Employee Background Screening FAQs – PART II: Pre-Employment Check

This three-part series of articles looks at employee background screening FAQs.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling you is the truth? Or are you just 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process?

Simply investing in sufficient screening systems can save you time, money and heartbreak.

Part One of the series of articles on employee background screening FAQs, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this employee background screening FAQs ebook developed by the CRI Group™ is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS TO DO WITH BACKGROUND SCREENING. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI® Group, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

Does a Candidate Have to Give Consent to Process a Background Check?

A job applicant must give written or electronic consent before any screening conducting (whether in-house or by a third party company like CRI Group™) any criminal record search, credit history check or reference interview, etc.

How Long Does it Take to Conduct a Background Check?

Background checks typically take 2 to 3 days to process and receive back from the outside contracted agency. A few exceptions may take up to 2 weeks. A background check may rarely take longer than 3 to 4 weeks. Please allow additional processing time for each background check in the event of a delay. A delay can occur for any of the following reasons:

- The information has been entered incorrectly by the applicant or the requestor into the vendor’s system.

- The county or district listed for a background check in researching whether the applicant has any criminal felony or misdemeanour charges is delayed in responding to the vendor.

When Should I Conduct Pre-Employment Checks?

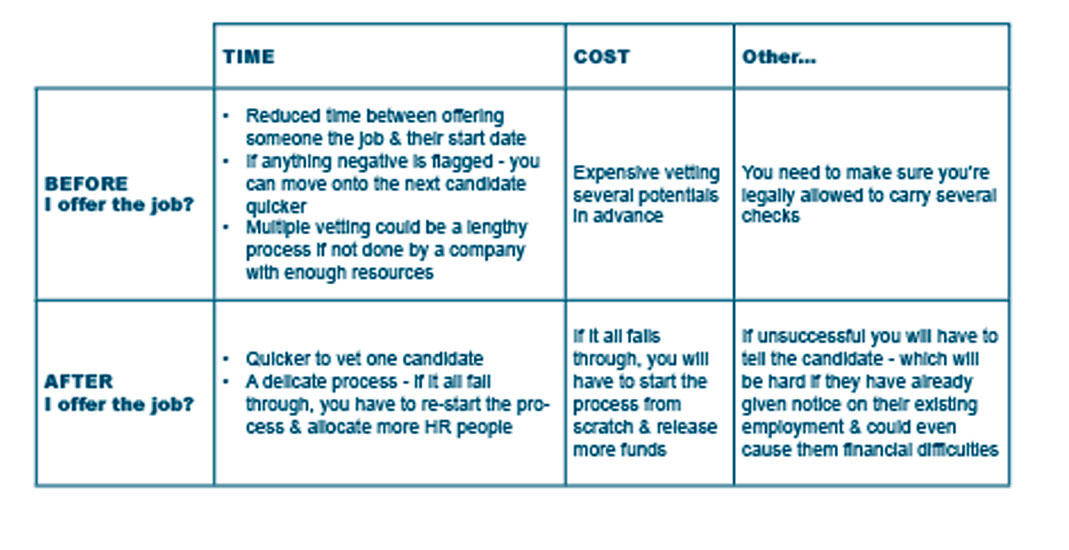

Pre-employment screening services can help you avoid adding potential fraudsters and other bad actors to your staff. These checks can be implemented before or after a job offer (with each having its pros and cons).

How Often Should I Screen Employees?

Employees should be screened regularly to reveal any new information relevant to the business. That’s why our background investigations services also include:

- Employee monitoring & risk management

- Data protection compliance

- Employee testing & confidentiality

- Employee risk management

- Post-employment background checks

How to Collect References and What to Ask?

Because it is impossible to know how your candidate will work daily from just one interview, you will need references. References are a great way to find out whether your candidates are suitable for the role or will fit with your company culture. A primary reference check asks for:

- Employment dates

- Employment main responsibilities

- Attendance record

- Any disciplinary actions against them

- Any reasons why they shouldn’t be employed

These references will help you back up their CV – however, many candidates tend to exaggerate or misrepresent themselves. Third-party vendors such as CRI® Group can go beyond to get a fuller picture for you:

- Greatest strengths?

- Are they suitable for the role they’ve applied for?

- Would they rehire the candidate?

- Suitable management style?

- Do they have any leadership skills?

- Situations in which they have excelled at?

Note: Some companies have policies not giving references and just providing necessary employment details, while others direct you towards HR.

How Much Does it Cost to Conduct a Background Check?

That will depend on the scope. Please contact the team for a free consultation.

What are Employment References?

CRI Group’s comprehensive and detailed reference checks have been carefully designed for senior-level positions. Our highly skilled researchers probe extensively across a range of performance and behavioural attributes that have been specifically targeted to meet the information and management requirements of hiring senior-level executives.

We also verify any restrictive covenants, disciplinary actions or warnings; attendance or reliability issues; claims by or their former employer; acts of dishonesty, and eligibility for rehire in a comparable role. We provide a valuable perspective of an individual’s past performance and behaviours by conducting professional, impartial references.

What is the Difference Between Employment History Verification & Employment Reference?

CRI Group™ verifies who the individual reported to and their dates of employment, positions held, remuneration, responsibilities and reason for leaving. This is different to an Employment Reference as it verifies quantitative information such as employment dates, salary packages etc.

Media Search

An individual’s media profile can encompass both professional and personal activities. This check can provide the client with a unique insight into an individual’s public activities and reputation. Our broad-based press search encompasses electronically available national newspapers and regional media sources from states where an individual has worked, helping to ensure that there are no hidden surprises. The search can be conducted by country, region or globally, where it can be of immense value in the uncovering of omissions made by the candidate (note: additional charges apply).

How do I Check on Entitlement to Work?

It is an employer’s responsibility to ensure that every individual they hire is legally eligible to work in certain Jurisdictions. CRI Group™ uses copies of the candidate’s passport or birth certificate to verify entitlement to work in the respective Jurisdiction. Where the candidate is not a local citizen, we have an online verification process set up with the Department of Immigration and Citizenship, as the case may be, to confirm eligibility to work. We will confirm whether or not the candidate is entitled to work in Australia and provide details of any limitations attached to a work visa. This search verifies and appropriately documents the individual’s entitlement to work in accordance with DIMIA requirements.

How do You Conduct Identity Checks?

The availability of identity checks varies from nation to nation, depending on centralised databases and legislation. In essence, these checks are designed to ensure the person is who they claim to be. Where there is a recognised legislated identity card system, CRI Group™ will collect this card, ensure the details are reflected on the background check form submitted and upload the identity card to the candidate file to allow for the requestor to sight.

Identity theft is on the rise, and validating an individual’s identity is essential to making an informed hiring decision. CRI® Group verifies an individual’s identity details via a comparison with details held in the electoral roll, online telephone directory and the National database registration authorities.

Passport Check

This passport verification solution enables the client to verify a person’s identity and whether their passport is forged. Passport Check verifies the authenticity of machine-readable passports and identity documents by simply entering the passport/ID data.

CV Comparison Check

Curricula Vitae (CV) are increasingly being used as a sales tool rather than a factual account of a person’s work history. This check will compare information supplied by the candidate to CRI Group™ with details supplied to an organisation in a candidate’s CV. This check aims to provide a thorough review of the candidate’s background and reveal any misrepresentations that may exist through a candidate omitting or overstating information on their CV.

Supply Chain Due Diligence Act: New Risk Management & Reporting Duties for German Businesses

This article looks at the Supply Chain Due Diligence Act (LkSG) that applies to companies operating or trading in Germany and will enter into force on 1 January 2023.

The new German law, known as the Supply Chain Due Diligence Act (LkSG, short for Lieferkettensorgfaltspflichtengesetz in German) imposes due diligence obligations on environmental protection and on human rights, with all businesses having to introduce iterative and ongoing, or in certain circumstances ad hoc, due diligence processes specified by the Act.

Identification and management of an organisation’s supply chain and the risks that come with it require the implementation of due diligence processes.

The term “supply chain” refers to all products/services of a business, including all manufacturing and services, in Germany and/or abroad, from the extraction of raw materials to their delivery to the end customer.

Furthermore, due diligence processes should implement the following criteria:

- type and scope of the business activities of the company subject to the due diligence obligations,

- the ability of the company subject to the due diligence obligations to exert influence (so-called leverage),

- typically expected severity of the violation, and

- type of contribution by the company subject to the due diligence obligations to cause a violation.

More details can be had in our FREE Supply Chain Due Diligence Act (LkSG) eBook.

Who is Affected by the Supply Chain Due Diligence Act?

- As of 1 January 2023: Companies with at least 3,000 employees that have their head office, administrative seat or statutory seat in Germany OR companies that have a branch in Germany and usually employ at least 3,000 employees in this branch;

- As of 1 January 2024: Companies with at least 1,000 employees that have their head office, administrative seat or statutory seat in Germany OR companies that have a branch in Germany and usually employ at least 1,000 employees in this branch.

From 2024, the law will apply to businesses with more than 1,000 employees.

Even if companies with fewer employees are not addressees of the Supply Chain Act, they may still be indirectly affected. This is because the companies directly affected would be obliged to enforce compliance to the best of their ability with human rights in their supply chain. The measures necessary for this can have a direct impact on their suppliers, for example, through the implementation of a code of conduct. In addition, the directly affected companies will often be dependent on the active support of their suppliers and thus have this support be contractually assured, e.g. in the form of reporting obligations as part of their risk analysis.

DOWNLOAD THE SUPPLY CHAIN DUE DILIGENCE ACT (LkSG) EBOOK.

Due Diligence Investigations: Mitigate Critical Risks

At CRI®, we provide corporate reporting and due diligence services wherever you are. Use our DueDiligence360™ reports to help you comply with anti-money laundering, anti-bribery, and anti-corruption regulations ahead of a merger, acquisition, or joint venture. You can also use them for third-party risk assessment, onboarding decision-making, and identifying beneficial ownership structures.

Due Diligence helps you Identify key risk issues clearly and concisely using accurate information in a well-structured and transparent report format. Our comprehensive range of reports includes specialised reports that support specific compliance requirements. Protect your reputation and the risk of financial damage and regulator action using our detailed reports. They enhance your knowledge and understanding of the customer, supplier, and third-party risk, helping you avoid those involved with financial crime.

The CRI® Group invites you to schedule a quick appointment with them to discuss in more detail how conducting due diligence and compliance can help you and your organisation.

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

FREE eBook | Supply Chain Due Diligence Act (LkSG)

In January 2023 a new German law, known as the Supply Chain Due Diligence Act (LkSG, short for Lieferkettensorgfaltspflichtengesetz in German), becomes effective and applies to companies operating or trading in Germany. This eBook looks at the key issues in the Supply Chain Due Diligence Act.

The Supply Chain Due Diligence Act requires businesses to undergo significant efforts in order to achieve compliance. The law introduces a legal requirement for businesses to manage social and environmental issues in their supply chains, through more responsible business practices. We’ve compiled more details on the act in our FREE ebook that can be downloaded now!

What is The Supply Chain Due Diligence Act All About?

In Part 1 of this eBook, we will provide a first outline of the Act’s material contents and an in-depth analysis of the applicability of the Act to various corporate structures.

The eBook is the collection of a series of articles in which we will take a closer look at key issues. It addresses the question of what you can do to adequately prepare yourself at this early stage rather than wait till later in the year. We would be happy to provide you with individual advice, as well. Please do not hesitate to contact us.

Preparatory Actions for Supply Chain Due Diligence Act

In Part Two of the Playbook, we’ll explore what preparatory actions you can take and how an effective risk management plan can be achieved and implemented through several services including due diligence.

Global integrity due diligence investigations provide your business with the critical information it needs in making sound decisions regarding mergers and acquisitions, strategic partnerships and the selection of vendors and suppliers. The level of due diligence will ensure that working with a potential i.e. trade partner will ultimately achieve your organisation’s strategic and financial goals.

Operating in the international market requires organisations to establish partnerships with numerous third parties, which supply raw materials, run business operations abroad and/or act as agents. At the same time, third parties are considered as the greatest area of bribery risks for international enterprises. Under the Bribery Act 2010, British-based organisations have to conduct due diligence on their third parties as the core principle of meeting the adequate procedures requirement.

IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

Subscribe now to our monthly newsletter, and receive more ebooks just like these one!

Employee Background Screening FAQs – PART I: What, Why and Who?

How do you know the candidate you just offered a role to is the ideal candidate, when it comes to Employee Background Screening? Are you 100% sure that everything they’re telling you is the truth? Or are you 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process? Who Performs Background Screening? What’s Involved in Background Checks covering History Around the Globe? Why do Employers Check Criminal History?

Employee Background Screening: What, Why & Who?

This three-part series of articles looks at employee background screening FAQs.

Part One of the series, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this ebook on employee background screening FAQs developed by the CRI® Group is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS TO DO WITH BACKGROUND SCREENING. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI Group™, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates. Simply investing in sufficient screening systems can save you time, money and heartbreak.

Why Conduct Pre-employment Background Checks?

To protect the company from various potential risks, a background check is considered an imperative pre-employment screening step before hiring. Companies often assume that the applicants are telling the truth on their resumes – what if they are not?

These checks are essentially an investigation into a person’s character – inside and outside their professional lives. Some checks you probably already carry out in-house, such as the candidate’s qualifications (documents provided), work history (with a reference check), right to work in the country and even a quick social media presence scan.

A Pre Employment Background Check: Who conducts it?

Permanent, temporary, benefit-eligible, non-benefit eligible, full-time and part-time staff require an acceptable background check.

Former employees, including retirees, are also subject to a background check if a contract breach occurs.

You could have an in-house HR team or contract with a third party vendor like CRI Group™.

Why Should I Contract a Third Party Vendor if I have an In-House Team?

You may have the capabilities to carry out the above services; however, to perform a full in-depth background screening service for candidates and employees at all levels, you need a considerable amount of manpower and skills – and it can be all-consuming work.

A third party vendor such as CRI Group™, with a global network that works with companies across the Americas, Europe, Africa, and Asia-Pacific, is a one-stop international Risk Management, Background Screening and Due Diligence solutions provider that brings true value to you and your team.

By contracting, you can benefit from the following:

- Cost Control & Savings

- Time Savings / Response Time

- Customer Service / Quality Control

- Expertise & Core Competency

- Technology & know-how

What Other Checks Can a Third Party Vendor Execute Better Than My In-House Team?

From checks on senior executives through to shop-floor employees, a full in-depth background check should include:

- Address Verification (Physical Verification)

- Identity Verification

- Previous Employment Verification

- Education & Credential Verification

- Local Language Media Check

- Credit Verification & Financial History (where publicly available)

- Compliance & Regulatory Check

- Civil Litigation Record Check

- Bankruptcy Record Check

- International Criminal Record Check

- Integrity Due Diligence…

and more.

Why is it Important?

These checks can reduce the risk of hiring someone who could cause irrevocable damage. Firms spend years, thousands, even millions to brand their products and services and one bad hire can cause a loss of capital and reputation to the extent that may cause a business to fail. A robust pre-employment check can help you and your company:

- Reduce turnover & training costs

- Gain a competitive edge through the hiring of better people

- Increase productivity – help your employees be more productive knowing that everyone employed by your company has been screened

- Set your company apart & win more business

- Reduce employee-related problems

- Protect company reputation/brand & customer relations

- Comply with mandates created by state or federal law for certain industries

- Increase retention

- Reduce negligent hiring claims

- Avoid violence in the workplace (threats of violence & actual violence)

- Reduce theft & espionage

- Avoid lawsuits & the costs associated with the defence

- Avoid loss of goodwill

- Various industry studies indicate escalating costs for worker replacement, loss of production, re-recruitment/interviewing, and training – the learning curve can cost you significant money.

DOWNLOAD THE EMPLOYEE BACKGROUND SCREENING FAQs FREE EBOOK HERE

WEBINAR RECORDING | “Remote Work & Other Trends Shaping Workplace Cultures”

CRI Group™ hosted a free webinar on August 31st. Our intention was to be able to provide resources on workplace cultures in organisations around the globe that will aid them in expansion and an positive employee environment. Take advantage of this free recording on employee wellness, remote work, pre-employment screening and workplace cultures.

The live training session was conducted by senior certified HR professional and member of CRI’s expert team,

Improving Workplace Cultures

Workplace trends are dictating major shifts and becoming new norms in the workplace. These trends are expected to grow in the coming years. Examples of this include hybrid work, employee wellness, and ongoing education. Adapting to workplace trends will help employers improve company culture, boost employee retention and defeat workplace complacency. This will help companies stay competitive within the industry and remain relevant in the wider world.

With over nine years of experience in HR, Nilofar A. Gardezi is a HRBP & an Associate Director with the CRI Group™. She is a gold-certified Trainer from DWE with a Certification in Psychology and serves as a Certified Professional Counsellor. She has worked with renowned organisations like Attock Group, British Council and Standard Chartered Bank.

Struggling with Employee Screening?

Get answers to frequently asked questions about background checks / screening cost, guidelines, check references etc. This eBook is a compilation of all of the background screening related questions you ever needed answers to:

- Does a candidate have to give consent to process a background check / screening?

- How long does it take to conduct a background check?

- When should I conduct pre-employment checks?

- How often should I screen employees?

- How to collect references and what to ask?

- How much does it cost to conduct a background checks?

- What is he difference between employment history verification and employment reference?

- How do I check on entitlement to work?

- How to conduct identity checks?

- What will a financial regulatory check show?

- Is it possible to identify conflict of interest during checks?

- What is a bankruptcy check?

- What about directorships and shareholding search?

- Can I have access to a criminal watch list?

- Anti-money laundering check?

- Can we conduct FACIS (fraud and abuse control information system) searches?

- … and MORE!

Taken as a whole, is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions.

Download your “Employee Background Screening FAQ” FREE ebook now!

The CRI Group™ has been safeguarding businesses from fraud, bribery and corruption since 1990. We are a global company based in London, United Kingdom. Our experts and resources are located in key regional marketplaces. These are across the Asia Pacific, South Asia, the Middle East, North Africa, Europe, North and South America. Our global team can support your organisation anywhere in the world. For more details about the CRI Group™ or to schedule a meeting with us, click here.

IPR Infringement Report Says IP Infringement is Getting Worse!

Intellectual property can be a business’s most valuable asset. So when outside parties threaten to steal your ideas, copy your products or disrupt your marketing channels, corrective action on your part can become tedious, time-consuming and expensive. Also, because of the high value associated with Intellectual Property Right (IPR), infringement of those rights is a lucrative criminal activity, which generates significant costs to the rights owners and to the economy in general. In fact around 12,000 IP infringement cases are filed each year.

Now, a study conducted by the European Union Intellectual Property Office (EUIPO) in partnership with the European Patent Office (EPO) found that the total contribution of IPR-intensive industries to the EU economy accounts for approximately 42% of GDP (€5.7 trillion) and 28% of employment plus another 10% in indirect employment effects in non-IPR intensive sectors. Those sectors also generate a trade surplus of approximately €96 billion with the rest of the world and pay their workers 46% higher salaries than other sectors.

The economic Value of IPRs

This IP infringement report brings together the findings of the research carried out in recent years by the EUIPO, through the European Observatory on the Infringement of Intellectual Property Rights, on the extent, scope and economic consequences of IPR infringement in the EU. Evidence on the economic value of IPRs in the EU economy, the extent to which this value is exploited, the infringement mechanisms used to capture that value and the actions being taken in response to these challenges are outlined and discussed in the report as well.

According to a study carried out by EUIPO and the Organization for Economic Co-operation and Development (OECD) in 2019, estimates of IPR infringement in international trade in 2016 could reach as much as 3.3% of world trade. Up to 6.8% of EU imports, or €121 billion per year, consist of fake goods. Both sets of figures are significantly higher than those found in study by the two organisations published in 2016, indicating that the problem has grown even more serious in recent years.

Annual Losses of €92 Billion During 2012-16 Due to Counterfeiting

In a series of sectorial studies, the EUIPO fears it has lost sales in 11 sectors in the EU, as a result of counterfeiting. These losses have occurred directly in the industries being analysed and across their associated supply chains and totalled more than €92 billion per year during 2012-16.

Abundant value, lenient sentences and high returns on investment together make it attractive for criminal gangs to engage in counterfeiting activities. The modus operandi of such gangs is becoming increasingly complex as technology and distribution channels evolve, hand in hand with the breadth of products being counterfeited.

How Legitimate Brands Can Suffer Due to Advertising!

The business models adopted by counterfeiters make significant use of the internet to distribute their products and to promote the distribution and consumption of illegal digital content. Internet sites selling counterfeit goods benefit from additional advertising revenues from both “high risk” ads (adult, gaming, and malware) and, paradoxically, also from legitimate brands, which then suffer in two ways from advertising on such sites: damage to their own brand and provision of credibility to the hosting website.

In addition to analysing the supply of counterfeit goods and pirated content, the EUIPO has also studied the demand side, that is, the attitudes of EU citizens towards IPR and their willingness to consume IPR-infringing goods and services. The incentives for consumers to purchase counterfeit goods and to access copyright-protected content illegally include lower prices, easy accessibility and a low degree of social stigma associated with such activities.

In response to these developments the EUIPO, together with public and private partners, is undertaking and supporting a number of actions to meet these challenges.

The Economic and Social Impact of IPR Infringements

The actions by the EUIPO range from providing rights owners with information on the changing infringement landscape and working with Europol on wider responses to IP crime. It also included participating in the funding of a specialised IP crime unit within Europol, supporting the European Commission’s efforts to address the supply of counterfeit goods in third countries and to help Small and Medium-Sized Enterprises (SMEs) protect their IPRs. This was done by providing citizens with information on the availability of legally accessible digital content and on the economic and social impact of purchasing counterfeit goods or accessing digital content illegally.

How the CRI Group™ Can Help You Tackle IPR Infringement

CRI Group’s Intellectual Property Investigations team helps companies identify threats to IP and confidential information internally and throughout their supply chain, develop the appropriate mitigation strategies and investigate suspected infringements.

For further information on IPR infringement or to book a meeting with our experts, click here.

Infringement of Intellectual Property Rights

Suppose you suspect that your intellectual property (IP) rights have been infringed. In that case, CRI Group’s Intellectual Property Investigations team helps companies identify threats to IP and confidential information internally and throughout their supply chain, develop the appropriate mitigation strategies and investigate suspected infringements. Our experts can track intrusions, data manipulation and a range of “digital footprints.” With our findings you can take action.

Patent Infringement

If someone uses your product or invention protected by a patent without authorization, you to prove it so you can defend your right and take action. Our investigative capabilities include gathering intelligence on the dark web and in the field, social network analysis, sample acquisition and testing.

CRI Group’s IP experts understand the intricacies and importance of protecting your intellectual property. CRI® Group can stay a step ahead of the wrongdoers who want to benefit from your IP investment by working alongside a global network of anti-counterfeit investigators, consultants, advisors, and industry groups.

Our experts can track intrusions, data manipulation and a range of “digital footprints.” Additionally, we have strong working relationships with regulators, police forces and customs and enforcement agencies worldwide. Our investigations frequently form the basis of litigation or criminal prosecutions.

Imitation of a Branded Good – Counterfeit Products

If someone is selling a good bearing your trademark without your authorization, you are the victim of counterfeiting. If you suspect that certain goods infringe your IP rights, you outsource IP investigations services.

Our investigative capabilities include gathering intelligence on the dark web and in the field, social network analysis, sample acquisition and testing. CRI Group’s IP experts understand the intricacies and importance of protecting your intellectual property. CRI Group™ can stay a step ahead of the wrongdoers who want to benefit from your IP investment by working alongside a global network of anti-counterfeit investigators, consultants, advisors, and industry groups.

Our experts can track intrusions, data manipulation and a range of “digital footprints.” Additionally, we have strong working relationships with regulators, police forces and customs and enforcement agencies worldwide. Our investigations frequently form the basis of litigation or criminal prosecutions.

IF YOU SUSPECT OF COUNTERFITING LET US KNOW NOW

To protect your products against counterfeiting, register with the Enforcement Database of the European Union Intellectual Property Office (EUIPO), which puts you in direct communication with the relevant authorities. If you are an EU company and want to report a counterfeit in a country outside the EU, you can use the Anti-Counterfeiting Rapid Intelligence System (ACRIS).

Infringement of Trade Secrets

To qualify as a trade secret, the information must:

- Be known only to a limited group of persons,

- Be commercially valuable because it is secret, and

- Be subject to reasonable steps taken by the rightful holder of the information to keep it secret, including the use of confidentiality agreements for business partners and employees.

The unauthorised acquisition, use or disclosure of such secret information in a manner contrary to honest commercial practices by others is regarded as an unfair practice and a violation of trade secret protection.

As an integral member of the ICC Counterfeiting Intelligence Bureau, CRI Group™ is certified to advise and assist organisations with intellectual property investigations involving grey market and product counterfeiting crimes.

CRI® Group investigators are specially trained to protect the brand equity and customer loyalty you’ve built by providing professional assistance in many areas, including Trade Secret Breaches.

In case of infringement of trade secrets, you can initiate a legal proceeding before a court. The outcome might be a court order prohibiting the infringer from using or further disclosing the trade secret and/or monetary compensation.

Dispute Over Domain Names

If you find out that someone has deceivingly registered a domain name whose IP rights belong to you, such as:

- for one or more top-level extensions (like .eu, or .com.)

- a trade mark

- a trading name

If this person tries to sell you such a domain, you are a victim of cybersquatting. In domain name dispute cases, you can either go to court or make good use of non-judicial remedies, including ICANN alternative proceedings.

2022 Key Infringement of Intellectual Property Rights Cases to Watch

IP practitioners are eagerly watching the court dockets for several high-impact cases related to IP issues (copyright, government liability and ethics) likely to be decided in the second half of 2022.

These decisions are expected to guide several IP law areas, including fair use of copyrights, government contractor defences, patent-eligible inventions, and the enablement requirement.

Infringement of Protected Geographical Indications

If your product protected by geographical indication has been counterfeited or there have been other infringements of geographical indication, you should contact the competent national authority.

The Cost of Infringement of Your Intellectual Property Rights

Counterfeiting threatens the fabric of national economies, endangers safety and frequently kills. It devalues corporate reputations, hinders investment, funds terrorism, and costs hundreds of thousands of people their livelihood annually. (ICC) Our IP Investigations include 1) Trademark Investigations; 2) Intellectual Property Acquisition Services; 3) Patent Investigations; 4) Brand, Media and Internet Monitoring Services; 5) Anti-Counterfeiting Programs; 6) Brand Integrity Programs; 7) Copyright Abuse Investigations; 8) Cyber Surveillance; and 9) Litigation Support.

Take action against the infringement of your intellectual property rights now!

UAE Central Bank Issues New Anti-Money Laundering Guide on Dealing with Politically Exposed Persons

The Central Bank of the UAE (CBUAE) has issued a new anti-money laundering (AML) guide and combatting the financing of terrorism (AML/CFT) for licenced financial institutions (LFIs) on risks related to politically exposed persons (PEPs), the regulator announced on Tuesday (2 August 2022). This set of guidelines comes to effect immediately.

Globally, money laundering activity is projected to more than double to $5.8 billion by 2027 from an estimated $2.8bn in 2022, research company Markets and Markets said in a report last month. The anti-money laundering task force imposed fines of more than Dh41 million ($11.16m) in the first six months of 2022 as it continues to rein in illicit financial activity. UAE imposed $11.2 million in penalties for anti-money laundering cases during the first half of 2022

Are you Following the UAE Anti-Money Laundering New Guide?

Licensed financial institutions (LFIs) offering services to politically exposed persons (PEPs) have been asked to develop “risk-based policies.” According to the state news agency, WAM, the guidelines consider Financial Action Task Force (FATF) standards and require LFIs to comply with its requirements within one month.

Under the new CBUAE guidelines, customers that are PEPs and transactions involving PEPs may expose LFIs to a heightened risk of terrorism financing, money laundering and other illicit finance – and these guidelines follow CBUAE’s recently introduced AML/ CFT guidance for licensed financial institutions on payment risks. The new guidance “will assist LFIs’ understanding of risks and effective implementation of their statutory AML/CFT obligations, and takes Financial Action Task Force (FATF) standards into account,” WAM said in a statement, adding that LFIs must comply with the regulator within a month.

PEPs and transactions related to them may expose LFIs to a higher risk of money laundering and terror financing, the lender said.

The guidance enables LFIs to do due diligence on PEPs and their direct family members or close associates.

VIEW DUEDILIGENCE360TM BROCHURE

Governor of the CBUAE, Khaled Mohamed Balama, said, “We are keen to ensure that all LFIs comprehensively understand their role and responsibilities in mitigating relevant AML/CFT risks and safeguarding the UAE financial system from illicit activities. This guidance provides LFIs with further requirements and measures they must fulfil before and after initiating business relationships with politically exposed persons to stay anti-money laundering compliant. We will continue our efforts to issue similar regulatory guidelines, to enhance the efficiency and robustness of our financial system in line with international standards related to anti-money laundering and the financing of terrorism.”

Balama added this guidance provides LFIs with further requirements and measures they must fulfil before and after initiating business relationships with PEPs to stay compliant with anti-money laundering.

LFIs providing services to PEPs must develop risk-based policies, the lender said, adding this would ensure accurately identified PEPs or related customers before the start of the business relationship, risk rating and applying equivalent customer due diligence.

UAE has made positive advances in anti-money laundering, anti-financial crime: global watchdog

The regulator also said LFIs must constantly monitor business relationships and maintain a transaction monitoring system to track suspicious transactions.

Any unusual activity would then be reported to the UAE’s financial intelligence unit using the ‘goAML’ portal.

The UAE has announced various measures to fight and prevent money laundering in the country, including renewing anti-money laundering policies for payment risks.

ANTI-MONEY LAUNDERING (AML) SERVICES – AML ADVISORY SOLUTIONS MADE EASY!

There are many advantages to outsourcing portions of your Anti-Money Laundering (AML) compliance program to CRI Group™. CRI™ Anti-Money Laundering (AML) advisory services can help analyse systems and develop effective solutions that reduce your company’s risk of falling prey to employee, supplier or outside corporate and financial crimes.

An effective AML framework is a testament to your organisation’s position against crime. Our unmatched investigative capabilities, worldwide presence and long-standing 32 years of reputation for independence and integrity make us uniquely qualified to resolve regulatory concerns.

Our vast Compliance and Anti-Corruption network gives you much-needed protection when making critical bottom-line decisions crucial to your organisation’s success. Ensure you have the 360-degree analysis of your challenges – get in touch with the experienced CRI Group’s AML team for a bespoke quote. Leave it to the experts to provide you with the protection you need.

Let’s Celebrate Human Resources Appreciation Week

Being in Human Resources (HR) can be difficult to handle. After all, the HR department plays an integral role in ensuring the success of organisations by nurturing and developing human capital. However, they do not get enough credit. Human Resources Appreciation Week is a holiday to change people’s HR perspective and learn why their job is valuable for businesses.

History of Human Resource Professional Day

Governor-General Sir Patrick Allen referenced Human Resource Professional Day (HR Professional Day) in October 2013. He created this day to recognise and celebrate HR professionals.

HR professionals carry out multiple tasks in an organisation. They have to follow important legislation, help co-workers get paid, and get to plan those fun company parties after a long year’s work. It was not until Governor-General Hon Steadman Alvin Ridout Fuller declared it an official holiday in Jamaica in 2018 that HR Professional Day came into the spotlight. Human Resource Professional Day is designed to tribute to those working in HR departments worldwide.

Human Resources Appreciation Week is an opportunity to learn about what HR does to improve employees’ lives and allow people to join the HR industry. Human Resources Appreciation Week is about thanking and appreciating the hard work of HR staff since they handle the most difficult situations, such as staff negotiations, corporate liaison, and legislation interpreting.

HR Professionals Day-to-Day

Becoming an HR officer is great for someone with strong interpersonal skills, who likes helping others, and who is self-motivated. Working in HR means implementing policies, advising on, and developing plans relating to how staff are used and operate within a business.

Your role is to ensure that you have the right balance of workers in terms of experience and skills and that development and training opportunities are available so that colleagues can achieve their corporate aims and improve their performance.

Several different activities are covered in the HR department. This involves working practices, recruitment, pay, negotiation with work-related external agencies, diversity and equality, and conditions of employment too.

There are many different skills that HR professionals are expected to have. This includes the potential to cope with a leadership role, negotiate and influence effectively, so personnel policies are implemented, and have good organisational skills, management skills, and business awareness.

Aside from this, working in HR demands someone who has a willingness and curiosity to challenge organisational culture where needed, approachability and integrity, and interpersonal skills so that effective working relationships can be formed with people at all levels.

Celebrate Your HR Professionals in This Human Resources Appreciation Week

As you can see, being involved in HR is not easy, and a lot will be demanded of you. This is why Human Resources Appreciation Week is so important. It is a great chance to honour everyone working in this industry. Express your gratitude to HR professionals that work so hard for you.

It is also a great day to raise awareness about this job role and share information about what it is like to be part of the HR community. If you’re interested in working in HR, you should be able to find a lot of great information online during this period too, but here are a few articles you can here:

- What is continuous background screening?

- Employee Fraud: Why are human factors so important in risk management?

- Employee Screening During COVID-19: It doesn’t have to be complicated

- The consequences of neglecting background screening

- Employee Background Checks: A requisite for all businesses

- How to Identify and Prevent Employee Fraud?

Background Investigations: One-on-one interview with Zafar Anjum

Background Investigations: One-on-one Interview with Zafar Anjum

Having dedicated his career to a background investigation, fraud prevention, protective integrity, security and compliance, Zafar Anjum is a distinguished and highly respected professional in his field. As Group Chief Executive Officer (CEO) at Corporate Research and Investigations Limited (CRI Group™), he uses his extensive knowledge and expertise in creating stable and secure networks across challenging global markets. For organisations needing comprehensive project management, security, safeguard testing, background investigations and real-time compliance applications, Anjum is the assurance expert of choice for industry professionals.

Q: To what extent have you seen an increase in corporate fraud in recent years? What are some of the common themes and underlying causes?

Anjum: Fraud always seems to be increasing. No matter how sophisticated our attempts to prevent it become, perpetrators are always adapting with new methods. According to the 2020 Association of Certified Fraud Examiners (ACFE) Report to the nations, asset misappropriation is the leading type of occupational fraud. It makes up 86% of fraud cases and causes a median loss of $100,000. On the other spectrum, financial statement fraud schemes are the least common (10% of cases) but are the most costly, causing a median loss of $954,000. A typical fraud case can last 14 months before detection and cause a loss of $8,300 per month – a whopping 5% of an organisations revenue is lost to fraud each year. There are various factors at play here, but it starts with ‘tone at the top’. Basically, corporate culture often sets the tone for how strict or lax an organisation prevents or detects fraud. Combine a lax approach with a country or jurisdiction where corruption is still prevalent, even considered ‘business as usual, and there will likely be a fraud.

Q: Could you outline the benefits of using background investigations to reduce potential fraud? Under what circumstances is it prudent to undertake a background investigation?

Anjum: It should be a priority to conduct thorough background investigations when engaging in a merger or acquisition, an initial public offering (IPO), engaging suppliers, contractors or new clients – your client relationships can affect your organisation’s reputation and your ability – to name a few situations. This can help you avoid becoming entangled with third parties that have hidden fraud and other legal issues. It will also make you aware of a potential partner who has credit risk, has claimed bankruptcy or is faced with debtor filings, for example. In one case, a company was seeking to engage a new supplier for medical supplies and equipment. A background investigation revealed that the warehouse’s physical location – claimed by this ‘supplier’ did not exist. The company’s principal had previously been charged with a ‘criminal breach of trust’. Three other civil damages claims against the principal were discovered, with millions claimed in liabilities.

Q: What are some of the best practice approaches to conducting a background investigation?

Anjum: One of the most important aspects of thorough background investigations is having a ‘boots on the ground approach. Online database searches can only take you so far. When conducting due diligence on entities or individuals, red flags that pop up often warrant further checking before they can be truly weighed as part of the decision process. For example, if you are considering partnering with another company and providing information for their physical location, do you have agents who can visit that location to make sure it is legitimate? Investigations sometimes discover that purported ‘headquarters’ is actually an abandoned home or vacant lot. Also, if certain credentials are claimed, you need to make phone calls or possibly a visit to the school or accrediting bodies to verify them. These are the important details that help you with facts that help guide your decisions.

EFFECTIVE RISK MANAGEMENT THROUGH BACKGROUND INVESTIGATIONS. FIND OUT HERE

Q: What kinds of legal or regulatory issues might complicate a background investigation?

Anjum: Privacy laws are probably the most important issue, and they need to be carefully understood and followed for every jurisdiction. In the UK, for example, the pandemic has created new data privacy issues, but prudent organisations are constantly evaluating their data protection strategies under the General Data Protection Regulation (GDPR). When it comes to background investigations, similar privacy considerations apply. You might want to check an individuals’ financial or credit history – relevant information if they own a business you seek to partner with or acquire, or if you are considering them for a high-level position at your organisation. Accessing such information is permitted in some jurisdictions and restricted by law in others. The last thing you want is to end up in court for violating someone’s privacy. It is best to engage a professional due diligence background screening firm. They will be trained and up-to-date on the laws governing your background investigations, plus they will have access to resources that most companies do not have.

Q: To what extent are background investigations more challenging in a cross-border or multi-jurisdictional context? How can these additional challenges be overcome or avoided?

Anjum: This goes back to the importance of having investigators in various locations, your ‘boots on the ground’, in your approach to due diligence. The world is much smaller these days as organisations seek to expand across international borders. And the COVID-19 is teaching leaders invaluable lessons in business efficiencies and future strategy. This can lead to obvious challenges – both following the laws and regulations in various jurisdictions and overcoming language and cultural barriers. That is why it is important to have access to locally-based agents – including certified fraud examiners and similarly credentialed professionals – to help with your checks, whether investigating a potential third-party partner or an individual being considered for employment. Another advantage is to have a set, written policy and process for conducting background investigations that you can reference and rely upon when undertaking key business decisions. In this way, your organisation is less susceptible to someone convincing you to bypass proper due diligence simply because it might seem logistically difficult to conduct an overseas investigation.

MITIGATE EMPLOYEE RISK BEFORE & AFTER HIRE? LEARN MORE HERE

Q: Once the background investigation results are collated, what are the key points to analysing?

Anjum: If red flags are uncovered, the best way to further investigate is to understand discrepancies. For example, suppose you are conducting background screening on a potential employee, and something comes up in their criminal record, rather than eliminating them from consideration. In that case, you should ensure that there was no error in your background check, investigate the discrepancy, gather all relevant information, and ask the person to explain what you found and why they did not disclose it. They might have an explanation that affects your decision process. In other words, do not overlook potential talent. According to Nacro, more than 11 million people in the UK have a criminal record – that’s 1 in 3 men – however, just over half of these had been convicted on only one occasion, and 85% were convicted before they were 30 years old. Not all of those have a prison record, however. Most convictions are for motoring offences, such as speeding or unpaid tickets.

Q: What essential advice would you offer to companies on developing internal policies and processes to combat fraud? should intensive background investigations form part of their standard procedures?

Anjum: Intensive background investigations should be a part of an organisation’s standard procedures. It should be part of a greater risk management plan, be set forth as written policy that owners and directors approve, and be reviewed and understood by management and other relevant personnel. Engage risk management professionals when developing your policies and procedures. They can help tailor a plan based o your organisation. Key questions to address should include; who will implement the plan, how an investigation is conducted, who evaluates and reports the results, etc. Sometimes organisations put forth a thorough, excellent programme for background investigations and then, six months or a year later, nobody is following it. The key to success is following through with it and ensuring your entire organisation understands the process and why it is so important. The security of your company depends on effective risk management.

The security of your company depends on effective risk management

Background investigations are critical to any company’s success because working with qualified, honest and hard-working employees and other businesses is integral to thriving in the business community. What you don’t know can hurt you, and the simple act of one bad decision can result in an unprecedented loss for your company.

From vendor and third-party screening to employment screening, CRI Group™ recommends background investigations as critical proactive measures to help keep your business safe. An effective background screening investigation will help screen for bad apples that can cause havoc down the road. Because we maintain a diverse talent base comprised of multilingual and multi-cultural professionals, CRI™ can traverse obstacles that often impede international background investigations. That’s why we are frequently contracted by our competitors to conduct background investigations in geographic regions not serviced or accessible by larger investigative firms.

Meet our CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI Group™ (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading businesses organisations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center-QFC, and the Abu Dhabi Global Market-ADGM, CRI Group safeguards businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI Group™ to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

اتصل بنا

المقر الرئيسي: +44 7588 454959

المحلي: +971 800 274552

:البريد الإلكتروني info@crigroup.com

المقر الرئيسي: 454959 7588 44

المحلي: 274552 800 971

:البريد الإلكتروني info@crigroup.com

الاشتراك في النشرة الإخبارية