COVID19 increases identity theft cases: 7 steps to lessen your risk

What does an embezzler spend their money on? In the case of a New York man’s alleged fraud, just about everything, apparently. According to IDentutyUSA identity theft is on the rise during COVID-19 pandemic. Experts predict that one out of every four people in the United States will be a victim of this growing crime trend as more people work from home because of COVID-19. While data from Experian and the National Hunter Fraud Prevention Service shows that fraud rate rises 33% during Covid-19 lockdown. As many as 1 in 10 people are now victims of identity fraud annually, with 21% of these individuals having been victimized multiple times.

When fraud investigators are asked what is the biggest fraud risk to the public at large, identity theft is usually at or near the top of the list. In today’s technologically connected world, criminals can get personal identifying information on countless unsuspecting individuals with just a few keystrokes.

At CRI® Group, our experts have investigated their fair share of identity theft cases, and while they can be very damaging, there is good news – many could have been avoided (and can be avoided in the future) with some proper due diligence. With that in mind, here are some important tips to help lessen the chances of becoming a victim of this insidious fraud:

1. (If/When out) Be careful using public wifi

When using the wifi at a coffee shop, Internet café or any other public place, don’t access bank account information or other sensitive information. Your data is vulnerable to those looking to steal it.

2. Update your passwords regularly

Change your passwords and vary them among different accounts. Password managers like LastPass can help you keep track of them.

3. Don’t become a victim of phishing

Be very skeptical of unsolicited emails or website pop-ups that pose as legitimate sites (like those pretending to be a bank, a delivery service, or the IRS, for example) and ask you for personal identifying information, or financial particulars. Don’t follow links or click on attachments for any of these unconfirmed emails or sites.

4. Consider going paperless

Identity thieves can still get your information the old-fashioned way: by intercepting your mail, going through your trash or finding other ways to get bills, invoices or receipts. Shred documents that you do have and don’t need, and opt to go paperless (requesting electronic documents only) as often as possible.

5. Check your bank and credit card statements

If someone is using your existing accounts, you’ll want to know as quickly as possible so that your bank can be alerted and take the proper measures.

6. Watch for fraud alerts

Most banks will now proactively alert their customers when they see suspicious transactions. If this is an optional service, opt-in – it’s better to be safe than sorry. Then you can confirm whether the transaction is actually fraudulent or not.

7. Monitor your credit history

Credit reports can help you know if any new lines of credit have been fraudulently opened in your name. Services include Experian, Equifax, TransUnion, and Callcredit, and in the U.S., you are able to receive your credit report once a year at no charge.

Identity theft is a serious problem, and it’s not going away anytime soon. But it’s good to know that there are some common-sense precautions we can all take to lessen our chances of having our information stolen.

If you do become the victim of ID theft, or believe your information may have been compromised, there are resources to help you deal with the crisis.

In the U.S., you can visit IdentityTheft.gov. This official U.S. government website invites users to report if they have been victims of identity theft. Based on the information they provide, victims are assisted with a personalized recovery plan, and can receive step-by-step instructions on how to proceed and navigate the sometimes murky and complicated world of untangling identity theft.

In the UK, ActionFraud National Fraud & Cyber Crime Reporting Centre provides tips, advice and a reporting system as your first point of contact if you have been a victim of fraud.

Many other countries and jurisdictions provide similar services. If you are a victim of identity theft, rest assured you are not alone. It is one of the most common frauds around the world, but with a little preventative action, we can lessen its incidence and its impact.

Identity theft is a persistent problem in business, but it doesn’t have to be a crisis at your company. By using a common sense approach and some key prevention strategies, you can help ensure that your employees know the rules and are less likely to be victims. For assistance in developing and implementing a fraud prevention strategy, contact us today or get a FREE QUOTE now!

Speak up – report any illegal, unethical, or improper behavior

Ethics & Compliance Hotline is an anonymous reporting mechanism that facilitates reporting of possible illegal, unethical, or improper conduct when the normal channels of communication have proven ineffective, or are impractical under the circumstances. At CRI Group, we are committed to having an open dialogue on ethical dilemmas regardless.

Learn more about how EmploySmart™ can help your company stay protected during these strange and uncertain times. Contact CRI® today.

About us…

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organizations. Contact ABAC® for more on ISO Certification and training.

MEET THE CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

10 top business risks

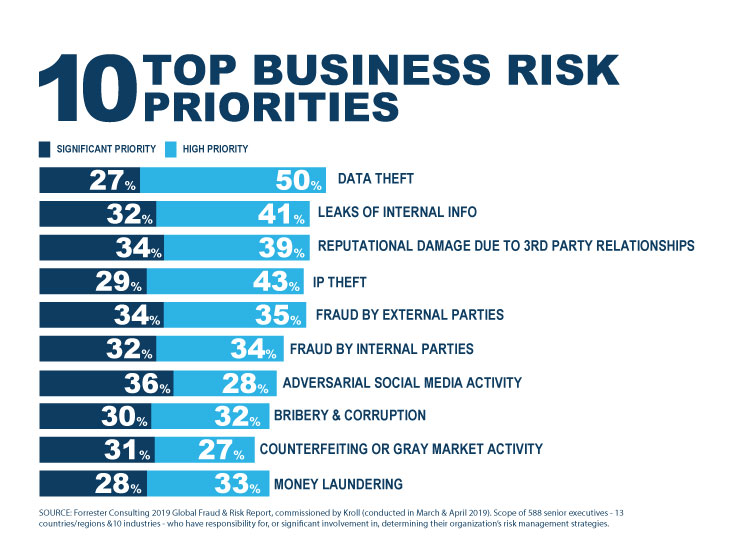

Sometimes business owners or management have an outsized sense of business risks for a particular threat. For example, some companies place extreme emphasis on guarding their intellectual property (IP), when in actuality the incidence of IP theft for their industry might be low. Other times, however, their priorities are firmly in line with the threat posed by the risk. According to a recent study, this is exactly the case when it comes to leaks of internal information, data theft, and reputational damage due to third-party relationships (Global Fraud Risk Report 2019/20).

This report is based on a survey of 588 senior executives from 13 countries and regions and 10 industries. It provides valuable insight into what types of threats are keeping business leaders awake at night. “The broadening of the risk landscape is visible in the types of significant incidents our survey respondents report experiencing in the last 12 months and in the priority levels they assign to various risk mitigations,” the report states. “The most frequently cited incident is leaks of internal information, reported by 39 percent. But this perennial challenge now coexists with risks from relatively recent threats, such as data theft, and even newer threats, such as adversarial social media activity.”

Business information leaks occur when confidential information is revealed to unauthorized persons or parties. This happens with alarming frequency, as recent news stories illustrate. Headlines include “Stunning iPhone 12 video shows Apple’s leaked prototype design with no notch” (BGR, 2020); “New Leaks Show Business and Politics Behind Tiktok Content Management” (China Digital Times, 2020); “DOJ charges Defense Intelligence Agency employee for leaking highly classified information to the media” (Business Insider, 2019). There can be direct and/or indirect negative repercussions from an information leak at your business. It can affect product rollouts, or give you a disadvantage in a competitive market; among other effects. At CRI Group, our experts work with companies to develop policies that provide zero-tolerance for information leaks, and put controls in place (such as secure communications and data systems) to prevent such leaks from occurring in the first place.

Data theft

Perhaps the fastest-growing scourge of businesses since the beginning of this century. Massive data breaches have cause major distrust among consumers worldwide, and have led directly to identity theft and financial crimes such as theft of credit, illegitimate loans and other schemes. Data theft involves stealing computer-based information from an unknowing victim, usually a company with a large customer or client base. This usually results in the sale or sharing or private information. Most recently, a data breach reportedly exposed more than 200 million Americans: “Data Breach Exposes 200 million Americans: What You Need To Know” (Screen Rant, 2020). In another case, a major cruise operator saw its customers’ information exposed: “Norwegian Cruise Line Suffers Data Breach” (infosecurity, 2020).

For any company that is entrusted with customers’ or members’ private information, especially personally identifying information (PII), data theft can be a devastating crime. Beyond lawsuits and financial damage caused by such a disaster, rebuilding the company’s reputation (and earning back customers’ trust) is an uphill battle that might take years or more. That’s why CRI Group recommends that every business, regardless of size or industry, make protecting customer data one of its highest priorities. Today, leading technology can help make data more secure. But even the most secure system is dependent upon a properly trained workforce that follows all of the protocols to achieve effective data protection.

Reputational damage due to third-party relationship

Another serious business risk to any organisation that partners with other companies, suppliers or contractors. Even worse, they can be completely outside of your control. Here are examples of some of the risks: A business partner is embroiled in behind-the-scenes legal battles; a supplier makes procurement decisions involving the inappropriate influence of government officials who receive kickbacks; a partner falsely claims to have experience in an industry, and cannot deliver on its contractual promises. CRI Group’s integrity due diligence experts have helped clients avoid those very scenarios. Our investigators employ a proven, multi-faceted research approach which involves a global array of databases, courts and public record searches, local contacts, industry and media resources, and in-depth web-based research.

As the report states, “The last decade has seen cybercrime evolve from an IT issue to a boardroom concern, mirroring the digital transformation of the global economy on the macro level and of business operations on the micro level. The more the business world integrates digital elements, the more likely it is that computer systems have or will become a pathway for crime.” Now, more than ever, it is important for business leaders to be proactive in managing these modern business risks. Fraudsters and those who steal information are evolving their methods every day. Depend on the experts to help you stay one step ahead.

Lets Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

About us…

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

MEET THE CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organisations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

COVID-19: Fraudsters are preying on fear and confusion

In a time of crisis, we often see the best in people. Even before COVID-19 was officially classified by the World Health Organization (WHO) as a global pandemic, citizens and government leaders were praising the selfless sacrifice of doctors, nurses, first responders and others putting themselves in harm’s way to help treat and limit the spread of the disease. Unfortunately, a crisis can also bring out the worst in some people. Fraudsters who prey on people’s fear and confusion tend to waste no time when a global disaster strikes. COVID-19 is relatively new and still spreading, yet fraud schemes are multiplying like the virus itself as criminals look for vulnerabilities among a fearful population.

Interpol issued a warning on March 13 that fraudsters are “exploiting the fear and uncertainty” around COVID-19 through several different schemes utilizing different approaches. These include telephone fraud, through which “victims receive calls from criminals pretending to be medical officials, claiming a relative has fallen sick with the virus and then requesting payment for their treatment;” and phishing, in which “victims receive emails from criminals pretending to be from health authorities, or legitimate companies, using similar looking websites or email addresses” (Euronews, 2020).

While the public might be surprised to see an uptick in shameless fraud schemes during such a time, investigators are not. Disaster fraud is a common scourge of law enforcement and regulatory bodies everywhere. For example, in 2012, Hurricane Sandy devastated the Caribbean and eventually wreaked havoc upon the U.S. eastern seaboard. More than a hundred individuals in New Jersey alone were prosecuted for filing fraudulent applications for relief funding. Investigators in the southern U.S. launched similar actions after Hurricane Harvey in 2017.

Fraud that preys on the fearful or vulnerable is even more insidious. That’s what investigators are seeing right now as COVID-19 continues to spread. The Food and Drug Administration (FDA) and the Federal Trade Commission (FTC) recently issued warning letters to seven companies for selling fraudulent COVID-19 products. “These products are unapproved drugs that pose significant risks to patient health and violate federal law. The warning letters are the first to be issued by the FDA for unapproved products intended to prevent or treat “Novel Coronavirus Disease 2019″ (COVID-19)” (FDA, 2020). The FDA and FTC are taking this action as part of their response to protecting Americans during the global COVID-19 outbreak.

The FDA and FTC issued warning letters to Vital Silver, Quinessence Aromatherapy Ltd., Xephyr, LLC (doing business as N-Ergetics), GuruNanda, LLC Vivify Holistic Clinic, Herbal Amy LLC, and The Jim Bakker Show. In some cases, colloidal silver was being fraudulently peddled as a successful treatment for preventing and/or curing COVID-19.

An article in New York Magazine provides an insightful look at various herbal and homeopathic “cures” that become a hot commodity at times of widespread illness. As the article points out, useless treatments aren’t simply harmless. They can have a seriously detrimental effect when they replace actual science: “Even without the looming threat of a pandemic, pseudoscientific cures can pose a real threat to the public. No scientific evidence supports the claim that homeopathy has curative properties, for example, and relying on unproven treatments without the assistance of conventional medicine can put a person’s health at risk. Some popular treatments, like colloidal silver, can actually be dangerous if consumed in enough quantities. Nevertheless, alternative medicine is a big market in the U.S. Americans spent $30 billion on alternative medicine in 2012; by the time COVID-19 appeared, people were already primed to trust dubious cures” (New York Magazine, 2020).

So how can the general public avoid frauds and phishing schemes during a crisis? Here are some things to keep in mind:

- Be suspicious of emails that are peddling cures or medical devices. Don’t click links or open attachments.

- When searching for information online, be aware of fake websites impersonating legitimate organisations. Check the web address carefully and don’t provide any personal information.

- Follow the same rule for unsolicited phone calls – under no circumstances should you reveal any personal or financial information.

- If you believe you have fallen for a scheme, contact your bank or credit card provider immediately.

Remember, fraudsters take advantage of a sense of panic among their victims that they have to take action immediately. Anyone (other than a legitimate government or medical official) who tries to pressure you to make a decision, especially a financial one, may try to scam you. Keep a cool head, do your research, and don’t panic. Businesses are not immune to such frauds, either. If you think your business has fallen prey to a scam, contact CRI® Group immediately. Our investigators are standing by to help prevent and detect such schemes.

Let us know if you would like to learn more

If you have any further questions or are interested in implementing compliance solutions, please contact us.

About us…

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organizations. Contact ABAC® for more on ISO Certification and training.

MEET THE CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

Risk & Compliance magazine: interview with our CEO

Interested in employee integrity due diligence and pre-employment screening? Or are you engaging in a merger or acquisition, an IPO, engaging suppliers, contractors, or new clients and looking for third-party risk management solutions? Background checks and necessary screenings are vital to avoid horror stories and taboo tales that occur within HR, your business or even your brand – simply investing in sufficient screening can save you time, money and heartbreak.

Learn the benefits and best practises of background investigations from the industry leader Mr. Z. Anjum, CEO at CRI Group.

Click here to download the insights on Background investigations in a one-on-one interview published in Risk and Compliance magazine, 2019.

Have you read?

- Brexit poses new bribery challenges, ISO 37001 provides solutions

- Bribery and corruption plague Middle East, how can ISO 37001 help?

- As South Asia Grapples with anti-bribery compliance, ISO 37001 provides solutions

- Whitepaper: Organised catastrophe of international Pakistan airlines

- Rolls-Royce Case study: Ethics & Compliance

- ISO 37001 FAQ

- Are you ready for ISO 37001?

- Don’t have an ethical code of conduct? Your organisation needs one

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Background screening: 10 things you should know

Hiring new employees is an essential part of operating, and growing, a successful business. It also presents an inherent risk to any organisation. According to popular employment site CareerBuilder.com, “58% of hiring managers said they’ve caught a lie on a resume; one-third (33% of these employers have seen an increase in resume embellishments post-recession.” Background screening

Here’s another statistic: according to a survey conducted by CRI™, more than 75% of organisations conduct some sort of background checks. That’s good news. But it also means that nearly a quarter of companies don’t do any pre-employment screening, which is concerning. Screening employees means having a safer, more secure work environment. Here are 10 important things every organisation should know about the hiring process, and the need to conduct thorough pre-employment background screening.

1. Some job candidates will actually fabricate a new identity.

This is especially true if they have something to hide, such as a criminal background. Proper screening can verify names, addresses, phone numbers, national ID numbers and other identifying information to confirm that they are who they claim to be.

2. Credit and financial history should be reviewed.

Fraud statistics have shown financial distress to be a key red flag for fraudulent behaviour. Has the candidate claimed bankruptcy? Have they dissolved prior companies or are they faced with debtor filings? An individual’s financial history should be checked to the degree that is permissible by local laws.

3. Previous employment needs to be confirmed.

Background checks will verify past employers, locations of past employment, dates employed, salary levels, reasons for leaving, position titles, gaps in employment history and pertinent contact information.

4. Stretching employment dates is a major problem.

Speaking of previous employment, CRI Group™’s survey found that the top form of résumé fraud is stretching employment dates. This can cover gaps in employment, or make it seem they have more experience in certain positions than they actually do.

5. Some candidates present fake education credentials.

Verification is needed to confirm school grades, degrees and professional qualifications. Claiming a degree that was never earned is one of the most common fabrications. Certifications, assessments, awards – all of these can be fabricated or fraudulently claimed by a candidate in an effort to make themselves look more qualified for a position than they actually are.

6. International criminal records searches are critically important.

Criminal background checks should include any convictions for the applicant in the requested jurisdictions. Hiding a criminal background is one of the most serious omissions. Depending on their history, your business and employees could be at risk from a bad actor who intentionally hides their criminal past.

7. Checking (and verifying) references is important.

A job seeker might provide an employment reference that gives a shining recommendation – but the contact turns out to be their close friend. This type of deception can hide the true nature and work record of the candidate.

8. Formalise your background screening policy.

What is your company’s current, written policy for hiring new employees? How does it address background checks, due diligence, and other issues? Is the process followed in every case? Having the process detailed in writing will help make it a regular part of your business practice.

9. Make sure someone owns the background screening process.

Ultimately, who has the responsibility of vetting new hires? Is it ownership? Human resources? Individual managers? It might be a collaborative process. All of those who are involved in hiring should also be involved in the implementation of a due diligence solution that includes background checks.

10. Don’t skip post-employment background screening.

Proper due diligence doesn’t just apply to prospective new hires. It should also be used to periodically evaluate your current workforce. Examine the various roles and personnel at your organisation, and consider a policy that addresses risk areas with background checks. For example, CRI Group’s survey found that nearly half of business leaders see financial services, investments and banking positions as “high risk.”

It’s important to have a formal, written policy for background screening. It’s also important to know that comprehensive background checks are best performed by industry experts who understand where to find and confirm employee information. This ranges from criminal, education and employment history records checks to verification of credentials, training and certifications. CRI Group™’s professional background screening services engage international resources in geographic regions not serviced or accessible by typical “out-of-the-box” screening services.

EMPLOYEE BACKGROUND CHECKS

EmploySmart™ is a CRI™ employee background checks service. It is a robust new pre-employment background screening service certified for BS7858, to avoid negligent hiring liabilities. Ensure a safe work environment for all – EmploySmart™ can be tailored into specific screening packages to meet the requirements of each specific position within your company. We are a leading worldwide provider, specialised in local and international employee background checks, including pre-employment and post-employment background checks.

CRI™ Employee Background Checks are essentially an investigation into a person’s character – inside and outside their professional lives. Some checks you probably already carry out in-house, such as candidate’s qualifications (documents provided), work history (with a reference check), right to work in the country and even a quick social media presence scan. However, we provide a full in-depth background screening service for candidates and employees at all levels – from senior executives through to shop-floor employees:

|

|

CRI™ is duly certified by British Standard Institute BSI for the scope of BS 7858:2019 Screening of individuals working in a secure environment, Code of practice (the only BS 7858 certified background screening services provider in the UAE and across the Middle East); and BS 102000:2018 Code of practice for the provision of investigative services.

Ensure a safe work environment for all in this difficult time – EmploySmart™ can be tailored into specific screening packages to meet the requirements of each specific position within your company.

حول مجموعة سي آر آي (CRI Group™)

Since 1990, Corporate Research and Investigations Limited (CRI Group™) has been safeguarding businesses from fraud, bribery and corruption. Globally, we are a leading Compliance and Risk Management company licensed and incorporated entity of the Dubai International Financial Center (DIFC) and Qatar Financial Center (QFC). CRI™ protects businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. Based in London, United Kingdom, CRI™ is a global company with experts and resources located in key regional marketplaces across the Asia Pacific, South Asia, the Middle East, North Africa, Europe, North and South America. Our global team can support your organisation anywhere in the world.

In 2016, the company launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body that helps organisations mitigate internal and external risks by providing a complete suite of Anti-Bribery, Compliance and Risk Management programs.

OUR MISSION AND VISION

- CRI™ mission is to safeguard the corporate world by detecting and exposing those elements that can cause irreparable harm to a business

- Stand up against the outside forces that, through corruption, collusion, coercion and fraud, can cause financial, organisational, reputational and legal harm to our global clients

- Stand out as the preeminent provider of specialised investigative services that enable our clients to exhibit the highest standards of business integrity, ethics and behaviour

6 ways forensic accountants fight financial threats

Forensic accountants are experts with a unique set of training and skills. “Forensic” means suitable for use in court, and forensic accounting is a speciality practice area of accounting that deals with engagements and investigations where disputes or litigation are anticipated.

For those reasons, the training and expertise demonstrated by these professionals make them very effective in investigating and combating fraud and other financial threats. That’s why CRI Group provides forensic accounting services to help clients safeguard their financial investments and utilise best practices when a case progresses to legal action – which is happening on a regular basis as more companies make rooting out fraud a top priority.

“Forensic accountants inhabit a cloak and dagger corner of the accounting world. Their job: respond at a moment’s notice when a client spots trouble – anything from procurement fraud to a top executive cooking the books to industrial espionage.”– Justin Pope, Associated Press

Here are some ways that forensic accountants lead the fight against fraud (Source: Forensic CPA Society, titled “What is a Forensic Accountant?”).

1. Forensic accountants are suspicious

They must be able to apply their accounting knowledge to legal issues. A forensic CPA will be asked to write expert reports, assist in depositions, testify as an expert witness, conduct fraud investigations and assist in civil and criminal investigations.

2. Forensic accountants are trained investigators

They are experts at determining whether criminal matters such as employee theft, securities fraud (including falsification of financial statements), identity theft, or insurance fraud have occurred. Investigation may also occur in civil matters.

3. Forensic accountants can testify in court

Forensic accountants often have to give expert evidence at the eventual trial. Forensic accountants not only utilise their accounting and auditing skills, but also use their investigative skills to determine what events actually took place in a financial setting. Knowledge of the courtroom sets the forensic accountant apart from a typical accountant.

4. Forensic accountants provide litigation support

Litigation represents the factual presentation of economic issues related to existing or pending litigation. In this capacity, the forensic accountant quantifies damages sustained by parties involved in legal disputes and can assist in resolving disputes before they reach the courtroom.

5. Forensic accountants can assist with business valuation

Forensic accountants often assist in professional negligence claims where they are assessing and commenting on the work of other professionals.

6. Forensic accountants can help recover assets

In the aftermath, forensic accountants may be involved in recovering proceeds of crime and in relation to confiscation proceedings concerning actual or assumed proceeds of crime or money laundering.

When financial pressure leads to fraud, you need a qualified forensic accountant – or better yet, a team of them – to unravel the numbers and the facts of the case. CRI Group’s highly qualified forensic accounting experts, which include our Certified Fraud Examiners (CFEs), can quickly find discrepancies in your finances and investigate the source of the problem.

The future of your business depends on safeguarding assets and investments from fraud. Contact CRI Group today and ask us how we can help your business by preventing and detecting fraud — thereby improving your bottom line.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Rent Checks Post-Brexit

Uncertainty around Brexit continues, and the possibility of a no-deal means it is still challenging to predict what will happen when the UK leaves the EU. The Government is yet to release official guidance on what letting agents and Landlords will need to do, should a no-deal Brexit be the outcome of the process. The lack of clarity from the Government has already caused problems. Many landlords are averse to letting their properties to non-UK nationals in case they are in breach of the Right to Rent rules, post-Brexit. The Government is under increased pressure to give clear guidance on post-Brexit Right to Work and Right to Rent checks.

What do we know so far?

Right to Rent is creating a hostile environment in the private rented sector with more landlords refusing to consider renting to non-British nationals, including EU citizens, due to concerns about Brexit. According to research from the Residential Landlords Association (RLA), 44% of private rented sector landlords are less likely to rent to those without a British passport.

The Right to Rent scheme – introduced in 2016 – has never been popular as it requires landlords to carry out immigration checks to make sure that they do not rent a property to someone who does not have the right to live in the UK. Furthermore, landlords face prosecution if they know or have ‘reasonable cause to believe’ that the property they are letting is occupied by someone who does not have the right to rent in the UK.

Potential changes post-Brexit

One change which may be implemented post-Brexit is the introduction of a digital checking service. A white paper in December last year* suggested this would enable prospective tenants to view and ‘verify’ their immigration status. Meaning landlords could confirm the applicant’s eligibility to rent far more quickly. Those renting to foreign nationals from the EU would no longer need to manually check the documents which are currently required under the right to rent legislation.

Summary

There’s no denying that both landlords and EU tenants have many unanswered questions when it comes to Brexit and right to rent legislation, mainly down to the fact that a deal has not yet been decided. The 31st October 2019 should hopefully bring a clearer picture and provide the answers both parties need.

Let us know if you would like to find out more. If you have any further questions or interest in implementing a digital checking service in advance, please do get in contact.

*”The UK’s future skills-based immigration system”, by HM Government

About CRI Group

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Manage business intelligence and identify risks

Gathering intelligence isn’t just the stuff of spy movies. It’s also an important part of the business world – and when conducted legally, ethically and effectively, it is a critical tool for any organisation seeking to be successful in their industry or field.

Business investigations are about more than just identifying risk factors or weaknesses. They also reveal opportunities, from emerging commercial markets to potential new partnerships and acquisitions. At CRI® Group, our business intelligence revolves around giving you the information and the edge you need to make smart, insightful decisions that help grow your business.

Consider this: How quickly is the business world-changing in the face of technology and our interconnected world? What is your organisation doing to stay ahead of this curve and position yourself to take advantage of opportunities as they develop? In this article, we’ll talk about how business intelligence can help you grow your business while also avoiding some serious pitfalls.

Market research & analysis: Your key to information

CRI® Group’s market research & analysis experts gather the facts you need to make critical decisions, from entering new markets or industries to partnering with other organisations. Our service is based on getting you accurate information on a timely basis, interpreting and communicating it in a way that makes it easy to integrate it into your business planning.

For example, our CRI® Group’s agents put their investigative skills to work for you by helping you identify and analyse the following factors in your organisation’s market:

- Unmet needs. What gap can your organisation help fill?

- Consumer behaviour and business trends. How can your organisation take advantage?

- Brand awareness and identity. Is your organisation known and respected?

- Commercial viability and potential for success. What’s holding you back?

CRI® Group’s experts also know business trends and market changes and will guide you through the process of effectively communicating your brand and marketing your product through times of transition.

Commercial investigations: Know what you’re getting into

Mergers, partnerships and acquisitions represent another exciting area of potential growth for your organisation. But never go into such major engagements blind. CRI® Group’s comprehensive and thorough commercial investigation services involve a review of all relevant information concerning virtually any business on the planet to ascertain past business dealings, criminal records, executive stability and suspect associations.

Before you engage with another entity, CRI Group’s experts focus on the other organisation’s industry experience, its financial condition, knowledge of applicable laws and regulations, reputation, and the scope and effectiveness of its operations and controls. Our commercial investigations can reveal:

- Details of the organisation’s business and operations

- The organisation’s financial condition and reputation

- Any past or present litigation involving the organisation

- Background checks of the organisation’s key principals

- Reference checks, including peer businesses and industry groups

- Certifications, quality controls and continuous improvement initiatives

- The organisation’s experience in implementing and delivering on the proposed scope of services

- The organisation’s culture, vision and business style

- The organisation’s internal controls, information systems, security, confidentiality and contingency planning documents

- Any existing working relationships to gauge the reliance on subcontractors

- Adequacy of insurance coverage

- Marketing and customer service practices

In business, you need every piece of information available in order to position your organisation for success. With the right mix of market research and analysis and commercial investigations, opportunities will be clearer, and engagements become more secure. Contact CRI® Group today to learn how our business intelligence services can help.

Investigative research reveals opportunities

Having the critical information you need can mean the difference between success and failure in business. When it comes to investigative research, trained experts can uncover facts that help you make the right decisions; and save your organisation from making costly mistakes. CRI® Group has trained investigators positioned worldwide who can help provide a range of investigative research services. When used as a tool of effective due diligence, investigative research can provide an immediate advantage and be a proven benefit for an organisation in any industry. In this article, we’ll discuss a few ways investigative research can help uncover previously unknown weaknesses.

Finding fraud

Any organisation is susceptible to fraud. To make matters worse, corporate fraud is often a complex crime, requiring a high degree of investigative expertise to ensure that evidence is gathered and handled correctly, interviews are conducted effectively, and laws are carefully followed in the investigation.

CRI® Group has conducted financial investigations for companies worldwide to uncover a variety of criminal activity, including:

- Corporate and accounting fraud

- Asset misappropriation

- Data manipulation or data theft

- Internal & external corruption

- Embezzlement

- Kickback schemes

- Expense manipulation

- Procurement fraud

- Third-party fraud

- IP Infringement

- Insurance fraud

The worst type of fraud scheme is the one you don’t know about. Statistics say that a typical fraud lasts as long as 18 months before it is discovered. With proper investigative research, you can uncover fraud sooner – and hopefully prevent the next one.

Discovering IP Theft

Intellectual property (IP) theft is a serious threat to any organisation. Unfortunately, trying to counteract it can be a slow and expensive process. Using proper investigative research by an expert provider like CRI Group can help uncover cases of IP theft and help you begin the process of securing your property.

Did you know how many types of IP theft are out there? In today’s high-tech world, your organisation can’t afford not to protect its IP assets. Through IP infringement investigations, our experts have helped uncover the following:

- Trade secret breaches

- Data breaches and IP leaks

- Patent investigations

- Theft of proprietary customer data

- Copyright abuse

- Unauthorised use of trademarks

- Counterfeit & pirated products

- Threats to brand integrity and reputation

- Brand imitation & product copying

Uncovering conflicts of interest

Conflicts of interest can cause serious harm and weaken your organisation. They can impact your bottom line, such as when an executive awards business to a colleague or friend at higher prices or partners with an unethical or disreputable third party. Investigative research provides extensive due diligence, looking deep into partnerships and vendors to uncover potential conflicts of interest.

Some of the scenarios CRI® Group’s experts have discovered:

- Criminal conduct and background issues

- Hidden assets

- Shell companies

- Unethical partnerships

- Bid-rigging

- Hidden financial interests among executives or management

Investigative research is critical in helping your organisation stay on top of any issues before spiral out of control. And as an effective tool for risk management, it helps you put preventative measures in place for the future. In business, the more you know the facts, the better positioned you will be. Contact CRI® Group to learn more about how investigative research can help your organisation today.

Who is CRI® Group?

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

اتصل بنا

المقر الرئيسي: +44 7588 454959

المحلي: +971 800 274552

:البريد الإلكتروني info@crigroup.com

المقر الرئيسي: 454959 7588 44

المحلي: 274552 800 971

:البريد الإلكتروني info@crigroup.com

الاشتراك في النشرة الإخبارية