CRI® Group celebrates International Anti-Corruption Day

Wednesday the 9th of December marks the International Anti-Corruption day since the passage of the United Nations Convention Against Corruption on 31st October 2003. Based on AntiCorruptionDay.org, as the world is recovering from COVID-19 pandemic, this year “the campaign for International Anti-Corruption Day will therefore focus on measures to reduce the risks of mismanagement and corruption without compromising the speed and flexibility demanded by the health crisis, while ensuring an inclusive recovery. This year’s motto “RECOVER with INTEGRITY” focuses on recovery through corruption mitigation and emphasizes that inclusive COVID-19 recovery can only be achieved with integrity.”

Bribery and corruption stories 2020

Even with much of the world under partial lockdown during the COVID-19 pandemic, there’s been no shortage of bribery and corruption cases. Each of these stories makes it clear that organisations must have proper controls in place to prevent bribery and corruption. ISO 37001 Anti-Bribery Management Systems standard provides a comprehensive approach to mitigating bribery and corruption risk. In no particular order, we collated some of the top bribery and corruption stories we’ve seen so far in 2020. Click here to read the full list.

Airbus

In February, French-based Airbus agreed to pay a record $4 billion in fines for alleged bribery and corruption spanning at least 15 years. The company reached a plea bargain with prosecutors in Britain, France and the United States. According to prosecution documents, Airbus used a global network of agents or middlemen for corrupt transactions, included payouts disguised as commissions to push airplane sales.

“Fallout from the Airbus bribery scandal reverberated around the world on Monday as the head of one of its top buyers temporarily stood down and investigations were launched in countries aggrieved at being dragged into the increasingly political row.” (Reuters, 2020)

Novartis

While the investigation into suspected corruption at Novartis began seven years ago, it appears that 2020 is the year the company can finally close this damaging chapter in its history. The resolution comes at a steep cost. The Swiss-based pharmaceutical company will pay a staggering $1.3 billion in a settlement for kickbacks, bribery and price-fixing.

“The latest settlements cover two different cases. In the first, federal prosecutors claim Novartis used ‘tens of thousands of’ speaker programs and events — some entailing exorbitant meals — as disguise to provide bribes to doctors. The goal, according to prosecutors, was to encourage doctors to prescribe its drugs, including Lotrel, Valturna, Starlix, Tekturna, Tekamlo, Diovan and Exforge.” (Fierce Pharma, 2020)

Ohio House Speaker Larry Householder

While political corruption is nothing new, his constituents were nevertheless shocked when Ohio House Speaker Larry Householder was arrested, along with four alleged co-conspirators, as part of a $60 million racketeering and bribery investigation. The alleged scheme is being described as one of the biggest public corruption cases in Ohio, U.S. history.

“All the charges are tied to what federal prosecutors said was a criminal enterprise dedicated to securing a bailout for two nuclear power plants in northern Ohio owned by FirstEnergy Solutions of Akron. The bailout is expected to cost the state’s utility ratepayers $1 billion.” (Cincinnati Enquirer, 2020)

Alexion Pharmaceuticals

Charged by the SEC with violating the FCPA by bribing officials in Turkey and Russia, Alexion Pharmaceuticals will pay $21.4 million to resolve an investigation that began in 2015. The Connecticut, U.S.- based company was also accused of failing to keep accurate financial records at subsidiaries in Brazil and Colombia.

“In Turkey and Russia, Alexion paid government officials and doctors at state-connected hospitals to promote use of its blood-disease drug, Soliris. Alexion retained a consultant in Turkey from 2010 to 2015 with ties to health officials. Alexion Turkey paid the consultant over $1.3 million for ‘consulting fees and purported expense reimbursements,’ the SEC said. … In Russia, Alexion paid doctors at government hospitals over $1 million from 2011 to 2015 to increase Soliris prescriptions. … The bribery resulted in Alexion being ‘unjustly enriched’ by about $6.6 million in Turkey and $7.5 million in Russia, the SEC said.” (FCPA Blog, 2020)

> Read the full list of bribery and corruption cases in 2020

Prosecution of corruption is like a dose of painkillers. It can help with the symptoms, but it won’t solve the problem. On the other hand, the anti-bribery management system is comparable to a healthy diet. No one is excited about it but some of us are more determined to choose an apple instead of cake. International Anti-Corruption Day is the best time for organisations of all sizes and industries take steps now to ensure that they don’t end up on a future list of top bribery and corruption scandals. Earlier this year, we published a series of articles how ISO 37001 standard could be implemented into the different industries – the first part of the article focused on automotive, aviation, insurance industries, while the second edition examined how pharma and healthcare, property, IT and telecommunications, food and beverage industries might benefit from ISO 37001 certification too.

CRI Group’s continuous fight against bribery and corruption risks

At CRI Group we understand, that corruption and bribery affect any organisation, large or small, public or not-for-profit. It has the potential to cause severe harm to your business, including financial loss, dire legal consequences, damage to your brand, company’s reputation and sustainable development. Therefore anti-bribery needs to be managed correctly and effectively. ISO developed ISO 37001:2016 ABMS standard helps organisations promote an ethical business culture. “Designed to help your organisation implement an anti-bribery management system (ABMS), and/or enhance the controls you currently have. It helps to reduce the risk of bribery [and corruption] occurring and can demonstrate to your stakeholders that you have put in place internationally recognised good-practice anti-bribery [and anti-corruption] controls”.

The first step of demonstrating your organisation’s commitment to implementing an effective anti-bribery management system solutions is to commit to ISO 37001 solutions. In order to offer you ISO 37001 training and/or certification, CRI Group launched an Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence. ABAC® offers a complete suite of services and solutions designed to educate, equip & support the world’s leading business organisations with the latest best-in-practice risk & performance assessments, systems improvement & standards certification. ABAC® programs protect your organisation from damaging litigation & safeguard your business in the global marketplace by providing certification & training not only in ISO 37001 Anti-Bribery Management Systems but also in other internationally recognised ISO standards such as ISO 37301 Compliance Management Systemss and ISO 31000 Risk Management Systems implementation.

ABAC® offers ISO 37001 Introductory, Internal Auditor and Lead Auditor training to upskill the teams and organisations who want to show a proactive way of demonstrating your organisation’s commitment to ethical sustainability. Your employees will be able to recognise any form of corruption, and report it. Our trainers are the best in the business. They’re passionate about sharing their knowledge with you and/or your employees. ABAC® trusted experts have years of hands-on and business experience – they bring the subject matter to life with relevant and contemporary examples.

Companies should take a zero-tolerance attitude towards corruption and put policies in place covering issues such as gifts, supply chains and whistle-blowers, in order to promote a fair and just environment. In business terms, integrity pays: the world’s most ethical companies prove a clear correlation between ethical business practices and improved financial performance.

Recently, ABAC® also launched ISO 31000 Risk management e-training – even though this course is for risk management in general, ISO 31000 implementation and training give businesses a broader view of all risks associated with their organisations and how to overcome them. ISO 31000 training is focused on improving your and/or your team’s skills in implementing ISO 31000 Risk Management which will help organisations see both the positive opportunities and negative consequences associated with all types of risk, and allow for more informed, and thus more effective, decision making, namely in the allocation of resources.

> Learn more about ISO 31000 training

Expand Your Third-Party Risk Management Strategies

CRI Group is launching a third-party compliance verification and certification program – 3PRM-Certified™ – across the Middle East, Europe and the Asian region. This Third-Party Risk Management (TPRM) program can help organisations establish the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with their business.

Third-party relationships are critical in business today and include partnerships with suppliers, distributors, consultants, agents and other contractors. While such affiliations are essential to the success of your organisation, the consequences of inadequate due diligence cannot be overestimated. The risk of data breaches and supply chain disruptions continue to rise with COVID-19, so does the need for an effective TPRM program. Whether you’re a TPRM professional looking for a certification to advance your skillset, or the leader of your organisation considering how to better equip your team with the best knowledge and skills, the 3PRM-Certified™ program is an all-in solution.

Support International Anti-Corruption Day – consider ISO 37001, ISO 31000 and ISO 19600 as invaluable tools of your

> Read more about the 3PRM-Certified™ program

Supporting International Anti-Corruption Day 2020

Find below CRI Group’s resources helping you to know more about bribery and corruption risk. It does not wait and can happen anytime – we encourage you to think about anti-bribery and anti-corruption not only on International Anti-Corruption Day 2020 but all year round. Explore our other resources, or sign up for risk management, compliance, anti-bribery and anti-corruption related news, solutions, events and publications in your inbox. We will be happy to hear from you if you have any questions at all – contact us today or get a quote for any anti-bribery, anti-corruption, risk or compliance management solutions through our ABAC® Center of Excellence. Explore our recourses and expert insights in the Q&A sessions now:

Q&A: Corporate Fraud and Corruption in Pakistan

Q&A: Corporate Fraud and Corruption in the UK is growing, FAST!

Q&A session with our CEO: the United Arab Emirates fighting Fraud and corruption

Prove that your business is ethical

ABAC® published the free Highest Ethical Business Assessment (HEBA) to evaluate businesses’ current Corporate Compliance Programs. Find out if your organisation’s compliance program is in the line with worldwide Compliance, Business Ethics, Anti-Bribery and Anti-Corruption Frameworks. Let ABAC® experts prepare a complimentary gap analysis – the HEBA survey is designed to evaluate your compliance with adequate procedures to prevent bribery and corruption across the organisation. This survey is monitored and evaluated by qualified ABAC® professionals with Business Ethics, Legal and Compliance background. The questions are open-ended to encourage a qualitative analysis of your Compliance Program and to facilitate the gap analysis process.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Q&A: Corporate Fraud and Corruption in UAE

The United Arab Emirates (UAE) is the 21 least corrupt nation out of 180 countries, according to the 2019 Corruption Perceptions Index reported by Transparency International. However, UAE corporate fraud and corruption still prevails as UAE is just one of many enablers of global corruption, crime, and illicit financial flows. Addressing the emirate’s role presents anti-corruption practitioners, law enforcement agencies, and policymakers with incredibly complex challenges. Read the answers to the following questions:

- To what extent are boards and senior executives in UAE taking proactive steps to reduce incidences of fraud and corruption from surfacing within their company?

- Have there been any significant legal and regulatory developments relevant to corporate fraud and corruption in the UAE over the past 12-18 months?

- When suspicions of fraud or corruption arise within a firm, what steps should be taken to evaluate and resolve the potential problem?

- Do you believe companies are paying enough attention to employee awareness, such as training staff to identify and report potential fraud and misconduct?

- How has the renewed focus on encouraging and protecting whistleblowers changed the way companies manage and respond to reports of potential wrongdoing?

- And much more…

Q. To what extent are boards and senior executives in UAE taking proactive steps to reduce incidences of fraud and corruption from surfacing within their company?

Anjum: High-profile corruption scandals have driven home the seriousness of fraud and corruption, and the turmoil that can engulf a company because of it. Organisations in the United Arab Emirates (UAE), and in the Middle East region as a whole, understand that being proactive against risk can be a matter of survival, especially in a competitive environment, but it is more than that. Today, being forward-thinking and proactive when it comes to fraud and corruption can actually foster organisational growth. Business grows an average of 3 per cent faster where corruption is low, according to the World Bank. And more organisations are engaging in trusted certifications like ISO 37001 for anti-bribery management because having that certification tells customers, vendors, third parties and employees that the company places a high priority on fraud training and prevention.

Q. Have there been any significant legal and regulatory developments relevant to corporate fraud and corruption in the UAE over the past 12-18 months?

Anjum: In January 2017, UAE president Shaikh Khalifa Bin Zayed Al Nahyan approved the highly anticipated Anti-Commercial Fraud Law, which strengthens protections of intellectual property rights (IPR) and imposes stricter penalties on counterfeiters. Counterfeiting and adulterated goods, along with intellectual property (IP) theft, are severe problems in the Middle East, propagated by unscrupulous inland and free zone traders. And while fraud and corruption still plague the region, the UAE continues to lead the Middle East in Transparency International’s latest Corruption Perception Index for its strides in addressing fraud risk and areas of concern, including bribery and corruption. With that said, experts have noted that businesses and governments in the UAE, and the Middle East, on the whole, face increasing threats of cybercrime, with a need for continuously updated laws and regulations to keep pace with this ever-evolving fraud threat.

Q. When suspicions of fraud or corruption arise within a firm, what steps should be taken to evaluate and resolve the potential problem?

Anjum: Fraud allegations, from bribery to embezzlement, should be treated as a very serious issue. When suspicion arises at an organisation, business leaders and the board should bring in expert help. Professional investigators have years of training in evidence collection and interviewing, and their role is to establish the facts of the case. The key to a proper investigation is to not approach it with a preconceived notion of how it will conclude. It is critical to remember that companies do not get a second chance when conducting a fraud investigation. It has to be done right the first time to reach a successful conclusion.

Q. Do you believe companies are paying enough attention to employee awareness, such as training staff to identify and report potential fraud and misconduct?

Anjum: Employees are the eyes and ears of your company, and the first line of defence against fraud and corruption. Many organisations are getting the message and making employee training and awareness of key parts of their fraud prevention programme. One key way to do this is by engaging in ISO 37001, which certifies that an organisation has implemented reasonable and proportionate measures to prevent bribery. The certification process involves a training module for employees. It stresses the importance that such training should continue as mandatory for all staff, and be provided on an annual basis – if not more frequently. If employees do not know what constitutes fraud, or how to recognise it, organisations face a heightened risk of being victimised.

Q. How has the renewed focus on encouraging and protecting whistleblowers changed the way companies manage and respond to reports of potential wrongdoing?

Anjum: Statistics from the Association of Certified Fraud Examiners (ACFE) show that most fraud is discovered by tips, which often come from employees, vendors and others connected to the organisation in some way, and the only way to get those tips is to provide a culture that supports and encourages whistleblowers. That is why having an anonymous reporting system, and communicating it to employees is a critical part of any fraud and risk prevention strategy. But for it to work, employees have to know what type of behaviour should be reported. This is where a training protocol like ISO 37001 comes in. It provides a curriculum that helps employees recognise the red flags of fraud, and also communicates how they can report fraud when they see it.

Q. Could you outline the main fraud and corruption risks that can emerge from third-party relationships? In your opinion, do firms pay sufficient attention to due diligence at the outset of a new business relationship?

Anjum: Many companies pay lip service to due diligence, but when an opportunity arises to make a major move, such as a merger, acquisition or new partnership, the interest of growing the business trumps a more cautious approach. This may be changing, however, as more organisations in the UAE and elsewhere put established due diligence procedures in place that cannot be circumvented by overeager business leaders. This is important because the risks are great.

Q. What advice can you offer to companies on implementing and maintaining a robust fraud and corruption risk management process, with appropriate internal controls?

Anjum: Begin with a thorough fraud risk assessment that examines every area of your organisation. This should be conducted by experts and used to gauge your overall threat level, as well as help you create a plan for moving forward by exposing a weakness that could lead to fraud risk and compliance issues. When creating your fraud and corruption risk management process, be sure to include hiring procedures, including thorough background checks, due diligence for any new mergers, acquisitions and partnerships, regular schedule audits and implement an anonymous reporting system. Build-in review processes that track the effectiveness of your controls, including how tips were handled and ultimately resolved. Finally, try to think like a fraudster. Consider any way that an employee, vendor or even customer might try to take advantage of your organisation. You might be surprised at what you find.

Speak up – report any illegal, unethical, or improper behaviour

If you find yourself in an ethical dilemma or suspect inappropriate or illegal conduct, and you feel uncomfortable reporting through normal channels of communication, or wish to raise the issue anonymously, use CRI® Group’s Compliance Hotline. The Compliance Hotline is a secure and confidential reporting channel managed by an independent provider. When reporting a concern in good faith, you will be protected by CRI® Group’s Non-Retaliation Policy.

Meet our CEO

Zafar I. Anjum, is Group Chief Executive Officer of CRI® Group, a global supplier of investigative, forensic accounting, business due diligence and employee background screening services for some of the world’s leading business organisations. Headquartered in London (with significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center-QFC, and the Abu Dhabi Global Market-ADGM, CRI Group safeguards businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Turkey Malaysia, Brazil, China, USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e:

About CRI®

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI® Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Download 2018 annual reviews by Mr. Zafar Anjum, CEO, and Ms. Fatima Farrukh, Compliance professional at CRI® Group.

Click here to download the review of UAE (Mr. Zafar Anjum, CEO at CRI® Group)

Click here to download the review of UK (Mr. Zafar Anjum, CEO at CRI® Group)

Click here to download the review of Pakistan (Ms. Fatima Farrukh, Compliance professional at CRI Group)

CRI® Group was included in the 2018 Annual Review: UAE Corporate Fraud & Corruption, published by Financier Worldwide Magazine. The above is an updated version of the Financier Worldwide reprint.

The Unseen Enemy: Insurance Fraud – Part III

This three-part series of articles examines the problem of insurance fraud, including its pervasiveness and general characteristics in the United States, the United Kingdom and the world. Insurance fraud is a widespread problem that requires real solutions and is often difficult to detect and combat.

Part One of the series, “What is Insurance Fraud,” provides an introduction to a topic that is important for any business leader, insurance professional, compliance agent or fraud investigator. Part Two, “How do Companies Detect Insurance Fraud,” details red flags of insurance fraud that help tip off investigators to possible illegal behaviour. Part Three, “Anatomy of an Insurance Fraud Investigation,” provides a look at case studies and reveals key tips for handling a successful investigation. To receive the next series subscribe to our monthly newsletter here!

Taken as a whole, this series is the perfect primer for any insurance fraud professional and companies looking to avoid becoming victims of insurance fraud claims. It provides the tools and knowledge needed to effectively combat insurance fraud.

Part Three: Anatomy of an Insurance Fraud Investigation

The insurance fraud epidemic is of serious concern to businesses, insurance providers and consumers worldwide. In Part One of this three-part series, we examined the scope of the problem, and discussed a few cases that illustrate the magnitude of insurance fraud. In Part Two, we looked at how companies can detect insurance fraud, including how to recognise the red flags that represent potential criminal behaviour.

In this final Part Three, we’ll examine the elements of an insurance fraud investigation, beginning with a case study that illustrates how CRI Group™’s insurance fraud investigators exposed fraud schemes – saving its clients thousands of dollars.

Case Study: Health Insurance Fraud

A CRI Group client requested an investigation of a health insurance claim filed by one of their employees, “Mr. Jones.” Mr. Jones claimed that while on an official visit to UAE from the U.S., he felt sudden abdominal pain with nausea and vomiting lasting 18 hours. He was admitted to a clinic and stayed under observation for two days, which cost him around $4,000 (US).According to the claim, Mr. Jones (name changed) was discharged from the clinic, but then felt the return of his sickness, so he was admitted to another clinic for two more days. During this time, he was kept under observation. For this second clinic visit, he was charged nearly $1,000.

As part of CRI Group™’s “experts in a field” approach, a local investigator visited both of the clinics involved in the claim. One clinic was located in Dubai, while the other was in Abu Dhabi. When he arrived at the Dubai clinic, CRI Group’s local expert immediately learned that the clinic deals specifically in cosmetic surgery for women. In fact, as advertised on the outside of the clinic, its services are only for women. The clinic’s administrator confirmed that the clinic is only in the business of providing cosmetic surgery for women.

CRI Group™’s local investigator then visited the clinic in Abu Dhabi. This clinic also appeared to be in the business of providing cosmetic surgery for women. When the local expert tried to contact the doctor who was named as the treating physician for Mr. Jones, the doctor was hesitant to meet the expert. CRI Group™’s expert showed the report to the doctor, and though it was on the official letterhead of the clinic, the doctor first denied involvement in the case.

Later, the doctor told CRI Group™’s expert that while “we don’t treat that kind of illness,” the patient “was in such bad condition that we treated him on a humanitarian basis.” Yet the doctor was hesitant to accept that the bills came from his clinic (the expert had already learned that the doctor in question was also the owner of the clinic). Regardless, CRI Group™ successfully secured the evidence that the health insurance invoices were fake and Mr. Jones was making false claims to get money from his employer.

When it’s Time to Open an Investigation

When red flags of fraud are uncovered, it’s time to begin an investigation. As you can see from the examples above, CRI Group’s investigations are based on a thorough approach that includes site visits and leaving no stone unturned. When you work with CRI Group, this is how the process will typically proceed. CRI Group will:

- Assign the appropriate investigators with the right expertise in that area to investigate the claim.

- Contact the parties involved to gather all relevant details about the incident.

- Use all resources available, including police reports, court filings, database records and other means to establish the truth in insurance fraud cases.

- Make site visits, speak to witnesses, take photos and establish timelines as needed to create a full, truthful story of the incident.

- Uncover useful evidence, carefully documenting and preserving it in a way that is admissible in court.

- Present investigation findings to the client, with recommendations on how to proceed. Sometimes, legal action is warranted.

Working with an insurance fraud investigation company like CRI Group provides the advantage of having an independent, impartial and unbiased third-party collecting the facts you need regarding any case that might involve potential fraud. CRI Group has been safeguarding businesses for more than 28 years, and you will be assured of the quality, professionalism and discreet nature of all investigations conducted by our experts.

Our global presence ensures that no matter how international your operations are, CRI Group™’s investigations have the network needed to provide you all necessary support, wherever you happen to be. We take great care to ensure that our trained and licensed investigators are the best at what they do.

3 types of insurance fraud investigations

1. Social Media Evidence

“Social media is an absolute gold mine” for insurance fraud investigations, according to Kelly Riddle, founder of private investigation company Kelmar Global. Many people think that setting high privacy settings on their social media accounts makes everything they post impossible to access. On the contrary, social media platforms usually hand over user information if they receive a subpoena for it.

Fraudsters often slip up online and post information revealing their fraud. For instance, someone receiving worker’s compensation for an injured foot may post a video of themselves playing soccer with their kids. Or, someone else may unintentionally expose their scheme, as is the case if friends and family tag the claimant in an incriminating post.

Fraudsters who are proud of their work may boast about it on social media, thinking they will never get caught. Make sure to search for alternate accounts as well as the claimant’s main social media pages to find as much of this type of evidence as you can.

2. Activity Check

In order to learn everything you can about the claimant, you need to see where and how they live. Good old-fashioned surveillance of their home or workplace can provide evidence. For example, someone who has claimed compensation for a shoulder injury leaving their home with a tennis racket, that is possible evidence for insurance fraud.

While you are in the claimant’s neighbourhood, canvass others in the community. Even if the neighbours don’t know the person well, they may have observed their lifestyle. Ask about the insured person’s financial situation, which can indicate if they are in need of quick money.

In property insurance fraud investigations, be sure to also ask neighbours if they have seen or heard anything out of the ordinary around the time of the claim. This can include moving trucks or more comings and goings than usual from the claimant’s home. They can also help you determine whether or not the claimant is actually living in their home.

3. Fake Documentation of the Claim

Just because a claimant has included all of the relevant documents in their claim doesn’t mean they aren’t committing insurance fraud. In fact, fake documentation is a very common way to pull off a fraud. Signs of false documents include:

- An unusual number of receipts.

- Falsified receipts.

- Fake affidavits.

- Photos or receipts used for more than one claim.

When studying accompanying documentation during an insurance fraud investigation, use a keen eye to spot signs of editing. Inconsistent lighting in photos and fonts that don’t match the rest of the document are some common examples. Be sure to also review the claimant’s history to see if they have claimed loss of the same items before.

6 Keys to Successful Insurance Fraud Investigations

1. Follow the Law

Nothing can derail your insurance fraud investigation quicker than finding out you have conducted it in violation of the law. Every jurisdiction is different, and privacy laws are the major consideration in these types of investigations. Understand the laws regarding filming or recording a subject or a witness, as doing it without their consent might be a violation of their rights. This is where it is helpful to engage the experts. At CRI Group, our investigators are trained and knowledgeable about local laws and the importance of proper evidence collection. Avoid trying to collect information by deceptive means, such as “friending” a subject on social media.

2. Conduct an Initial Assessment

It’s important to gather the known facts of the case at the outset of your insurance fraud investigation: You need to have some idea of the who, what, when where, and how of the case. With your baseline facts in place, your investigation will proceed much more smoothly. Keep in mind that the subject of an insurance fraud investigation might work quickly to conceal or destroy evidence if they know they are under suspicion. You should make sure to immediately secure all documents and other evidence that you might need late in your investigation. If you are conducting the investigation for a client, make sure they follow proper security measures to keep evidence intact, especially when it comes to digital evidence.

3. Plan the Investigation Well

An effective investigation is one that is carefully planned. Failure to do so can cause problems from the outset, such as missing important details and evidence in the case, or running afoul of regulations such as reporting to FinCEN in the U.S. or FINTRAC in Canada. Before you start the investigation, think about questions like:

- Who should be interviewed?

- In what order should you conduct those interviews?

- What supporting documents do you need to collect?

- Are there any other allegations against the subject?

- Which entities need to be informed of the investigation and how should it be done?

Carefully document all the details and steps taken during the case to make sure your insurance fraud investigation stays on track.

When engaging with CRI Group™, a fraud investigator will be allocated to your case. Read more about their skills and expertise in our article “The role of a FRAUD INVESTIGATOR.”

4. Perform Great Interviews

This is where being an effective communicator comes into play. Most successful investigations include subject and witness interviews as a critical part of the evidence-gathering process:

- You need to ask questions in order to find out the “how” and “why” an insurance fraud has occurred.

- The best interviews are those in which the interviewer is in complete control, yet the subject or witness feels comfortable and undistracted. Have some general questions prepared, but engage the subject in a conversational style, and don’t hesitate to go “off-script” to learn more information.

- Be friendly and establish trust and build rapport with the subject. Small talk is encouraged, plus warming up with some easy questions so that the interviewee feels comfortable talking to you.

- Don’t ask “yes” or “no” questions. Instead, ask open-ended questions, such as “tell me about what you did that morning” or “what happened that day?”

5. Understand Evidence

During an insurance fraud investigation, and when reporting the results, an investigator should take care to separate his opinion from the facts of the case. The investigator should let the hard facts of evidence speak for itself in the case, rather than engaging in speculation or providing opinions on guilt or innocence. This is why proper evidence collecting and examination is so important. Files, documents and other evidence should be kept secure and chain-of-custody should be maintained. Never alter or mark up original documents or files with your own notes, even if they seem relevant. Keep copies for your files and make sure nothing slips through the cracks.

6. Report the Findings

When your investigation has concluded, it’s time to report the results. Prepare a thorough, facts-based report detailing the evidence and your findings. A good investigation report should include the following items:

- Your understanding of the allegation (who, what, where, when, how)

- The steps taken in the investigation

- Copies of documents and other material evidence

- A list of interviewees

- A summary of interviews

- A conclusion as to whether the allegation was substantiated or not

Write your report in objective language, avoiding judgemental or inflammatory adjectives when describing details of the case. Use as many direct quotations as possible from interviewees or documents. Only include facts, not opinions or inferences, in your report.

This three-part series of articles is part of our “The Unseen Enemy: Insurance Fraud” e-book. The e-book contains actionable advise on how to protect your business from insurance fraud and much more. Download the FREE e-book here!

Have you done your Corporate Compliance Programs Gap Analysis (HEBA) yet?

Prove that your business is ethical. Complete our FREE Highest Ethical Business Assessment (HEBA) and evaluate your current Corporate Compliance Program. Find out if your organisation’s compliance program is in line with worldwide Compliance, Business Ethics, Anti-Bribery and Anti-Corruption Frameworks. Let our experts prepare a complimentary gap analysis (worth USD 1,172 | GBP 950 | ₨ 220,312 | EUR 1,122) of your compliance program to evaluate if it meets “adequate procedures” requirements under UK Bribery Act, DOJ’s Evaluation of Corporate Compliance Programs Guidance and Malaysian Anti-Corruption Commission.

What’s a Gap Analysis, and why do I need it?

In management literature, Gap analysis involves the comparison of actual performance with potential or desired performance. If your organisation does not make the best use of current resources or forgoes investment in capital or technology, it is likely to perform below the desired goal. Our Gap analysis involves determining, if your current set of internal policies and procedures do comply with laws, rules, and regulations to uphold your business reputation and how can you improve current capabilities difference to meet current industry and regulatory requirements.

Our HEBA survey is designed to evaluate your compliance with adequate procedures to prevent bribery and corruption across the organisation. Acting as a benchmarking, the gap analysis will allow you to understand what is the general expectation of performance within your industry and compare that expectation with your organisation’s current level of performance. At this level, the gap analysis will allow you to highlight any gap and focus on ways to address it and improve your Corporate Compliance Program.

Highest Ethical Business Assessment: Evaluating Adequate Compliance, Business Ethics, Anti-Bribery and Anti-Corruption Framework

This survey is monitored and evaluated by qualified ABAC® professionals with Business Ethics, Legal and Compliance background. The questions are open-ended to encourage a qualitative analysis of your Compliance Program and to facilitate the gap analysis process. If you aren’t performing gap analyses within your company, you may have a more significant gap than you think.

The survey takes around 10 minutes to complete

Are you addressing corporate compliance?

- Implementing written policies, procedures, and standards of conduct;

- Designating a compliance officer and compliance committee;

- Conducting effective training and education;

- Developing effective lines of communication;

- Conducting internal monitoring and auditing;

- Enforcing standards through well-publicized disciplinary guidelines;

- Responding promptly to detected offences and undertaking corrective action; and

- Annual reviews.

Each of these elements requires a robust, organisation-wide enforcement and documentation. Corporate compliance programs are most successful when they’re integrated into the management of your practice–creating a culture of compliance within your practice is your best bet to avoid any regulatory breaches and fines!

Why is it important?

Corporate compliance should be an essential part of your business operations, regardless industry or size. How does your business manage compliance and mitigate risk? Taking preventative measures can feel like a hassle upfront, but it can save your organisation untold costs in the long run. Corporate compliance violations can result in fines, penalties, lawsuits, loss of reputation, and more. Keep your business from learning the lesson the hard way. If you’re ready to take control of compliance and protect your business from risk, learn more about CRI® Group today and discover how we can help your corporate compliance program.

Start developing a compliance program today!

About us

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI® Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Speak up – report any illegal, unethical, or improper behaviour!

ILO Monitor: COVID-19 and the world of work, 2nd update

ILO (International Labour Organization) has updated “ILO Monitor: COVID-19 and the world of work. Second edition”. Since the first edition, the COVID-19 pandemic has further accelerated in terms of intensity and expanded its global reach. According to ILO, full or partial lockdown measures are now affecting almost 2.7 billion workers, representing around 81% of the world’s workforce. Leaders and businesses across a range of economic sectors are facing difficult decisions, as COVID-19 is changing their business. There are many cases where COVID-19 has prompted innovative leadership in an attempt to avoid catastrophic losses, and a potential end to operations and or even solvency.

COVID-19 crisis is leaving millions of workers vulnerable to income loss and layoffs. According to ILO new edition, employment contraction has already begun on a large scale in many countries. Changes in working hours (which reflect both layoffs and other temporary reductions) reflect the new reality of the current labour market situation. As of 1 April 2020, the ILO’s estimates that global working hours will decline by 6.7% in the second quarter of 2020, which is equivalent to 195 million full-time workers.

The ILO estimates that 1.25 billion workers, representing almost 38% of the global workforce, are employed in sectors such as retail trade, accommodation, food services, and manufacturing. Dues to Covid-19 crisis these are sectors that are now facing a severe decline in output and consequently a dramatic impact on the world’s workforce. The workforce in high risk of displacement will experience greater challenges in regaining their livelihoods during the recovery period.

>Read the full report here!

ILO discusses how policy responses are critical now in order to provide immediate relief to workers and enterprises and protect livelihoods and economically viable businesses. According to the ILO report, the final tally of annual job losses will depend on how much longer will COVID-19 continue to impact the world and whatever measures taken to mitigate its impact. Stay updated, subscribe for more insights like these!

Managing your people through COVID-19

The COVID-19 pandemic is undeniable affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses are having to adapt quickly to survive, i.e. cutting steps in their hiring process, and no-one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook. Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. Read the answers to the following questions:

- How to turn the tide’ on coronavirus crisis?;

- COVID-19 Action point checklist;

- Background Screening: Essential Checks;

- Six steps for good practice in connection with COVID-19;

- 11 Steps to Reduce Personnel Costs;

- COVID-19 General advice;

- How to remove any danger to your business during COVID-19;

- … and more!

> Download your “Employee Screening during COVID-19: everything you need to know and more!“ FREE ebook here![/vc_column_text][accordion_father][accordion_son title=”Who is ILO?” clr=”#ffffff” bgclr=”#1e73be”]The ILO was founded in 1919, in the wake of a destructive war, to pursue a vision based on the premise that universal, lasting peace can be established only if it is based on social justice. The ILO became the first specialized agency of the UN in 1946.[/accordion_son][accordion_son title=”About CRI Group” clr=”#ffffff” bgclr=”#1e73be”]Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.[/accordion_son][/accordion_father]

Have you read…

[/vc_column_text][vc_basic_grid post_type=”case-study” max_items=”6″ style=”pagination” items_per_page=”3″ item=”234″ grid_id=”vc_gid:1605683277613-8a07ec62-1f1d-4″][/vc_column][/vc_row]

CRI Group™ Celebrate 2021 International Fraud Awareness Week

CRI Group™ is once again a proud supporter of 2021’s International Fraud Awareness Week. Taking place throughout the week of November 14th to November 20th of 2021, International Fraud Awareness Week is a global effort is a move to diminish the influence of fraud by advocating for anti-fraud awareness and education. According to the 2021 ACFE Report to the Nations, organisation’s continue to lose about 5% of revenue to fraud each year and currently, there are more than 3.3 billion people in the global workforce with nearly all of them having access to or control over some portion of their employer’s cash or assets – an amount which contributes to such a loss.

Corresponding to the most recent ACFE report, other fraud trends which have remained constant throughout the last few years include:

- Asset misappropriation is the most identified scheme

- Tips are the greatest process of exposure

- The lengthier that fraud goes unbridled, the greater the median loss

Zafar Anjum, founder, and CEO of CRI Group™ said that International Fraud Awareness Week (called Fraud Week, for short) is a crucial endeavour drawing attention to fraud and aiding to support better education towards communities about the liabilities that accompany fraud. “CRI Group™ has been a proud supporter of Fraud Week for past years”, Anjum said. “It’s an important time to urge organisations of all shapes and sizes to conduct proper due diligence and minimise risk. Only by addressing fraud and corruption proactively can we make progress in preventing and detecting it”.

For CRI Group™, though, assisting organisations with the deterrence and detection of fraud is a year-round responsibility which is why Fraud Week is a wonderful occasion to acknowledge CRI® Group’s contemporary exertions in the bout alongside fraud; it is also a wonderful time to look ahead on CRI Group’s activities which are all nearing their time of action.

Here are just a few of the highlights:

Active Participants

CRI Group™ participated in conferences as a means of educating professionals on fraud and corruption; such as the PBSA 2021 Annual Conference. Furthermore, our experts discussed ISO 37001 and other anti-bribery management solutions with a range of industry professionals across the world by inviting them as speakers to our webinars and actively collaborating with them through other means. “CRI Group™ is comprised of subject-specific experts with diversified speciality areas,” Anjum said. “Our audit team has years of substantive field experience as investigators, compliance officers and legal professionals.”

Continue educating the masses

With ABAC™ in place, we found that corporate leaders were eager to learn more about preventing bribery and fighting corruption however, one other obstacle remained in our way; the pandemic. 2021 saw CRI alongside ABAC™ continue their efforts to share best practices, demonstrate resources and discuss the latest technology for preventing corruption despite the global pandemic which admittedly, probably has changed the way the corporate world works forever. Our webinars are designed with every passing moment in mind so that solutions and advice can be entirely bespoke to the client at hand. Our webinars to date include:

We kicked off the year with a webinar built to explore and identify a combination of institutional solutions for managing and monitoring corporate compliance to prevent bribery and corruption in a modern enterprise. The aim of this webinar was to identify how to protect your organisation from global corruption and to critically assess the applicability of several recent legislative guidelines to the proactive mitigation of corruption and bribery in corporate administration across the world. Based on Airbus and Rolls-Royce cases of multinational, multi-party bribery, the webinar dived into the consequences of systemic inadequacy, confirming a paradigm shift in corporate oversight and network risk management.

- Bribery discovered: what to do in the next 48 hours? with Robert Youill, Executive Director at Key Risk Consulting Asia

We explored what course of action to take in the first 48 hours after discovering bribery as well as how to prepare for such crisis management and finally, how to manage the risks more effectively and minimise the chances of such a situation happening at all. Key speakers consisted of CRI Group’s/ABAC’s own Zafar Anjum, and Robert Youill, Executive Director at Key Risk Consulting Asia. Both talked about the steps you have to take in the next 48 hours after bribery is discovered concerning your organisation and how to identify the gaps in your existing anti-bribery anti-corruption management system.

- Pitfalls Most Organisations Often Commit – the importance of implementing Anti-Bribery Management System (ABMS) with DATO’SRI AKHBAR SATAR, Managing Director at Akhbar Corporate Integrity Services

Here at CRI™, we like to say why be a part of the problem when you can be a part of the solution? This webinar covered information regarding bribery, including consequences of bribery and defences to bribery as well as an overview of the regulatory framework, specifically the New Corporate Liability provision under Section 17A of the Malaysian Anticorruption Commission Act 2009 and a comparative study of Section 7 of the UK Bribery Act 2010. This webinar is great for organisations who wish to widen their knowledge and expertise regarding the ISO 37001 Anti-bribery Management System standard.

- What does it mean to be a whistleblower? with MACC Senior Assistant Commissioner & Head Private Sector Branch Community Education Division (Tuan Haji Mohd Nur Lokman Samingan) and President – Association of ABMS Practitioners Malaysia, Dr KM Loi

Whistleblowing does not only refer to the act of a whistleblower who informs, reports or discloses on someone or the organisation is conducting or going to conduct any illicit activity which may harm the interests of stakeholders. Meanwhile, it has also emerged in its mainstream functions and the essential roles in leading today‘s modern corporations to enforce effective whistleblowing policy within their compounds of governance. The goal was to provide resources and access to organisations around the globe on standards and certifications that will aid them in expansion and an ethical working environment.

- Compliance & Adequate Due Diligence for Third-Party Risk Management with SAMIA EL KADIRI, IRCA Lead Auditor, Governance & Compliance Consultant, in collaboration with DQG

Widespread trust is built on a company culture of doing the right thing, where every employee contributes because they understand and believe in its importance. Our “Building a Culture of Compliance and Trust Through ISO 37301:2021 CMS” webinar in collaboration with Dubai Quality Group and our sister brand the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence highlighted all essential parts of a corporate compliance program. The aim of this webinar was to be able to provide resources on corporate compliance and due diligence to organisations around the globe that will aid them in expansion and an ethical working environment.

All of our webinars are designed with our audience and beyond in mind and we aim to educate and equip corporate leaders of all industries and sizes with the resources we have available to us.

Raised Fraud Awareness

Our content is created to inform and provide important information that might be missed in today’s news cycles – that being said, CRI Group™ has produced more than 50 educational news articles and publications to help educate business leaders, government leaders, professionals and the public about fraud and corruption. Our subject matter experts deliver important information, such as why forensic accounting can be important during a fraud investigation, or how risk assessments can be used to better protect your organisation.

The methods for committing fraud are ever-evolving, so it’s no question that our experts remain dedicated to building their skill sets and staying on the cutting edge in a bid to help clients be successful in detecting and deterring fraud in and out of their immediate workspace. To do so we have launched a few new educational articles:

- Due diligence and tips to avoid fraud

- 8 Steps to prevent fraud

- Reporting Fraud: Do you know what measures to implement?

- 2021 Fraud Week: Prevention is Key

- Why International Fraud Awareness Week is a great time to reflect

- Reporting Fraud: Do you know what measures to implement?

Collaborating with Anti-Bribery Anti-Corruption Centre of Excellence (ABAC™)

At CRI Group™, we recognised the need for an independent certification body for ISO 37001: Anti-Bribery Management System which is why we founded the Center of Excellence back in 2016. Our goal was and still is to assist organisations worldwide in certification for anti-corruption, risk management and compliance; we do this largely by providing training and certification for ISO 37001. Our experts help organisations implement effective anti-bribery management programs using widely accepted controls, systems and best practices in line with local and international legislation. 2021 allowed CRI Group™ various opportunities to work hand in hand with our sister brand to materialise our missions at both brands and make them into a reality that benefited so many corporate leaders and personnel across the globe.

CRI Group™ is proud to announce that we will be hosting a free webinar on December 9th 2021 in conjunction with our sister brand Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence Group. Our intention is to be able to provide resources on corporate compliance to organisations around the globe that will aid them in expansion and an ethical working environment. In recent years, third-party risk management has become a primary concern for organisations, amid increased outsourcing against a backdrop of rising costs, digitisation and low-interest rates, which have put downward pressure on margins. While there are many benefits driving outsourcing, e.g., increased efficiency and scale, it naturally also increases the level of risk and complexity of third-party relationships. Coupled with increased lengths of agreements, on average five to seven years, the need for ongoing performance management becomes that much greater.

Take advantage of this free webinar on third-party due diligence and oversight. Register below and save your seat today!

Accrediting global corporations with ISO 37001

CRI Group’s sister brand ABAC™ Center of Excellence was also incredibly honoured to earn official accreditation from Emirates International Accreditation Center – EIAC (UAE) to administer training and certification for ISO 37001 ABMS. The year 2021 saw the ABAC™ Center of Excellence accrediting organisations such as UDA Holdings Berhad Group (UDA) and Mubadala Petroleum with the certification which is a success in the sense of achieving a transparent corporate model. Founder and CEO of CRI Group™ Zafar Anjum has stated “EIAC provide objective evidence that organisations operate at the highest level of ethical, legal and technical standards…That’s exactly where ISO 37001 fits in – helping to protect organisations from bribery and money laundering.”

Found fraud

Through various client engagements, CRI Group’s investigative analysts found a large number of red flags indicating possible fraud. How many? The answer may be surprising: our agents discovered more than 700 red flags across 80 countries. The first step in fighting fraud is knowing that it exists. The sooner it is discovered, the less damage a fraud scheme can do to an organisation.

During International Fraud Awareness Week, think about the statistics at the beginning of this article … and ask yourself or your colleagues: Are we doing all we can to prevent fraud? Remember, the landscape is always changing, and fraudsters will do everything they can to use evolving technology and other methods to find vulnerabilities. Moreover, the best way to fight fraud is to prevent it in the first place. CRI Group™ is here to help, contact us today to learn more.

BS7858:2019 – everything you need to know and more!

The recent update of the BS7858 standard, “Screening of Individuals Working in a Secure Environment – Code of Practice,” places emphasis on the risk assessment of secure environment workers. The code focuses on the need for tighter controls over the pre-employment screening – and periodic re-screening – of individuals, who in their positions could potentially benefit from illicit personal gain, become compromised, or take advantage of other opportunities for creating breaches of confidentiality, trust or safety.

What is BS7858?

BS7858 stands for “Screening of Individuals Working in a Secure Environment – Code of Practice,” The BS7858 is a code of practice released by BSI (British Standards Institution), a business standards company which supports companies in achieving excellence within their field, and continuously boosting performance. Introduced in 2013, the standard was updated in September 2019 and is now considered to be the industry standard for all screening in employment, despite its original intention for use in security environments only. This code was meant to provide a critical security standard that guided employers on the screening process for security staff before offering full employment. However, the new update has widened the scope of this code.

This British Standard helps employers to screen personnel before they employ them. It gives best-practice recommendations, sets the standard for the screening of staff in an environment where the safety of people, goods or property is essential. This includes data security, sensitive and service contracts and confidential records. It can also be applied to situations where security screening is in the public’s interest. It sets out all the requirements to conduct a screening process. It covers ancillary staff, acquisitions and transfers, and the security conditions of contractors and subcontractors. It also looks at information relating to the Rehabilitation of Offenders and Data Protection Acts. CRI Group is the first and only investigative research company in the Middle East to receive the certifications BS7858:2019 and BS102000:2013, Code of Practice for the Provision of Investigative Services from internationally recognised training and certification body BSI.

Change of scope

The change of scope is possibly the biggest change of the standard. In the old document, the standard concerned the security sector only. However, the scope has been amended to allow organisations in all environments to adopt the standard when employee screening. And due to the current pandemic, this update is more significant than ever. There is a specific section of the standard that relates to risk management which states: “An integral part of risk management is to provide a structured process for organisations to identify how objectives might be affected. It is used to analyse the risk in terms of consequences and their probabilities before the organisation decides what further action is required”.

BS 7858:2019 lays out the scope of “obtaining personal background information to enable organisations to make an informed decision, based on risk, on employing an individual in a secure environment.” Those workers include business owners, directors, partners, silent partners and shareholders holding more than 10% of the business; managers, area managers, department managers, screening managers and staff; installers and service crew; security personnel; and office supervisors and staff with access to customer and system records.

The amended guidelines of the standard put the onus on the organisation’s top management to demonstrate that they are focused on the aspects of the business where the most risk lies, and the particular personnel roles that are involved within those risks areas. This is particularly important because, as the standard states, the “organisation retains ultimate responsibility for an outsourced screening process and is required to review the completed screening file.” Risks assessment includes examining specific roles that involve financial tasks, data security, management of goods, property risks or any number of “people risks” such as roles with direct access to vulnerable adults and children.

To that end, management is charged with ensuring that the organisation has proper and adequate resources and infrastructure in place to manage the adequate vetting of high-risk personnel. Management is tasked with the response and that there is a firm commitment at the top level to manage and support the coordination required to execute the screening process. Finally, management is tasked with ensuring that such responsibilities are correctly assigned and communicated throughout the organisation. The guideline also eliminates from its original text in 2012, a requirement to produce character references as part of the screening process. This decision was based on the supposition that such references are now deemed as potentially weak and difficult to verify. Managing risk effectively is essential to ensure businesses succeed and thrive in an environment of constant uncertainty. ISO 31000 aims to simplify risk management into a set of clearly understandable and actionable guidelines, that should be straightforward to implement, regardless of the size, nature, or location of a business.

BS7858:2019, a new way to mitigate employee risk during COVID-19

The far-reaching impact of the COVID-19 outbreak has affected virtually every business and economic sector worldwide, and depending on the global region, has hampered (on various levels) the ability to conduct proper and thorough background screening investigations. In the United Kingdom and the United Arab Emirates, the countrywide lockdowns forced leaders to close sites and send their workforce home. Many are having to learn how to manged people working from home (WFH) or remotely for the first time. The previous concerns about productivity, privacy and protecting sensitive information only grew more with the practice of WFH. They highlighted the vital importance of pre-employment background screening and background investigations. BS 7858:2019: the revised Standard for screening individuals working in secure environments offers a complete solution.

The revised BS7858 standard enables organisations to demonstrate a commitment to safeguarding their businesses, employees, customers and information utilising widely accepted methods that focus on risk assessment and top-down management involvement in the company’s employment policies and practices. In establishing policies and procedures around the standard, organisations can show that they place a high value on hiring individuals who possess integrity. Organisations can then task them with responsibilities designed to keep their co-workers, customers and information safe from the opposing forces that have become more prevalent in today’s ever-changing COVID-19 world. Find out more on how you can mitigate employee risk during this pandemic with BS7858:2019.

Playbook BS7858:2019, everything you need to know and more!

| The price of a bad hire has far-reaching consequences for any business, including productivity loss, decreased employee morale, risks to employee safety and increased exposure to costly negligent hiring claims and potentially devastating litigation. The premise behind the standard is to safeguard employers from harmful or fraudulent hires.

Cases of organisations that forego conducting due diligence on a new hire – especially a hire with high-risk exposure – often end badly for those organisations. At CRI Group we know how important is your background screening to your company’s success and to give you an idea of what is new we have produced this playbook detailing the differences between BS7858:2012 standard and the new BS7858:2019 standard. |

|

Managing your people through COVID-19

The COVID-19 pandemic is undeniable affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses are having to adapt quickly to survive, i.e. cutting steps in their hiring process, and no-one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook.

Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. Read the answers to the following questions:

|

|

Frequently asked questions about background checks

Get answers to frequently asked questions about background checks / screening cost, guidelines, check references etc.

This eBook is a compilation of all of the background screening related questions you ever needed answers to:

|

Taken as a whole, is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions. |

Let’s Talk!

BS7984:2008 accredited companies (such CRI Group) highlight to their clients that their security personnel are staff that can be trusted and relied upon to complete a high-quality job as the screening process highlights the level of conduct that they have presented in the past. This reassures the safety of the people, goods and property that they have been hired to protect. If you have any further questions or interest in implementing compliance solutions, please contact us.

About the Author

Zafar Anjum, MSc, MS, LLM, CFE, CII, MABI, MICA, Int. Dip. (Fin. Crime), Int. Dip. (GRC)

CRI Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA, United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

CRI® Proud Official Supporter of International Fraud Awareness Week 2020

International Fraud Awareness Week, November 14-20 – and CRI® Group is once again a proud Official Supporter of this global movement. Fraud Week was created to reduce the impact of fraud and corruption by promoting anti-fraud awareness and education.

Fraud statistics

Fraud is still increasingly common. Even when it comes to hiring employees, companies must be vigilant. CRI® Group’s investigative team found that providing incorrect employment details is the most common red flag, as it was uncovered in about 4.5 per cent of background screenings. This is followed by providing incorrect education degree details as well as having adverse media (unfavorable news or online mentions), both at 2.33 per cent. Most employers would probably say that when it comes to educational background, the only thing worse than providing incorrect degree information would be outright claiming a fake degree – which occurred in nearly 2 per cent of cases.

Read more in our article “Background Screening Red flags: Numbers Don’t Lie”.

In another survey conducted by CRI® Group, which analyzed how COVID-19 has impacted human resources and its functions, it was revealed that companies understand the fraud risk factor during the pandemic: nearly 77 per cent of HR professionals accept that there is a risk that employees can initiate fraudulent activity because of the work-from-home arrangement.

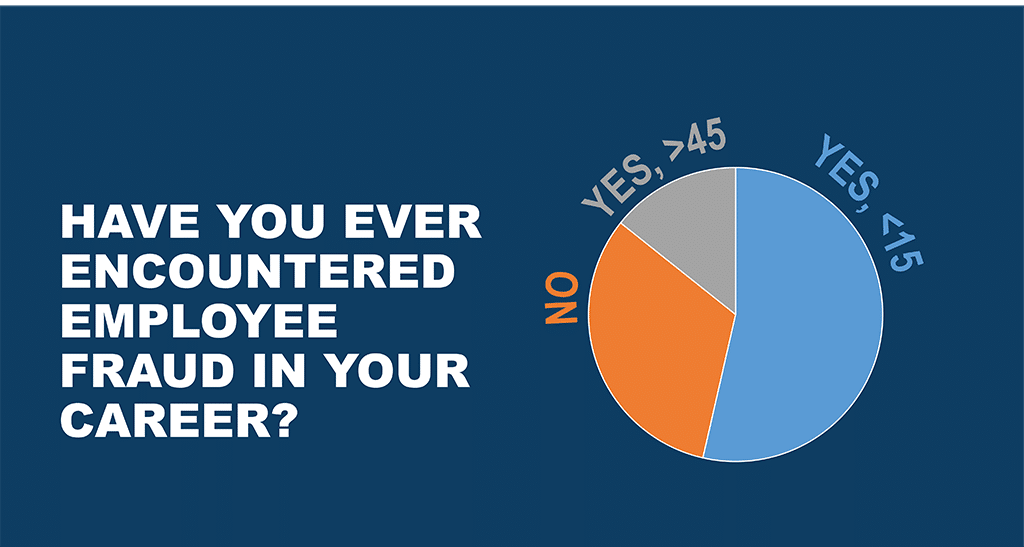

Also, the shocking number of survey participants highlighted that they have encountered employee fraud in their career. Luckily, most companies do conduct background screening of some type. In fact, 85 per cent do so, which is important because many companies have learned that trust can be misplaced. While an overwhelming 92 per cent said they trust their employees with confidential data, background screening can help verify that your employees aren’t hiding anything in their backgrounds that might put your company at risk.

Read more about the survey, as it provides valuable information for companies, employees, and human resources professionals and teams who serve them. It also sheds light on the critical need for increased employee background screening and data protection during a tumultuous time.

- The average fraud lasts 18 months before it is discovered. The longer a fraud lasts, the greater the financial damage (schemes that last for several years can cause hundreds of thousands of dollars).

- The most common detection method for fraud is tips. And organisations that have reporting hotlines are much more likely to detect fraud through tips than organisations without hotlines.

All of the above indicates that the fraud issue is real and organisations must take actions to prevent the fraud risks for their organisations and even careers. For CRI® Group, the goal is to help business leaders think about fraud and corruption this week and take steps to minimise it year-round. So, what is your organisation doing for Fraud Week?

Get involved in the Internal Fraud Awareness Week

Join CRI® Group and ACFE in the fight against fraud. ACFE provides a great set of the following tools to go a step further in your role and to start discussions amongst peers, co-workers, executives and stakeholders in your community about how important fraud prevention is to society as a whole:

- Post on social media using new badges and informative images with the tag #fraudweek

- Add the new Official Fraud Week Supporter badge to your email signature.

- Invite a ACFE to talk to your employees and co-workers virtually on how to avoid common mistakes when preventing fraud.

- Download the free Fraud Week logo to share on materials or websites.

- Involve your local chamber of commerce or city council to spread tips on fraud prevention for small businesses.

- Host a talk or seminar for your co-workers or community on regularly staying aware of fraud prevention best practices.

- Perform a fraud check-up for your organization and present your findings to executives, as well as a proactive plan for how to remedy weak spots in your current controls.

How does CRI® Group fight fraud?

CRI® proudly celebrates International Fraud awareness week and highlights that this occasion (called Fraud Week, for short) is an important effort to put a spotlight on fraud, help educate people about its perils and build a fraud-free future.

“Fraud Week reminds us that awareness is any organization’s first line of defense against fraud and corruption, as properly trained employees will have a better opportunity to recognise the red flags of fraud, and a better understanding of their organization’s zero-tolerance policy toward such behavior”, Zafar Anjum, founder and CEO of CRI® Group says.

“Fraud is everybody’s problem, and it cannot be prevented and detected if employees aren’t provided with the information they need to combat it. Providing a robust anti-fraud training program increases your company’s protection from risks of fraud and unethical behavior. An ounce of prevention is worth more than a pound of cure.”

For CRI®, though, helping organizations prevent and detect fraud is a year-round commitment. That’s why Fraud Week is a great time to reflect on CRI® Group’s recent efforts in the fight against fraud, and to also look ahead to activities on the near horizon. Below are just a few of the highlights.

Does your organization have a training program in place that addresses fraud, bribery and corruption? And, if so, how robust is your training? How often is it administered? And how do you know it’s working?

These are important questions, especially considering the fact that we know most fraud is discovered internally through employee tips. A recent case study is a perfect illustration of that.

Case study: Conflicts of interest

A major pharmaceutical company’s security department received conflict of interest complaints that reportedly involved a range of employees, from sales personnel on up to the chief financial officer (CFO). The company engaged CRI® Group to conduct an integrity due diligence and conflict of interest investigation in order to uncover unethical practices, including bribery and corruption, by senior employees.

CRI® Group’s investigators quickly launched a risk assessment of the company’s third-party relationships, which included several interviews with identified vendors and suppliers to help ascertain the engagement process and associated risks.

Investigators found one of the vendors used letterhead that lacked a physical address, and the only contact information listed was a single cell phone number. Site visits, background checks and interviews helped determine that the suspicious vendor was not a company at all – but a single person, and he was none other than the brother-in-law of the client company’s CFO. Worse still was the fact that this obvious fraud was being conducted right under the noses of the company’s procurement and finance professionals.

CRI® Group investigators discovered that the individual’s residence was being utilised as a warehouse to help facilitate the fraud. Comprehensive litigation records check with local and regional courts found that the subject was previously convicted in federal court and spent three years in prison for the charges of selling counterfeit products, physician samples and expired medicines; further regulatory checks found that his pharmacist license had been cancelled.

The fraud had continued for five years. However, the one thing that saved the company from further financial harm was the fact that employees had stepped forward to report unethical behaviour. If not for their action, the fraud could have continued indefinitely.