening industry professionals must adhere to strict data protection requirements (such as the GDPR, local Data Protection regimes specifically DIFC Data Protection, ADGM Data Protection and QFC Data Protection regulations) to process consensually based personal information.

In UAE, local police departments provide “Good Conduct Certificates” for employees for immigration purposes, while Dubai International Financial Centre (DIFC) Data Protection standards allow for the processing of sensitive personal information, such as criminal history, with signed consent from the data subject for employee due diligence requirements.

In the United Arab Emirates, data protection laws permit investigators to process sensitive personal information such as criminal history data. As a DIFC-licensed entity, the Corporate Research and Investigations Limited “CRI Group” (as well as other reputable background screening firms) must maintain strict adherence to the region’s Data Protection Law in order to fulfil our ongoing DIFC licensed status. As in the United States, the procurement of personal data in this region – and any subsequent transfer of data outside of the DIFC – may only be attained with the written consent of the individual being investigated.

Reputable screening firms in the Middle East will also comply with regional privacy laws (such as the GDPR) by appointing an internal Data Protection Officer (DPO) whose primary responsibility is to conduct independent audits of the firm’s various information processing operations which handle customer and employee data. The DPO ensures that personal data is handled in accordance with all relevant data protection provisions covering online and offline data procurement while complying with local and regional regulations pertaining to individual privacy standards.

The Urgent Need for Background Checks

While all guidelines and regulations must be followed, the absolute need for comprehensive background screening in the Middle East cannot be disputed. The region has a labor force of over 150 million individuals serving in all capacities and industries (World Bank, 2019). Those statistics can be quickly put into context when considering that deception in the employment process, such as résumé fraud, is believed to be rampant and widespread: One report estimates that 80 percent of all job applicants intentionally mislead potential employers on their résumé or application (Security, 2017).

Case Study

To help understand the problem, consider this case study: An international company was hiring to fill a position in the Middle East. When they engaged a firm that specialises in pre- and post-employment background screening, the firm’s investigators uncovered disturbing details about an applicant. One of the individual’s previous employers reported that the applicant was hired without any prior experience, was trained for a couple of months, and then terminated due to committing cash embezzlement as well as participating in harassment and workplace violence. A second employment verification revealed his termination, as he caused a financial loss to the company.

In the above example, the background checking company uncovered the deception through comprehensive background screening that went beyond basic database checks and reviews of public records. In the Middle East, background investigations – both for pre- and post-employment screening – often require a “boots on the ground” approach. This can mean conducting much of an investigation literally on foot, travelling to remote regions to interview sources and check documents in person. And, the entire investigation was conducted within all privacy laws and regulations.

Some job candidates will seek an advantage through fraudulent means. The hidden truth might even include criminal behavior. It is important for any organisation to verify information provided by individuals they seek to hire. In the Middle East, this process will often look different than it would in the U.S. By following all local laws and regulations, however, a reputable background check firm will be helping to protect your company – while also safeguarding your future.

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

About the Author

Zafar Anjum | Group Chief Executive, CRI Group

Anjum is founder and CEO of CRI Group and ABAC Center of Excellence. Having dedicated three decades to the areas of fraud prevention, protective integrity, security, compliance, anti-bribery and anti-corruption, Zafar Anjum is a highly respected professional in his field.

Due Diligence: 4 Red Flags of Collusion

One of the many schemes that can cause serious legal and financial consequences is collusion in business. While some business leaders might wonder what separates collusion from other types of fraud and how to identify it, there is a key factor: secrecy.

Collusion involves at least two parties (sometimes more) who collaborate to deceive others, usually for financial or market gain. Due to its secretive nature, collusion can be difficult to detect and weed out. This poses a serious problem because the consequences of noncompliance for an organisation are often severe.

According to the Wall Street Journal, the U.S. Department of Justice (DOJ) is “preparing to tackle competition issues in several important markets, including alleged price-fixing in the generic-drug industry, rules for music licensing and purported employer collusion that limits options for sought-after workers” (Wall Street Journal, 2020). Indeed, these are the types of schemes that are most often associated with collusion. Price fixing is a global problem found in many different industries, for example. However it’s important to note that collusion is just as common at the local level – for example, where contractors bid to provide goods or services regularly. Sometimes competitors will engage in collusion by making secret arrangements to rotate bids or share bid details to artificially deflate prices.

In one recent case, the branch manager for a U.S.-based insulation contractor pleaded guilty in a scheme to rig bids and commit other forms of fraud on insulation contracts. The DOJ had launched an investigation into the branch manager’s actions from 2011 to 2018, finding that he “conspired with other insulation installation contractors to rig bids and engage in fraud on insulation installation contracts in Connecticut, New York, and Massachusetts. Insulation installation contractors install insulation around pipes and ducts on renovation and new construction projects at universities, hospitals, and other public and private entities. In addition to his guilty plea, DeVoe has agreed to pay restitution” (DOJ, 2020). “Free and open markets are the foundation of a vibrant economy. For years, the defendant illegally coordinated bids on construction projects to enhance his profits, eliminate competition, and ultimately steal from public and private customers,” said Brian C. Turner, Special Agent in Charge of FBI’s New Haven Field Office.

The DOJ noted in its press release that this crime hurt the hospitals, universities and businesses that solicit and pay for the contractor’s services under the expectation that the bidding process is fair and above board, not rigged to benefit a contractor at their expense. The money lost in such schemes (through paying inflated contracts) often represents taxpayer dollars. The fact that collusion, in this case, lasted for at least seven years indicates that tens of thousands of dollars (or more) were likely lost through fraud.

So, what can organisations do to be better protected from collusion schemes – whether from inside their own company or perpetrated against them by outside partners/contractors? While collusion is secretive by its very nature and can be difficult to detect, red flags can indicate that something might be amiss. CRI® Group’s integrity due diligence experts are specially trained to uncover collusion in all its forms, and they describe the following as some of the signs to watch for when dealing with competitive bid contracts:

A high percentage of awards go to the same company

If a single bidder is winning most of the contracts for a particular set of goods or services, there might be something wrong despite several other contractors involved in the bidding. This is especially true if there are any issues or complaints around the bidder, such as poor quality products or services, they are late in delivering on their contracts, etc.

Lowest bidders are not winning awards

Suppose the contracts are consistently going to bidders other than the lowest bidder. In that case, this might warrant further investigation – as most contracts are considered “low bid” and would reasonably go to the lowest bidder. Also, if there is a higher-than-average range or spread between bidders, that could signal that something is off.

There is a high number of late bidders

Late bids can be a sign of collusion if bidders, or an agent at the organisation soliciting bids, are sharing bid information – such as the highest bid (so far) in an award process. This is especially true when the winning bidder is consistently the last one to submit bids. If late bidders are being approved regularly, you need to know why.

Bidders share (or have similar) names, addresses, or other information

This is an obvious red flag. In some cases, bids from two different contractors have been submitted from the same fax machine! This indicates that parties might be colluding in their bid submissions, and you need to look further.

Other countries’ DOJ and enforcement bodies have demonstrated their willingness to detect, investigate, and punish collusion. For the sake of your organisation, it is best to be proactive when it comes to your bidding and contract processes. CRI® Group’s integrity due diligence services can help you identify the above red flags. Our experts also conduct risk assessments to help find weaknesses in your business process and controls that might make your organisation vulnerable to collusion. This holds whether you need the goods or services or are a supplier or contractor submitting bids. The secret crime of collusion causes financial harm through inflated costs, representing a legal and financial liability to your organisation and/or clients. By being attuned to spot red flags, you’ll be more likely to notice the smoke …. before it turns into a fire.

Take a proactive stance with the highest integrity due diligence as a part of your essential business strategy. Contact us today to learn more about our full range of services to help your organisation stay protected. Get a FREE QUOTE

About Us

CRI® Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Risk & Compliance magazine: interview with our CEO

Interested in employee integrity due diligence and pre-employment screening? Or are you engaging in a merger or acquisition, an IPO, engaging suppliers, contractors, or new clients and looking for third-party risk management solutions? Background checks and necessary screenings are vital to avoid horror stories and taboo tales that occur within HR, your business or even your brand – simply investing in sufficient screening can save you time, money and heartbreak.

Learn the benefits and best practises of background investigations from the industry leader Mr. Z. Anjum, CEO at CRI Group.

Click here to download the insights on Background investigations in a one-on-one interview published in Risk and Compliance magazine, 2019.

Have you read?

- Brexit poses new bribery challenges, ISO 37001 provides solutions

- Bribery and corruption plague Middle East, how can ISO 37001 help?

- As South Asia Grapples with anti-bribery compliance, ISO 37001 provides solutions

- Whitepaper: Organised catastrophe of international Pakistan airlines

- Rolls-Royce Case study: Ethics & Compliance

- ISO 37001 FAQ

- Are you ready for ISO 37001?

- Don’t have an ethical code of conduct? Your organisation needs one

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Can you Run an International Background Check?

Pre-pandemic, global workforce mobility was an increasing trend. The demand for skilled workers had put employers on a hunt worldwide. According to a Finaccord research study, the total number of expatriates worldwide amounted to around 66.2 million in 2017 – which is 0.77% of the total global population. This figure had grown at a compound annual rate of 5.8% since 2013. By 2018 the global expatriate population had reached 66.2m and was predicted to rise to 87.5 million by 2021. And as of today, according to The Expat Survey, 232 million people are living outside of their nation of origin.

According to HSBC Annual Survey 2020

Finaccord forecasted that the number would reach around 87.5 million by 2021. Fast forward to today, COVID-19 is creating a new reality. The pandemic has an enormous impact on workers’ mobility across borders, mainly due to strict limitations on international travel. Many businesses have shifted to online modalities, recruiting nationally and preparing for safe and fair recruitment practices once travel restrictions are lifted. None of us could have anticipated the challenges of 2020 brought about by the global pandemic. The impact on global mobility has been significant, with lockdowns and ongoing travel and immigration restrictions affecting the majority of markets around the world. The latest HSBC 2020 report with 40 countries participating

The implementation of remote working is broader and deeper than most organisations realise. To be successful in the long term, a structured approach is needed and a significant investment to change corporate culture.

Overseas recruitment

We understand the complexities and requirements businesses face with overseas recruitment and the need for international employee vetting to ensure your candidates meet the job-specific requirements.

COVID-19 changed how your workforce is working.

The odds are good that the pool of top candidates for an open position may include someone from a foreign country. Along with making sure that person is right to go in terms of the documentation needed to live and work in the U.S., do you run an international employment background check in addition to a domestic one? What about a criminal background check? How about a credit check?

The answer to all is yes, especially if your candidate has recently relocated to this country. You need to verify that the information on his or her resume is accurate, and be informed about his or her criminal past, just like you would for any other candidate.

The good news? Verifying education and references internationally are both relatively straightforward. For education verification, a phone call to the schools the candidate claims to have attended will do the trick, although some schools will only allow the student to request those records. Similarly, a phone call or email to the listed reference is usually all that’s needed. However, the language barrier can be a significant stumbling block in both cases.

Unfortunately, conducting an international background screening is a complicated matter, and without the capabilities, you will face a tangle of bureaucracy and red tape. Here’s why international background screening is difficult without experts:

No Global Database

In this age of big data, smart everything, and increasing concerns about national security, you’d think there would be one central, global database where people could check, at the very least, a candidate’s criminal history. There isn’t. To run any pre-employment screening internationally, you need to contact the candidate’s country of origin.

Each Country Has Its Own Rules

Country rules vary in storing and releasing data about its citizens. Where to go to get the information varies, too. You can work through their embassy in Washington, D.C, for some countries. For others, you must request the data from the country directly. Some prohibit U.S. companies from obtaining records, and some have endless hoops to jump through and a mountain of red tape to untangle. And the documentation you need to provide to get the records varies by country. Photographs, fingerprints, parents’ names, birth certificates, proof that the candidate applied for a job at your company — the variations are seemingly endless. It’s no mystery to see why it will take a while, up to 20 days or more if you get any information at all.

Employment information Won’t Be Uniform.

If you’ve run a successful employment background check on a candidate from a specific country before, don’t expect to get the same results again. Why? In many cases, it’s up to the employer to decide whether to release any information.

Credit Score? What Credit Score?

Each country has its way of reporting credit and debt. While some are similar to the U.S., others don’t keep those sorts of records at all, and still, others have their own rules about who can and can’t get access to that information.

Bottom line, the value of remote working, now and after the crisis

Remote working is an opportunity for your organisation to work more sustainably and reap the medium to long term benefits. With less office space, less commuting, fewer business trips, shorter breaks, greater focus from employees and fewer short absences due to illness. However, it is more important than ever to run background, employment, and credit checks to make informed, solid hiring decisions. Still, the process is difficult and time-consuming if you’re dealing with another country, leaving you with a vacant position for longer than you had planned. This is the time to call in the pros.

CRI® Group Employee Background Checks

Employee background checks, also known as EmploySmart™, is a robust new pre-employment background screening service certified for BS7858 to avoid negligent hiring liabilities. We are a leading worldwide provider, specialising in local and international employee background checks, including pre-employment and post-employment background checks. Ensure a safe work environment for all – EmploySmart™ can be tailored into specific screening packages to meet the requirements of each specific position within your company.

How do you know the candidate you just offered a role to is ideal? Are you 100% sure you know that everything they’re telling you is the truth? 90%? They showed you a diploma; how do you know it’s not photoshopped? Did you follow the correct laws during your background checks process? Employee background checks and necessary screenings are vital to avoid horror stories and taboo tales within HR, your business, or even your brand – simply investing in a sufficient screening can save you time, money and heartbreak.

CRI® Employee Background Checks are an investigation into a person’s character – inside and outside their professional lives. Some checks you probably already carry out in-house, such as candidate’s qualifications (documents provided), work history (with a reference check), right to work in the country and even a quick social media presence scan.

However, we provide a full in-depth background screening service for candidates and employees at all levels – from senior executives through to shop-floor employees:

- Address Verification (Physical Verification)

- Identity Verification

- Previous Employment Verification

- Education & Credential Verification

- Local Language Media Check

- Credit Verification & Financial History (where publicly available)

- Compliance & Regulatory Check

- Civil Litigation Record Check

- Bankruptcy Record Check

- International Criminal Record Check

- Integrity Due Diligence

- and more.

Background screening: 10 things you should know

Hiring new employees is an essential part of operating, and growing, a successful business. It also presents an inherent risk to any organisation. According to popular employment site CareerBuilder.com, “58% of hiring managers said they’ve caught a lie on a resume; one-third (33% of these employers have seen an increase in resume embellishments post-recession.” Background screening

Here’s another statistic: according to a survey conducted by CRI™, more than 75% of organisations conduct some sort of background checks. That’s good news. But it also means that nearly a quarter of companies don’t do any pre-employment screening, which is concerning. Screening employees means having a safer, more secure work environment. Here are 10 important things every organisation should know about the hiring process, and the need to conduct thorough pre-employment background screening.

1. Some job candidates will actually fabricate a new identity.

This is especially true if they have something to hide, such as a criminal background. Proper screening can verify names, addresses, phone numbers, national ID numbers and other identifying information to confirm that they are who they claim to be.

2. Credit and financial history should be reviewed.

Fraud statistics have shown financial distress to be a key red flag for fraudulent behaviour. Has the candidate claimed bankruptcy? Have they dissolved prior companies or are they faced with debtor filings? An individual’s financial history should be checked to the degree that is permissible by local laws.

3. Previous employment needs to be confirmed.

Background checks will verify past employers, locations of past employment, dates employed, salary levels, reasons for leaving, position titles, gaps in employment history and pertinent contact information.

4. Stretching employment dates is a major problem.

Speaking of previous employment, CRI Group™’s survey found that the top form of résumé fraud is stretching employment dates. This can cover gaps in employment, or make it seem they have more experience in certain positions than they actually do.

5. Some candidates present fake education credentials.

Verification is needed to confirm school grades, degrees and professional qualifications. Claiming a degree that was never earned is one of the most common fabrications. Certifications, assessments, awards – all of these can be fabricated or fraudulently claimed by a candidate in an effort to make themselves look more qualified for a position than they actually are.

6. International criminal records searches are critically important.

Criminal background checks should include any convictions for the applicant in the requested jurisdictions. Hiding a criminal background is one of the most serious omissions. Depending on their history, your business and employees could be at risk from a bad actor who intentionally hides their criminal past.

7. Checking (and verifying) references is important.

A job seeker might provide an employment reference that gives a shining recommendation – but the contact turns out to be their close friend. This type of deception can hide the true nature and work record of the candidate.

8. Formalise your background screening policy.

What is your company’s current, written policy for hiring new employees? How does it address background checks, due diligence, and other issues? Is the process followed in every case? Having the process detailed in writing will help make it a regular part of your business practice.

9. Make sure someone owns the background screening process.

Ultimately, who has the responsibility of vetting new hires? Is it ownership? Human resources? Individual managers? It might be a collaborative process. All of those who are involved in hiring should also be involved in the implementation of a due diligence solution that includes background checks.

10. Don’t skip post-employment background screening.

Proper due diligence doesn’t just apply to prospective new hires. It should also be used to periodically evaluate your current workforce. Examine the various roles and personnel at your organisation, and consider a policy that addresses risk areas with background checks. For example, CRI Group’s survey found that nearly half of business leaders see financial services, investments and banking positions as “high risk.”

It’s important to have a formal, written policy for background screening. It’s also important to know that comprehensive background checks are best performed by industry experts who understand where to find and confirm employee information. This ranges from criminal, education and employment history records checks to verification of credentials, training and certifications. CRI Group™’s professional background screening services engage international resources in geographic regions not serviced or accessible by typical “out-of-the-box” screening services.

EMPLOYEE BACKGROUND CHECKS

EmploySmart™ is a CRI™ employee background checks service. It is a robust new pre-employment background screening service certified for BS7858, to avoid negligent hiring liabilities. Ensure a safe work environment for all – EmploySmart™ can be tailored into specific screening packages to meet the requirements of each specific position within your company. We are a leading worldwide provider, specialised in local and international employee background checks, including pre-employment and post-employment background checks.

CRI™ Employee Background Checks are essentially an investigation into a person’s character – inside and outside their professional lives. Some checks you probably already carry out in-house, such as candidate’s qualifications (documents provided), work history (with a reference check), right to work in the country and even a quick social media presence scan. However, we provide a full in-depth background screening service for candidates and employees at all levels – from senior executives through to shop-floor employees:

|

|

CRI™ is duly certified by British Standard Institute BSI for the scope of BS 7858:2019 Screening of individuals working in a secure environment, Code of practice (the only BS 7858 certified background screening services provider in the UAE and across the Middle East); and BS 102000:2018 Code of practice for the provision of investigative services.

Ensure a safe work environment for all in this difficult time – EmploySmart™ can be tailored into specific screening packages to meet the requirements of each specific position within your company.

حول مجموعة سي آر آي (CRI Group™)

Since 1990, Corporate Research and Investigations Limited (CRI Group™) has been safeguarding businesses from fraud, bribery and corruption. Globally, we are a leading Compliance and Risk Management company licensed and incorporated entity of the Dubai International Financial Center (DIFC) and Qatar Financial Center (QFC). CRI™ protects businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. Based in London, United Kingdom, CRI™ is a global company with experts and resources located in key regional marketplaces across the Asia Pacific, South Asia, the Middle East, North Africa, Europe, North and South America. Our global team can support your organisation anywhere in the world.

In 2016, the company launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body that helps organisations mitigate internal and external risks by providing a complete suite of Anti-Bribery, Compliance and Risk Management programs.

OUR MISSION AND VISION

- CRI™ mission is to safeguard the corporate world by detecting and exposing those elements that can cause irreparable harm to a business

- Stand up against the outside forces that, through corruption, collusion, coercion and fraud, can cause financial, organisational, reputational and legal harm to our global clients

- Stand out as the preeminent provider of specialised investigative services that enable our clients to exhibit the highest standards of business integrity, ethics and behaviour

The Importance of Background Checks

The Importance of Background Checks: A Case Study

The world is changing. Borders are opening up. Workforces are crossing international boundaries. Barriers to global competition are lifting and technology is simplifying communication and allowing virtually anyone to enter the global job market. The only constant that remains in today’s hiring equation is people. Resume fraud is a widespread problem for employers in every industry and at any size company. It’s persistent and sometimes even careful examination of a resume won’t immediately reveal red flags or problems. The only way to properly vet job candidates is to screen them with a thorough pre-employment background checking process.

The result of not comprehensive background screening checks was recently described on CNBC, 2018, titled: “HR Confidential: I hired him without performing a background check. Then he stole his colleagues’ identities”. Let’s have a look at the case study.

“I was a senior HR manager at a foreign banking company. An employee came to my office and informed me that someone had stolen his identity and applied for credit cards in his name. I took down a report but didn’t think anything of it because I oversaw payroll and other sensitive information. It wasn’t out of the ordinary for employees to notify me about changes to their banking information or if their bank account had been compromised. That way, I could make sure there were no issues with their deposits. But a week later, another employee came to me with the same problem and my red flag went up. By the third employee, I knew something was happening. I realised we had an internal problem because it’s too coincidental for three employees to have identity theft within a three-week span. My staff and I tried to figure out what was going on but we were getting nowhere.

The solution

After a few weeks, we hired an investigative company that specialises in fraud. They came to my office and requested the name, photo and address of everyone who has ever touched our employee files and I gave them a list of 15 to 20 people. One week later, they came back with the postmaster general and postal police officers who were armed with guns. They sat down, placed the list in front of me, pointed to a name and asked, “Who’s this person?” I responded, “Oh, he’s a temp in our file room.” They said, “Bring him in.” I brought him into my office and the guy’s in handcuffs in less than five minutes. I couldn’t believe it. I was in shock. The guy was a temp employee who we had hired through an outside agency to work in our file room. When you have 3,000 employees, their personal files quickly pile up so we hired him to clean up each person’s file, add information to them and put them away. However, he was going into these files, taking people’s social security numbers and stealing all of their information. The post office already had the guy under investigation for other credit card fraud that was linked to a particular address. Therefore, when they saw his name on our list, they were able to easily nail him. When he came into my office, he initially denied that he was the culprit. However, he eventually admitted that his friend talked him into stealing his colleagues’ information. He and his friend were stupid enough to fraudulently sign up for credit cards and got them sent to their home address. That address was the one that the postmaster spotted on our list. For the employees who had their identity stolen, this was such a nightmare. It took some of them more than a year to get this solved. I also felt somewhat responsible because I’m the one who hired the temp and this happened under my watch. I did the best I could in providing support.

As a company, we did feel obligated to offer help and paid the service fees to help them clean up their records. I felt terrible. This went on for months for them. Luckily, they didn’t sue us or anything but it was a mess.

The lesson

The first lesson here is this: Quickly determine when something is outside of your element and know when it’s time to get help. Doing an investigation of employee theft was outside of my staff’s expertise. Even though it cost us about $5,000 to hire the investigative company, it saved us time that would otherwise have been wasted. You need to know when you’ve reached your limit and when to outsource things.

The second lesson is to always perform background checks for temp employees (just like you would for a full-time employee), especially if the person is handling sensitive information.”

At CRI Group™, our EmploySmart™ pre-employment background screening process analyses a job candidate’s claims and credentials and digs beyond the surface to make sure the facts match up. Our experts conduct extensive checks that examine all of the following details of a potential employee:

- Employment History References

- Credit and Bankruptcies Checks

- Academic and Professional Qualifications

- Prior Work Experience and Business Success/Failure Searches

- Regulatory Registers, Compliance Databases and Regional Supplemental Searches

- Sanction List and Criminal Record Searches

- Identity and Good Conduct Certificate Validation

- Directorship Search

- Media and Social Network Search

Can you afford to let degrees and credentials go unchecked? Contact us today.

Source: CNBC, 2018, titled: “HR Confidential: I hired him without performing a background check. Then he stole his colleagues’ identities”, https://www.cnbc.com/2018/04/05/hr-confidential-i-hired-him-then-he-stole-his-colleagues-identities.html

Background Checks: An Essential Process

There are inherent risks in the hiring process, including deception by individuals seeking to gain an advantage over other candidates. Thorough pre- and post-employment background checks are critical in mitigating these risk factors, helping any organisation stay better protected from fraudulent candidates or unqualified employees.

The advantages of using an expert third-party service to conduct background checks are many. Comprehensive background checks are best performed by industry experts who understand where to find and confirm employee information, from criminal, education and employment history records checks to verification of credentials, training, certifications and other important info claimed by the employee or candidate. An international firm can access resources in geographic regions not serviced or accessible by typical “out-of-the-box” screening services.

Taking this approach puts protection in the hands of agents who are specially trained to use every resource available to provide timely and thorough pre- and post-employment background checks, adding a level of due diligence that allows you to focus on your core business needs. This is why any pre-employment background checks should dig deep enough (within all local laws and regulations) to assess every detail of a job candidate’s claims and credentials, to confirm that the claims match with the facts. An expert team should examine all of the following details of a potential employee:

- Identity: Some job candidates will actually fabricate a new identity, especially if they have something to hide. Proper screening can verify name, addresses, phone numbers, national ID numbers and other identifying information to confirm that they are who they claim to be.

- Credit checks and bankruptcy checks. As permitted by local laws, financial and credit history should be reviewed, as fraud statistics have shown financial distress to be a key red flag for fraudulent behaviour. Has the candidate claimed bankruptcy? Have they dissolved prior companies or are they faced with debtor filings?

- Previous employment verification. Background checks will verify past employers, locations of past employment, dates employed, salary levels, reasons for leaving, position titles, gaps in employment history and pertinent contact information.

- Education and credentials verification. Verification is needed to confirm school grades, degrees and professional qualifications.

- Criminal history. International criminal records searches are critically important, and should include any convictions for the applicant in the requested jurisdictions.

- … and more.

What gets uncovered serve both as cautionary tales and success stories. One client in the medical industry was hiring for a critical management-level position. After finding what appeared to be an exemplary candidate, they engaged thorough pre-employment

The candidate claimed to be a holder of a university degree, which, upon verification, turned out to be ‘fake and forged.’ The applicant also provided a reference letter, which turned out to be fake as well. In short, there was nothing legitimate about the candidate’s educational background. This person would have been a risk on all levels, including patient safety. The client dodged a very real bullet by applying proper background checks, and not hiring someone who was unqualified and untrustworthy.

Don’t take unnecessary risks with your business, assets, investments and reputation. Whenever you are hiring a new employee, conduct a thorough pre-employment background check, best implemented and administered by a third party. After all, a team that specialises in background checks will have a full bank of resources and experienced personal to do the job properly. Hiring new employees should be an occasion marked by excitement, not risk and uncertainty.

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Hiring Process: the 10 Top Risks

10 Top Risks Faced in the Hiring Process

Hiring new employees is an essential part of operating, and growing, a successful business. It is also a process that presents an inherent risk to any organisation. Company insiders often commit fraud and other criminal acts; the very people trusted to work for the business’s best interests. While most employees might be honest and trustworthy, it only takes one to cause major unforeseen problems that can be hard to predict and even more difficult to undo.

Companies that don’t perform pre-employment background checks, or conduct insufficient background checks, are at a particularly high level of risk. According to popular employment site CareerBuilder.com, “Fifty-eight per cent of hiring managers said they’d caught a lie on a resume; one-third (33 per cent) of these employers have seen an increase in resume embellishments post-recession.” Even more staggering, 50% of workers know someone else has lied on their resume (BestLife, 2018). This shows an uptick in recent years and should alarm any business owner or hiring manager/human resources professional as a wake-up call that there is a serious problem.

So what are the most common areas of resume fraud? The following is a rundown of the top 10 ways candidates might show deception in the hiring process:

1. Stretching Dates of Employment:

Someone who can only stay at each job for a few months at a time is likely to be a concern for a prospective employer. For that reason, they might fudge their employment dates to make it look like they have longer ranges of employment in certain positions.

2. Inflating Past Accomplishments and Skills:

The candidate might claim major successes; for example: “implemented new CRM process company-wide” – when in reality, they only played a small role in this achievement.

3. Enhancing Job Titles and Responsibilities:

Perhaps they were managers, but refer to themselves as a director. Or it might be something subtle, such as calling themselves “senior sales managers” when in fact, they were “assistant sales managers.”

4. Education Exaggeration and Fabricating Degrees:

Claiming a degree that was never earned is one of the most common fabrications. Several executives at large corporations have been exposed to this type of deception.

5. Unexplained Gaps and Periods of “Self-employment:”

A candidate who was simply unemployed (or worse … such as incarcerated, for example) might claim to have been running their own business to explain their employment gap(s) when in fact they were just not working.

6. Omitting Past Employment:

A prospective employee might leave out previous jobs if they were terminated for cause or don’t want that particular employer to be contacted for any other reason.

7. Faking Credentials:

Certifications, assessments, awards – all of these can be fabricated or fraudulently claimed by candidates to make themselves look more qualified for a position than they are.

8. Fabricating Reasons for Leaving the Previous Job:

Being terminated from a job, especially for a serious transgression, is not something most job candidates want to tell a prospective employer. For that reason, they might make up a different scenario, such as “I resigned to pursue better opportunities.”

9. Providing Fraudulent References:

A candidate provides an employment reference who gives a shining recommendation. However, the contact turns out to be a friend of the candidate. This type of deception can hide the true nature and work record of the candidate.

10. Hiding a Criminal Background:

This is one of the most serious omissions. Depending on their history, your business and employees could be at risk from a bad actor who intentionally hides their criminal past.

Several consequences can occur from the above deceptions. Fraud and criminality are possible. Having employees in place who are underqualified to do the job they’ve been hired for is another. This can lead to safety risks and obvious harm to business on every level. That’s why smart business leaders take a proactive approach toward minimising risk with thorough background checks and proper due diligence in the hiring process.

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI Group™ has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group™ launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC™ for more on ISO Certification and training.

Reference checking, 6 keys in the hiring process

Why Reference Checking?

Hiring more people within a company no matter the size can be a lot of effort, waste a lot of time and cost a lot of money so it is important to do it right, which means reference checking. As a large company, it is often the case that there will be an in-house HR team or outsourced company to deal with new employment and reference checking. As a smaller company, it is likely the managing director or office managers handle the process themselves. Companies are at risk of losing a great deal of money from not following the correct employment process. Below are a few recommendations on how you can create and run an effective pre-employment screening process.

1) Understand your risk profile

While lots of businesses have the brand and reputational risk among the leading reasons to conduct background checks, but all organisations have different types of risk. While organisations understandably wish to avoid bad publicity, risk profiles inevitably vary between companies and industry sectors. Other risk-profile considerations include whether the company has regulatory responsibilities to demonstrate due diligence in hirings, such as financial institutions and those working with sensitive or vulnerable people.

2) Implement a strong policy

A background check policy is important because it streamlines the collection, storage and dissemination of employee or applicant background information. When established protocols are in place, incidents of people making mistakes because they had to make a judgment call are reduced.

3) Make It Company-Wide

Create and apply background check policies across the whole company, even for senior management. On average, supervisors spend 17% of their time managing poorly performing employees. In the same survey, 95% of employers said that a poor hiring decision affects the morale of the whole team. Ensuring that the people you hire have the correct qualifications saves time and effort while preserving company spirit.[1]

4) Be Consistent

Pre-employment background screening must be consistent. Most negligence issues start from inconsistency in applying HR policies. Inconsistent enforcement opens the door to discrimination charges, and background screening is no exception.

5) What information can I search for?

Creating pre-defined service packages ensures that your screening policy will be consistently applied. Best practices basic packages includes the following:

• Address Verification

• Identity Verification

• Previous Employment Verification

• Education and Credential Verification

• Reference Check

• Media Check

• Criminal Record Check

6) Understand local and regional screening variance

When building your pre-employment screening program, it is critical to understand that not all countries take the same view of the availability and use of certain types of pre-employment screening information. Creating compliant data and background screening processes is a complex and evolving challenge for all organisations and one that is multiplied by every country involved. As an essential means to ensure the safety and quality of staff, employers need to ensure that their screening programs are right for their organisation and their candidates; transparent, consistent and proportionate by design; and capable of handling an increasingly globalised workforce and disparate regulatory requirements.

References:

Let’s Talk!

If you have any further questions or interest in implementing background screening solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Human Capital can make (or break) your business – mitigating employee risk!

Most organisations manage some of their risks via an insurance policy and risk retention. However, this is a reactive strategy when it comes to risk. If you are one of these organisations, then you are missing the riskiest part of the equation: people risk.

People risk IS…

- having the wrong people in the right positions;

- the failure to understand brand;

- having a weak tone at the top that sets a little precedent;

- a leadership failure that trickles down;

- the uncontrollable side of what people do.

At CRI Group we see people risk as a hidden, budget-busting risk. We know that people and culture can influence (very negatively) your strategy. In other words, human capital can make — or break — your organisation. This risk directly affects your culture, brand, operational efficiency, and ultimately your profitability. In our view, effective leaders of people risk squash organisational inconsistency by living the brand.

Employee investigative analysis findings expose employee risk

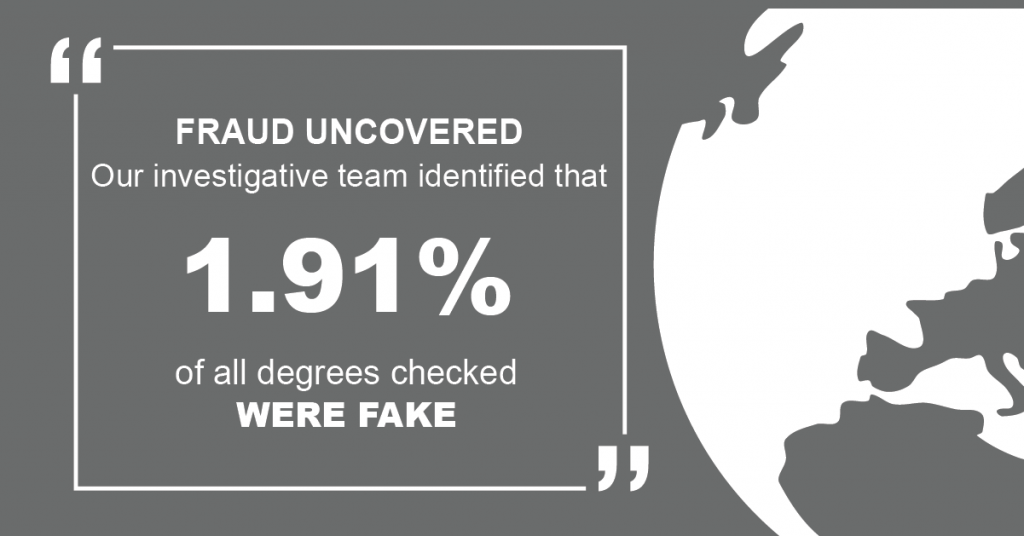

Between February and March 2019, CRI Groups’ investigative analysis team found 3.6% of all requested degree checks to be fake. This is followed by the statistics from January-June 2020, indicating that claiming a fake degree occurred in nearly 2% of cases. Our investigative operations team also found this year that providing incorrect education degree details resulted in 2.33% of all checks. Overall, providing incorrect employment details is the most common red flag, as it was uncovered in about 4.5% of background screenings. Learn more statistics in our article, titled “Background Screening Red flags: Numbers Don’t Lie“.

With degree fraud becoming more common and sophisticated in style globally, comes an increased necessity for pre-employment degree checks to deter potential candidates from fabricating their level of experience and qualification, and to prevent the harmful consequences that employing such applicant’s can have on the company. With job seeking becoming more competitive, many employers are looking for degree level candidates to fill their positions and this means that for some candidates, falsely claiming the existence of their degree is an attractive idea[1]. This can come in the form of referencing to their bogus degree in their CV, or potentially even buying a false certificate from a fake or real university under a site which creates these certificates later down the line if the candidate’s fraudulent activity is not initially flagged up.

Of course, using these websites with the purpose to deceive employers, rather than for “novelty use” which the websites so often claim is the purpose of their product, is a criminal offence and can result in 10 years in prison within the UK, under the Fraud Act of 2006[2]. However, this seemingly hasn’t deterred the thousands of UK nationals who have purchased fake degree certificates with one person spending nearly £500,000 on the certificate[3]. According to a study conducted in 2014, one in three employers do not verify the candidate’s degree qualification upon their hiring, meaning that people are hired into positions they are neither qualified nor educated in, so also pushing those who are degree standard out of the chance of reaching the position[4].

One fake degree holder in a sensitive position can ruin the organisation due to significant irreparable reputational damage. Our pre-employment background checks capability thus acts as an effective employee risk mitigation strategy, so protecting your company from the “human factor”.

Mitigating Employee Risk

Where there are people, there are risks. There are factors in employee-related risk management that are out of a company’s control. But just because you can’t prevent them from occurring doesn’t mean you can’t be prepared for them when they do occur. CRI Group has developed this playbook to help you understand how to mitigate employee risk. This playbook defines the risks, explains and identifies each and their impact. “Where there are people, there are risks: mitigating employee risk” provides actionable advice on how to take control within your organisation including information on background screening (pre-employment screening and post-employment background checks).

You secure their future. We secure their past.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure you know that everything they’re telling you is the truth? 90%? They showed you a diploma, how do you know it’s not photoshopped? Did you follow the correct laws during your background checks process?

Mitigating employee risk is vital to avoid horror stories and taboo tales that occur within HR, your business or even your brand – simply investing in sufficient screening can save you time, money and heartbreak. CRI Group’s EmploySmart service provides in-depth background screening services of employees and candidates at all levels, from senior executives t

o shop-floor employees. Outsource your employee background screening to one of our experienced providers, trusted by the world’s largest corporations, and you will only ever have to look forward, never back.

[accordion_father][accordion_son title=”About CRI Group” clr=”#ffffff” bgclr=”#1e73be”]Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.[/accordion_son][accordion_son title=”Sources & Credits” clr=”#ffffff” bgclr=”#1e73be”][1] https://www.theguardian.com/education/2002/apr/06/students.schools1

[2] https://luminate.prospects.ac.uk/7-ways-to-spot-a-fake-degree-certificate

[3] https://www.bbc.co.uk/news/uk-42579634

[4] https://www.agencycentral.co.uk/articles/2017-04/why-fake-degrees-are-destroying-recruitment.htm

اتصل بنا

المقر الرئيسي: +44 7588 454959

المحلي: +971 800 274552

:البريد الإلكتروني info@crigroup.com

المقر الرئيسي: 454959 7588 44

المحلي: 274552 800 971

:البريد الإلكتروني info@crigroup.com

الاشتراك في النشرة الإخبارية