The Story of Our CEO and Company

The Story of CRI Group™

By Zafar I. Anjum, Group CEO

THE BEGINNING: EVENT THAT CHANGED ME

Shortly after leaving the Pakistani Rangers in 1994 (five years after my graduation), I took over my father’s private investigation organisation – called, at the time, the Metropolitan Detective Agency. During this period, I was involved in investigating a case of suspected insurance fraud. The case involved a grandfather attempting to lay claim to his daughter’s life insurance settlement following her death under the pretext that he was responsible for the guardianship of her four orphaned children. After investigation, it was revealed that this was not the case and that the grandfather was attempting to defraud his late daughter’s insurance company.

Much like my feeling towards the case, the situation’s outcome could be characterised in two ways – one positive and one negative. I remember the overwhelming pride I felt in our success on the positive side. However, this was somewhat overshadowed by a sense of what is perhaps best articulated as injustice – I saw first-hand how fraud is damaging. And although fraud was having (and continues to have) a detrimental effect on the people, the lack of an effective solution to the problem meant that, frustratingly, such crimes were able to continue.

UNCOVERED MY FIRST FRAUD; WHAT’S NEXT?

Whilst I had managed to deal with one case of fraud and thus prevented the successful committing of a crime, this was just a single instance of fraud – I had done nothing to move towards an overall reduction of the problem. In other words, I concluded that I had managed to treat a mere symptom rather than the underlying illness.

DEDICATION TO INVESTIGATING FRAUD

Although the case itself was not particularly unusual, at least as far as fraud cases go, one particular aspect of the affair struck me – that, in contrast, most crimes are dealt with by the justice system, and fraud is peculiar. It often mandates investigation by an external agency or organisation that specialises in fraud detection. I noticed that such organisations were sorely lacking in Pakistan at the time – and that there was a distinct lack of counter fraud education in the general population, which aided those committing fraud greatly. Furthermore, even where individuals were aware that they were being defrauded, they lacked knowledge of effectively resolving disputes between themselves and the defrauder.

With this analysis in mind, I concluded that there needed to be significant growth in the counter-fraud industry within Pakistan. This is where the privatised nature of fraud investigation could make a significant positive impact.

Although the police might not have had the resources to deal with fraud in its entirety, there was certainly an incentive for private companies to increase their spending in this area. In other words, there was a clear market opportunity for the expansion of the anti-fraud industry, and one that I knew how to fill with my experience and knowledge. Although I am market-minded as a matter of business necessity, it has become apparent to me over recent years that I am at my most motivated not when I am seeking organisational growth but when I am seeking professional development.

Corporate Research and Investigations Ltd (CRI Group’s First Logo)

FUTURE PLANS: CRI GROUP™ EXPANSION

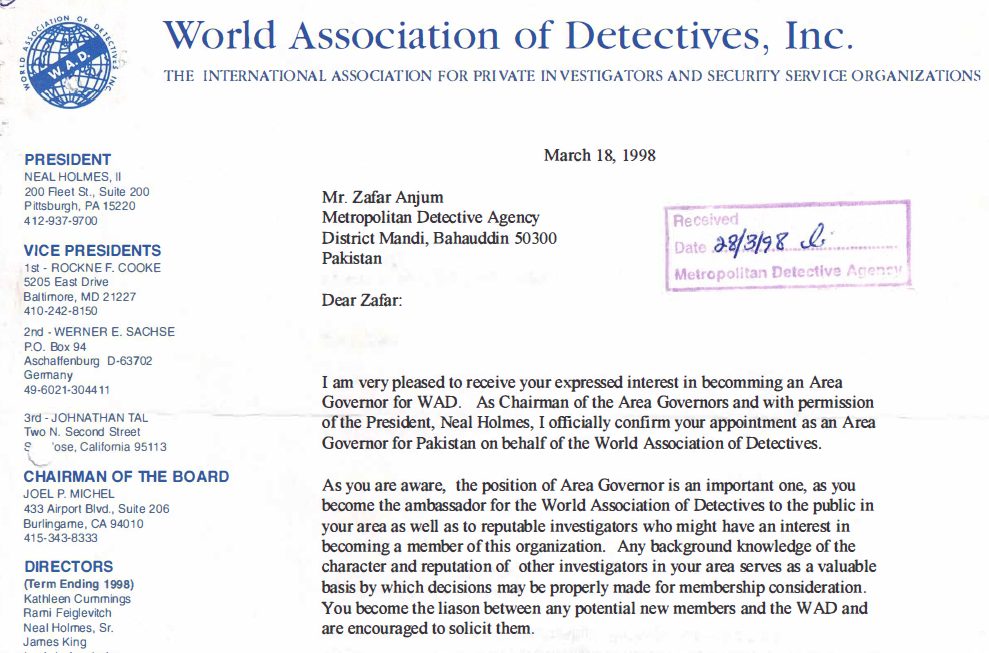

With this conclusion in mind, I continued with the operation and expansion of Corporate Research and Investigations Limited “CRI® Group”. As well as expanding the CRI® Group, I began to take more and more of an interest in the professional aspects of fraud investigation. For this reason, in 1995, I became the first member of the Association of Certified Fraud Examiners from Pakistan, and in 1998 I was appointed the Area Governor for Pakistan and the Middle East by the World Association of Detectives.

The Area Governor appointment letter, issued to Zafar Anjum by

World Association of Detectives, 1998

If I were to summarise the one lesson that I learned due to my early experiences in Pakistan, it would be important to expand counter-fraud and counter-corruption to where it is needed. The ramifications of this lesson did not end when I left Pakistan either. My awareness of areas into which fraud prevention might be further expanded has continued. For this reason, I have taken a particular interest in the emerging area of corporate corruption and fraud.

CRITICAL REFLECTIONS ON MY PERSONAL DEVELOPMENT

Being a business owner, it is only natural that my personal development has been attached to the development of my organisation. As noted above, I have sought to have my organisation grow in line with my field – where there has been a need to combat corporate corruption and fraud, I have sought to conquer the resulting market. Similarly to how I have sought to expand my business, I have also found it necessary to seek out personal development opportunities whenever they become available. To this end, I have consistently been seeking out academic development since 2009. I have since completed an ICA International Diploma in Financial Crime Prevention, ICA International Diploma Governance, Risk and Compliance, ICA International Diploma in Anti-Money laundering, and MSc in Counter Fraud and Counter Corruption Studies. I completed another Master in Fraud and Financial Crime with Distinction and a Master of Laws (Legal Practice Intellectual Property). It is only natural that I am currently seeking to learn academically and contribute something to academia in the form of my PhD thesis.

In terms of personal development, I can therefore consider myself lucky to bring my career experience to doctorate-level study. Still, I will be able to take what I have learned at the doctorate level and apply it in a professional setting. Although I am market-minded as a matter of business necessity, it has become apparent to me over recent years that I am at my most motivated not when I am seeking organisational growth but when I am seeking professional development.

Hard work and dedication are two values ingrained into our core and are found in all facets of our operation. We believe that true value comes from fostering trust with our colleagues and clients at an equal level. We take great care in keeping integrity at the forefront of our Anti-Corruption, Compliance and Risk Management services. We wish to build long-term relationships in which we can be counted on to provide efficient and cost-effective services.

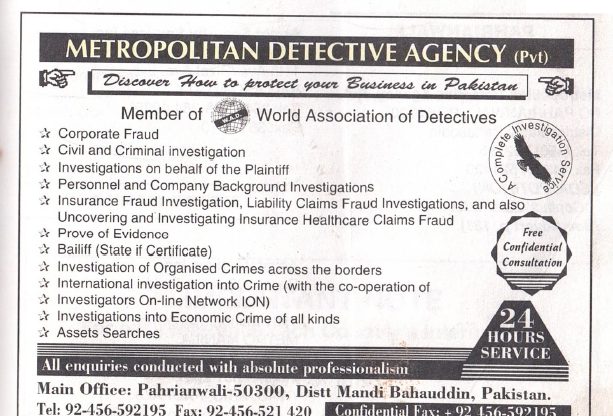

CRI Group’s very first international directory advertising in the UK during 1998

Looking Forward…

I believe it is important to constantly look for ways of improvement, especially in this rapidly changing industry. Each new technological development is an opportunity for us to advance our capabilities and competencies. Making use of the finest equipment and the most advanced technologies is one of the many ways that we set ourselves apart from the competition. I take great pleasure in implementing the most innovative ways to provide for our colleagues and team.

Our goal is to provide principled and reliable Anti-Corruption, Compliance and Risk Management Services for our clients. With the shifting marketplace, we pride ourselves on maintaining our core values as a constant. The message to our client is that your satisfaction is the main driving force behind our business. When you choose our services, you can expect a professional, high-quality experience every time.

Thank you all for your dedication, and congratulations on our 32nd anniversary!

With gratitude and wishing for more years to come for the CRI Group™ family,

Q&A session with our CEO: United Arab Emirates fighting Fraud and corruption

Middle east corruption is a threat to the world. The United Arab Emirates (UAE) is a land of complex extremes where fabulous wealth and supercars live right next to staggering poverty. This is generally a recipe for fraud and corruption. However UAE has been talking the right steps towards a fraud free future. This Financier Worldwide Q&A session with our CEO discusses United Arab Emirates role in fighting fraud and corruption. Read the answers to the following questions:

- To what extent have you seen a notable rise in the level f corporate fraud, bribery and corruption uncovered in United Arab Emirates in recent years?

- Have there been any legal and regulatory changes implemented in United Arab emirates designed to combat fraud and corruption? What penalties do companies face for failure comply?

- Do regulators in United Arab Emirates have sufficient resources to enforce the law in this area? Are they making inroads in this area?

- If a company finds itself subject to a government investigation or dawn raid, how should it respond?

- and much more…

Q. To what extent have you seen a notable rise in the level of corporate fraud, bribery and corruption uncovered in United Arab Emirates (UAE) in recent years?

ANJUM: Some recent, high profile cases have affected companies and countries in the Middle East. Embraer’s bribery scandal, involving sales of its aircraft, included officials in Saudi Arabia, among others. Further, there have been suspicions of corruption surrounding the awarding of the 2022 FIFA World Cup to Qatar, suspicious which have been worsened by allegations of human rights abuses involving migrant workers. In general, however, it is still issues like data theft, e-commerce fraud, information security and other high tech threats that pose serious risks to organisations in the Middle East. We live in an increasingly connected world, so while anti-fraud laws and controls in one country may be robust, a company might find itself doing business abroad in a location where laws and enforcement are more lax, and risk is heightened.

Q. Have there been any legal and regulatory changes implemented in UAE designed to combat fraud and corruption? What penalties do companies face for failure to comply?

ANJUM: the UAE has a strong reputation for being tough on corruption, and a new law enhances this stance. The recently approved, and highly anticipated, Anti-Commercial Fraud Law will strengthen protections of intellectual property rights (IPR) and will impose stricter penalties anon counterfeiters. For example, a fraud offence related to counterfeiting could now result in up to 2 years in prison, as well as a fine of up to Dh1m. Overall, corruption is still a low risk for companies operating in the UAE. Laws against corruption are enforced, and they cover bribery, facilitation payments, embezzlement and other types of fraud and abuse. However, when concerning the Middle East as a whole, there are indications that fraud and corruption are the rise, which means we must be ever vigilant in protecting investments throughout the region.

Q. In your opinion, do regulators in UAE have sufficient resources to enforce the law in this area and fight corruption? Are they making inroads in this area?

ANJUM: When considering the Middle East region, there can be no ignoring war-ravaged areas like Syria, Iraq, Libya and Yemen. It is an understatement to say that countries embroiled in conflicts and crisis usually do not have the resources or manpower to properly prevent and detect fraud. But according to Transparency international’s most recent Corruption Perceptions Index, a few of the other more stable and affluent countries in the region are experiencing some difficulty preventing fraud, as well. Different factors can contribute to these struggles, be they politics, autocratic leadership, weak laws or judiciary bodies. However, the UAE still ranks as the least corrupt country in the Middle East, and other countries might take heed of the country’s Anti-Commercial Fraud Law and other existing laws, not to mention the UAE’s enforcement measures, as a possible model for future efforts.

Q. If a company finds itself subject to a government fraud and corruption investigation or dawn raid, how should it respond?

ANJUM: A company that finds itself in such as crisis should immediately cooperate with authorities and work quickly to gather the facts. What are the allegations? What is the scope of the investigation? Was the raid expected, or has the company been taken completely by surprise? In the early stages, it is crucial that the company engages in a good-faith effort to be transparent and cooperative. Of course, retaining legal counsel, is a must at this an every stage of an investigation, If an employee or employees have engaged in fraud, the company should support the fact-finding process and let justice run its course. Company leaders should also evaluate their internal controls and ensure that additional fraud or corruption is not occurring under the radar.

Q. What role are whistle-blowers playing in the fight against corporate fraud and corruption? How important is it to train staff to identify and report potentially fraudulent activity?

ANJUM: The statistics on fraud, such as in the Association of Certified Fraud Examiners Report to the Nation on Occupational Fraud & Abuse show that fraud is most often uncovered by tips, more so than audits, surveillance, account reconciliation, document examination and other methods. Accordingly, a company’s own employees are their first line of defence against fraud. But to encourage whistle blowing, two critical measures need to be in place. First, employee should be trained to identify the red flags of fraud, and to know what does, and what does not, constitute fraudulent behaviour. Second, a reporting mechanism should be in place; an anonymous system by which whistle-blowers can submit their tips without fear of retaliation or negative consequences.

Q. What advice can you offer to companies on conducting an internal investigation to follow up on suspicions of fraud or corruption?

ANJUM: In any situation where fraud is suspected, it is crucial that experts be brought in as quickly as possible to help unravel the facts of the case, if the company does not have anti-fraud professional among its staff, It is critical to remember that there are various laws, depending on your country or region, which govern the rules of gathering evidence and interviewing witnesses. Any evidence that is mishandled or collected improperly can negatively impact an investigation and hurt the chances of a resolution. If an investigation is bungled from the start, it is nearly impossible to then ‘wind it back’ and correct mistakes later. Also, if criminal behaviour is suspected, legal authorities should be quickly notified and provided with the company’s findings and reasons for the allegation.

Q. What general steps can companies take to proactively prevent corruption and fraud within their organisation?

ANJUM: Every organisation, large or small, should have a plan in place for preventing and detecting fraud. The first step is to communicate the organisation’s zero-tolerance stance against fraud. An ethical code of conduct, signed by every employee, can be effective in this regard. A fraud risk assessment should be conducted to find vulnerabilities. The company’s hiring policy should include pre- and post-employment background screening. Job responsibilities should include segregation of duties, so that no single employee has too much control over finances or assets. The company should conduct audits and encourage whistle-blowing with an anonymous reporting system. With a comprehensive fraud prevention system in place, business owners can sleep a little easier, knowing that their organisation has reduced risk and increased their ability to prevent and detect fraud.

Speak up – report any illegal, unethical, or improper behaviour

If you find yourself in an ethical dilemma or suspect inappropriate or illegal conduct, and you feel uncomfortable reporting through normal channels of communication, or wish to raise the issue anonymously, use CRI® Group’s Compliance Hotline. The Compliance Hotline is a secure and confidential reporting channel managed by an independent provider. When reporting a concern in good faith, you will be protected by CRI® Group’s Non-Retaliation Policy.

About CRI® Group

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI® Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Meet our CEO

Zafar I. Anjum, is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due diligence and employee background screening services for some of the world’s leading business organisations. Headquartered in London (with significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center-QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguards businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Turkey, Singapore, Malaysia, Brazil, China, USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

This Q&A article is based on a 2017 Financier Worldwide interview.

Since 2001, Financier Worldwide has provided valuable information on corporate finance and board-level business issues through its monthly magazine and exclusive website content. As a leading publisher of news and analysis on this dynamic global market, the organisation is recognised as a valued source of intelligence to the corporate, investment and advisory community. More from Financier Worldwide:

- Corporate resilience: managing third party risks, April 2013 | SPECIAL REPORT: MANAGING RISK

- Contract fraud: is your organisation at risk?, February 2013 | SPECIAL REPORT: CORPORATE FRAUD & CORRUPTION

- Fraud & Regulatory Enforcement 2013, April 2013 | FRAUD & CORRUPTION

Download 2018 annual reviews by Mr. Zafar Anjum, CEO, and Ms. Fatima Farrukh, Compliance professional at CRI® Group.

COVID-19 Prompted Innovative Leadership

As of 3 September 2021, COVID-19 has affected more than million people globally, including 218,580,734 deaths, reported to WHO. The virus has also had severe economic implications, leaving organizations facing a unique set of new challenges that can only be summed up in one word: uncertainty. And the only way to navigate these uncertain times is through effective leadership. Good leaders can deliver on their mission in innovative ways while envisioning a new “normal”. This is critical right now, as COVID-19 has magnified not only societal vulnerabilities but vulnerabilities in business, as well.

Navigating the complexities of the unforeseen COVID-19 crisis has left many businesses struggling. Crisis often fuels innovation, however, and most organizations are stepping up with unique contributions and excellent leadership at a time when it is needed most. Leaders at the forefront of the COVID-19 pandemic – epidemiologists, data and behavioral scientists, academics, engineers, military logisticians and businesses – are collaborating (probably for the first time) to solve seemingly intractable problems.

These leaders are driving innovation with therapeutic, economic, and community-based solutions that are having a significant impact on the global pandemic. From the creation of multi-million global relief funds to shepherding vaccine development and treatments; from payment deferrals for people and businesses facing financial hardships to digital/telehealth solutions such as Beneficial Business Exchange (a self-service virtual community that matches urgent needs with critical resources); from solving supply chain challenges to creating innovative new products; leaders are adapting and making decisions to help their organizations weather the storm and survive the crisis.

For example, with ventilators in short supply (a critical need during the pandemic), Mercedes stepped up by collaborating with the University College London and clinicians at University College London Hospital to develop the Continuous Positive Airway Pressure (CPAP) ventilator. In South Korea, health authorities, vice-Health Minister Kim Gang-lip, businesses and students joined forces at an early stage of the COVID-19 pandemic. With their combined technological expertise and creative thinking skills, they produced a drive-through COVID-19 test; a body sterilizer that sprays people as they enter halls; and a health tracker app for overseas visitors. These and other innovative solutions have shown how collaboration between leaders is beneficial.

The COVID-19 pandemic has driven technological innovation. With more people working from home, internet and online services have been stretched to the limit. Behind strong leaders at Apple, Google, Amazon and other leading tech giants, companies have responded to fill needs in this new online framework. Web meetings, online shopping and other technological aspects driven by COVID-19 have forced quick adaptation and innovation to meet consumers’ needs and, in some cases, keep the economy going.

The reality is that leaders who push innovation during this crisis are setting their organizations up for better success once the crisis has passed. In fact, history suggests that companies that invest in innovation through a crisis outperform peers during the recovery. This finding came to light during the SARS outbreak and the 2009 financial crisis, among others. Statistics show that companies that maintained a focus on innovation during the 2009 crisis subsequently outperformed the market average by over 30 percent after the crisis resolved. This demonstrated a far-sighted approach with significant benefits beyond just a company’s survival.

Leaders and CEOs have creatively solved problems and inspired others by taking action and making decisions that might typically take months to emerge from the typical treacle of bureaucracy. However, good innovative leadership will continue to emerge, transform and discover new ways to tackle COVID-19 challenges. Resilient leaders can see a crisis as an opportunity to elevate and define their corporate culture; resilient leaders can find clarity by testing every decision against touchstones. Their companies, and the communities and people they serve, are counting on them.

Subscribe to our monthly newsletter now!

About us…

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI® Group also holds BS102000:2013 and BS7858:2019 Certifications is an HRO certified provider and partner with Oracle.

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organizations. Contact ABAC® for more on ISO Certification and training.

MEET THE CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

7 Traits of a Resilient Leader

Every successful leader has encountered a challenging scenario at some point in their career. The unprecedented COVID-19 pandemic, however, has forced leaders to face unforeseen new challenges. With the pandemic’s colossal impact on operations, workforces, profits and supply chains across the globe, all eyes are on leadership to guide their businesses through this crisis. Resilient Leader

Resilient leaders are generally seen as more effective, making them an asset to any business; but what is resilience and how can it be applied to your management skills?

What is Resilience?

Resilience is the capacity to recover quickly from difficulties; it is a further evolution of stress management. This makes it a “no brainer” as to why resilience is such a popular concept in today’s business environment. Many businesses are pushing the concept of resilience as a way of helping workers better cope with the stresses and strains of the modern-day office and unlock their performance potential.

In this article, we look at seven essential qualities that characterise resilient leaders, and how to increase your resilience. In general, resilient leaders:

- Show empathy

- Are adaptable and able to improvise

- Are self-aware and open to feedback

- Take calculated risks

- Keep a positive attitude

- Develop others

- Communicate effectively

1. Resilient Leaders Show Empathy

COVID-19 has generated one of the greatest challenges and, simultaneously, one of the greatest opportunities for resilient leaders – at all levels. According to a Gallup U.S poll, six in 10 people are “very” or “somewhat worried” that they or a family member will be exposed to COVID-19 (Gallup, 2020). During this crisis, emotional management is even more crucial than ever. According to studies carried out by Development Dimensions International (DDI), empathy is the most critical leadership skill. Leaders who display compassion, authenticity and vulnerability – and are capable of apologising when they’re wrong and handle criticism without blame – create strong emotional bonds with their teams (DDI, 2020).

The most resilient (and effective) leaders can demonstrate empathy and a high level of emotional intelligence. When your team feels understood, they feel more motivated and more confident to contribute cultivating stronger conversations, ideas and debate. As Mark Cuban shared in a recent interview: “How you treat your employees today will have more impact on your brand in future years than any amount of advertising, any amount of anything you literally could do” (Just Capital, 2020).

2. Resilient Leaders Are Adaptable

With COVID-19 infecting approximately 311,641 people in the UK alone, health officials suggested using hand sanitiser as the easiest way to prevent the spread of the disease. Consequently, these announcements led to panic buying (Euronews, 2020). In this type of situation, a resilient leader should be able to visualise this action as an opportunity – for example, dozens of spirit manufacturers across the UK started to produce hand sanitisers (i.e. BrewDog and Leith Gin). This is a classic example of an instant attitude adjustment – looking at what they can do as opposed to what they can’t (Telegraph, 2020).

When faced with change, resilient leaders can focus on the things within their business that they can still control. Whether impacted by new technologies, environmental challenges or even ethical dilemmas, the modern business landscape is always changing. A resilient leader needs to be flexible and adaptable to succeed. Is flexibility part of your leadership style?

3. Resilient Leaders Are Self-Aware and Coachable

According to Health Care Business Today, self-awareness and coachability are “The Two Most Important Leadership Traits” (Health Care Business Today, 2019). We think so, too. Resilient leaders are self-aware, confident, and most of all, able to recognise their strengths and overcome their weaknesses. Resilient leaders are open to feedback, ask for feedback and are always demonstrating a real effort to improve.

4. Resilient Leaders Take Calculated Risks

Successful leaders earned their success through taking calculated risks. When Amazon CEO Jeff Bezos launched AmazonFresh, he was scrutinised by others because he didn’t choose a successful delivery or supermarket executive to run the venture. Instead, Bezos selected a team that had previously run a web-based food delivery service in the ‘90s (which collapsed after two years in business). Why? Bezos knew that the team had learned from their failure, which made them the perfect choice to succeed with a new project.

Resilient leaders like Bezos take calculated risks while accepting that failure is a by-product of innovation and success. They learn to become comfortable with being uncomfortable, and flourish as the world changes around them.

5. Resilient Leaders Can Keep a Positive Mindset

The impact of COVID-19 is tough to manage. It is vital to have a positive mindset that can influence fellow professionals and raise team morale while maintaining business momentum.

Under the challenging circumstances posed by the COVID-19 crisis, a resilient leader needs to be enthusiastic, offer praise for success, and give credit when it’s due. American psychologist Carol Dweck has stated in her book “Mindset: The New Psychology of Success” that “a change of mindset must happen before other positive transformation can occur.”

Resiliency is needed when we encounter failure. As a resilient leader, you shouldn’t view failure as final, but as a necessary step to move further along your journey.

6. Resilient Leaders Develop Others

The most resilient leaders are concerned about the development of their teams. Developing others helps everyone to learn from their mistakes. We continue to find that leaders who want and accept honest feedback for themselves are more likely to give productive feedback and coaching to others.

7. Resilient Leaders Communicate Effectively

Effective communication helps teams understand changes, expectations and new directions. This understanding is the key to the success of any team. The most resilient and best leaders always communicate their intentions effectively to others and are willing to help their teams understand a new strategy or direction.

The COVID-19 pandemic is proving to be the ultimate test for business leadership. In times of crisis, only certain individuals can adapt and stand tall amongst the crowd. When it comes to leaders, being able to implement resilience tools and strategies will not only make you a better leader but help the company overall.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

COVID-19: Top risk management concerns

A global crisis calls for a fresh due diligence and risk management review of your company’s third-party partnerships

The worldwide coronavirus pandemic has disrupted life in just about every word, from personal health concerns and social distancing to shelter-in-place mandates and business closures. But in the corporate world, life plods on. Critical concerns about ongoing sales and revenue, keeping personnel employed, safety issues inside the workplace, and uncertainty about the future make business leaders lose a lot of sleep these days.

An added element that global organisations should genuinely be concerned about is the ongoing viability of the supply chain. The pandemic is affecting different parts of the world at varying levels, so it’s vitally important to be continually vigilant in how the crisis affects your third-party suppliers and how those supply chain partners behave and maintain legitimacy in these uncertain times.

The healthcare industry is on the front line of the global supply chain battle, as it feverishly addresses an unprecedented demand for personal protective equipment. The shortage of PPE (Personal Protective Equipment) has forced many organisations – out of sheer desperation – to seek and purchase supplies from just about any outside source that can produce what’s needed. This panic buying has led to unscrupulous manufacturers producing and flooding the market with sub-standard products that, aside from being grossly overpriced, are putting an untold number of lives in peril. Further, the global demand for PPE has fostered rising occurrences of bad actors who see lucrative opportunities for bribery, tax evasion and money laundering amid crisis and confusion.

The pandemic has thrown many other industries into complete disarray, which will naturally open the doors for opportunists to do what’s necessary to take advantage of the situation. And suppose your organisation happens to be affiliated with these bad actors. In that case, the long-term effects can be potentially devastating, affecting the organisation’s reputation, and resulting in untrusting customers, lost business, loss of market value, decreased share price, litigation, and any number of regulatory penalties.

Crisis Situations Require Enhanced Due Diligence

A Third-Party Risk Management Program is not a passive process. It requires time and effort, and, as we’ve witnessed during the present global crisis, the risks associated with Third-Party partnerships are continually evolving. Those outside risks can be found on many operational levels, from a supplier’s present working conditions and the protection of customer data to safeguarding the company’s intellectual property and suspicious changes in pricing and payment terms, among others. Here are several items to consider in re-evaluating the company’s relationship with Third-Party partners during this critical period:

- Essential Workers – Is the company observing the latest guidance related to safety practices for that personnel still working on the production lines? Is the company providing PPE protection and following social distancing on the factory floor?

- Remote Workers – Is the supplier’s staff working from home now? How do you know those staff members, working on your behalf, are behaving correctly and completing their work? Who is overseeing the production of at-home workers?

- Customer Data – If staff is working remotely, how are they accessing vital company data? Is the at-home network protected? Can it be accessed and infiltrated by unaffiliated outside parties?

- Information Sharing – Has the supplier addressed intellectual property protection concerning at-home workers? Are the various corporate (and at-home) communication channels safeguarded, including email accounts, online chats, direct messaging, video conferencing and phone calls?

- Product Quality – Can the supplier still provide proof of product viability, including compliance with safety, quality, labelling and other standards?

- Production, Component and Logistical Costs – Has the supplier altered its various costs in response to the crisis? Has it provided acceptable reasons for the changes? Are these additional costs verified and justified?

- Relationships with Agents – Are the agents that assist in your global supply chain maintaining business integrity during the crisis? Are there unreasonable changes to pricing, terms and delivery dates?

- Regulatory Compliance – Is the supplier complying with local, regional and national mandates recently enacted as a result of the pandemic?

Remember, your organisation is only as safe as the least protected component of your Third-Party supplier network. It’s vital to ensure adequate protection against the rising number of risks associated with the recent worldwide crisis.

The Need for Leadership in These Challenging Times

Desperate times call for desperate measures, and these are most undoubtedly desperate times. An organisation where leadership, management and workforce do not take the third-party risk seriously will eventually suffer the consequences brought on by lack of action. And to those organisations that practice effective risk management, passive engagement in times of crisis is not enough.

The key to effective risk management during these times is proactivity. Asking difficult questions now can save you from answering accusatory questions later. Questions company management might immediately consider include:

- Are our suppliers equipped to protect our sensitive information against today’s risks?

- How sophisticated are our cloud and social media security?

- Are our suppliers capable of adapting to regulatory compliance changes?

- Are proper redundancies in place to ensure our information is protected against disaster?

- Will we be prepared if one of our suppliers unexpectedly shut down a line or closed its doors?

- Do we have the adequate tools to vet new or replacement suppliers properly?

- Who owns the risk management process internally? What additional resources do they need to succeed in the current situation?

- Do we have a set methodology for addressing incidents involving our suppliers?

- Do we maintain an accurate and complete interactive inventory of our suppliers?

- Can we identify warning signs with suppliers?

- Do we have a well-communicated reporting process?

The coronavirus pandemic has created crisis and uncertainty that we’ve never experienced. And crises are breeding grounds for bad actors who see opportunity in the midst of uncertainty. Ongoing due diligence of third-party partners in times of crisis is vital to safeguard the organisation’s long-term interests and protect it from an increasing number of outside risks.

Let’s Talk!

If you have any further questions or are interested in implementing compliance solutions, please contact us.

Who is CRI® Group?

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI® Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body that provides education and certification services for individuals and organisations on a wide range of disciplines and ISO standards, including ISO 31000:2018 Risk Management- Guidelines, ISO 37000:2021 Governance of Organisations, ISO 37002:2021 Whistleblowing Management System, ISO 37301:2021 (formerly ISO 19600) Compliance Management system, Anti-Money Laundering (AML) and ISO 37001:2016 Anti-Bribery Management Systems.

ABOUT THE AUTHOR

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group, a global supplier of investigative, forensic accounting, business due diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center-QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguards businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, USA, and the United Kingdom.

t: +44 207 8681415 | m: +44 7588 454959 |e: zanjum@crigroup.com

Beating bribery leadership and culture, in risk and anti-bribery management systems

Beating bribery leadership and culture

Beating bribery leadership and culture. Global corruption costs trillions in bribes. Samsung Group’s third-generation leader, Lee Jae-Yong, has been accused of bribing Choi Soon-Sil, a friend of former President Park Geun-Hye. Following Lee Kun-hee’s (Lee Jae-Yong’s father) heart attack in 2014, it has been calculated that Lee Jae-Yong would need to pay $6 billion in tax bills to be able to inherit his father’s shares and maintain control of Samsung. The Beating Bribery Leadership and culture in risk and anti-bribery management systems company’s leaders have a long-standing history of alleged tax evasion but, up to now, the white-collar crimes have been pardoned by Park Geun-Hye and other South Korean presidents. The easier option was for Lee Jae-Yong to pay a bribe to orchestrate the merger of two divisions: Samsung C&T Corp., which is dedicated to construction and trading and Cheil Industries Inc., which owned several entertainment properties. Upon completion, the merger would have given the Lee family more power over the entire Samsung Group.

Now that the plan was looking very promising, Jay Y. Lee used a bribe to execute it. According to Bloomberg in 2017: “The form of the alleged bribe was Vitana V, an $800,000 thoroughbred show horse, plus $17million in donations to foundations affiliated with the friend, whose daughter was hoping to qualify for the 2020 Olympics as an equestrienne.” (Bloomberg, 2017). Following the investigation, the situation took a significant downturn and Jay Y. Lee was sentenced to five years in prison. Chung Sun-sup, chief executive of research firm Chaebul.com said: “The five-year sentence was low given that he was found guilty of all the charges. I think the court gave him a lighter sentence, taking into account Samsung’s importance to the economy.” It is, however, one of the longest given to South Korean business leaders.

As for stock prices, they fell more than one per cent the day after Jay Y. Lee was arrested and then a similar amount after the verdict. Samsung Group’s profit was not hurt but South Korea’s new liberal president, Moon Jae-in, has pledged to rein in powerful, family-owned firms, like Samsung, which are known as chaebols in South Korea. He has promised to empower minority shareholders and end the practice of pardoning tycoons convicted of a white-collar crime. Another example of a company where corruption could be said to be part of company culture is (or was – more on that later) Rolls-Royce plc. Between 2000 and 2013, the company conspired to violate the Foreign Corrupt Practices Act (FCPA) by paying more than $35million in bribes through a third party to foreign officials to secure contracts. The US Department of Justice (DOJ) reported that in Thailand, Rolls-Royce admitted to using intermediaries to pay approximately $11 million in bribes to officials at Thai state-owned and state-controlled oil and gas companies that awarded seven contracts to Rolls-Royce during the same period. The way business was conducted in Kazakhstan, Azerbaijan, Angola and Iraq did not differ. The corrupt practices were spread globally.

In 2003, before the criminal activities came to light, the company’s chief executive, John Rose, who had been appointed in 1996, was honoured with a knighthood. After the engineering giant admitted in a deal with the US prosecutor that it had made corrupt payments, the UK’s Labour party called for him to be stripped of his title. Sir John Rose insists that he did not know of the corrupt practices. Let’s say that is the truth, but did he not fail as a leader simply because of that?

As a result of the scandal in 2016, Rolls-Royce has suffered the biggest financial loss in its history. Other factors include Brexit and the drop in the value of the pound, but the £671 million charges for the penalties the company paid to settle bribery and corruption charges with Serious Fraud Office (SFO), the DOJ and Brazilian authorities left a hole in the company’s accounts. Since then, the authorities have appointed new management and if its praised cooperation with SFO is an indication of the company’s culture shift, Rolls-Royce should no longer be in the news due to corruption scandals.

ISO standards

Failed leadership is the obvious reason for the above bribery cases. ISO 37001: 2016 Clause 5 Leadership outlines what is required from top management in order to obtain ISO 37001:2016 anti-bribery management system certification. Leadership is crucial for an anti-bribery management system to be effective and all points under Clause 5 Leadership are requirements.

As illustrated in the standard: “For a compliance management system to be effective, the governing body and top management need to lead by example, by adhering to and actively supporting compliance and the compliance management system.” Management has a number of other responsibilities, which are outlined in the standard. There are responsibilities that are more obvious than others, such as “ensuring that the anti-bribery management system, including policy and objectives, is established, implemented, maintained and reviewed to adequately address the organisation’s bribery risk” (5.1.2. a) and “deploying accurate and appropriate resources for the effective operation of the anti-bribery management system” (5.1.2. c). There are also requirements that are not so obvious but just as important; “promoting an appropriate anti-bribery culture within the organisation” (5.1.2. h) and “promoting continual improvement” (5.1.2. i). These requirements highlight that obtaining ISO 37001:2016 certification is not just a box-ticking exercise. In order to obtain the certificate, a company needs to illustrate that compliance with anti-bribery legislation is integrated within its business model and, crucially, its culture. In practical terms, that means that the tone at the top needs to align with the ISO’s anti-bribery management system (ABMS) and the message needs to be understood from the boardroom to the factory floor.

Adopting bespoke policies

ISO 37001:2016 is a strategic approach to bribery risk identification and subsequent risk mitigation. Risk knowledge is a necessary factor for effective management. The adoption of ISO anti-bribery management system-tested principles and practices allows an organisation to tailor recommendations to its contextual business environment. ISO 37001:2016 has had the impact of making companies adhere to the international anti-bribery management system standard. As an international standard of high repute, ISO 37001 has brought changes to market dealings and firm operations. Organisations have a guideline of rules and code of ethics to follow to mitigate the risk of being involved in corruption charges. The international nature of the ISO 37001 management system allows organisations to align their internal policies with national laws where the organisation is operating. It is important to note that state-nations are increasingly internalising globally recognised legal anti-corruption frameworks and actively prosecuting offenders.

The assurance that an organisation is operating within international standards and processes helps cultivate social legitimacy in the operation of that company which directly serves to boost investor confidence and attract investors. Also, some consumers base their purchasing decisions on the ethical operations of a company. As such, the ISO standard serves as a pull factor for new consumers. Bribery is a very serious issue with adverse macroeconomic and microeconomic effects. In particular, it not only distorts markets and competition but also erodes the profitability of private firms and individual enterprises throughout an economy. The ISO anti-bribery management system provides measures that help organisations to prevent, detect, eradicate and address bribery. This is done by adopting anti-bribery policies, hiring personnel to oversee compliance risk management and due diligence on projects and business associates, implementing commercial and financial controls and also reporting and investigation procedures. ISO 37001:2016 can be used in any organisation regardless of its size, type whether public or private or non-profit.

Enhanced transparency

Identification and resolution of bribery risks increase an organisation’s capacity to deliver consistent and improved services to consumers within the law and without engaging in bribery and corruption. In addition, the anti-bribery management system improves the way the organisation protects its people from fraud and ensures that there is a favourable working environment. Therefore, the ISO 37001:2016 anti-bribery management system enhances transparency in organisational culture, thus promoting the optimisation of resources. Protection of the organisation’s assets, shareholders and management from the adverse effects of bribery and corruption is another benefit associated with an ISO standard anti-bribery management system. Often, the negative effects of corruption are economic in nature. For instance, bribery affects the profit margins of a company to the extent that the management has to divert funds meant for either operating capital or assets capital to facilitating bribes.

Additionally, the public knowledge that an organisation is actively involved in bribery or any other form of peddling influence affects brand identity, which erodes the consumer base, thus reducing the overall profitability of an organisation. This system can operate as a standalone facility or function under another system through integration. One advantage that cuts across all organisations is the amplification of confidence in the eyes of external stakeholders. From another perspective, an organisation using this ISO format is assured of a good reputation as well as an excellent working environment. The risk factors are minimised and a solid credential pathway is realised. Indeed, many for-profit outfits have consistently applied anti-bribery systems as a measure of acquiring extensive market penetration goals. The ISO 37001 typically seeks to create an accountability culture around the globe that allows organisations to conduct activities in a clean and healthy environment.

Committed approach

An organisation with an ISO: 37001 2016 certification is open to public scrutiny since its management operates without fear. Further, such an entity displays fidelity and compliance to bribery legislation, such as acts of parliament or the congress. More importantly, subscribing to the system certification demonstrates a commitment to collaborate and work with like-minded organisations in managing bribery and corruption in the world. The chain of responsibility and accountability, additionally, ensures that the supply chain systems used by the organisations conduct clean and verifiable business. Closely related to that advantage is the growth of moral and legal business transactions between businesses and their contractors. Corruption can permeate every corner of an organisation and the anti-bribery certification blocks such realities.

The ultimate beneficiary of ISO: 37001 is the shareholder. When an organisation bribes its way into the business and has its licence taken away, the shareholder loses their investment. If credibility is lost and the activity schedule goes down, it is the shareholder who bears the heaviest burden. However, bribery in organisations practically affects everyone in the political, commercial or social jurisdiction of such a company. Disgrace can lead to the loss of jobs. And a fined or closed company implies lower tax revenues to the government. Therefore, businesses should integrate ISO: 37001 2016 in their management operations as well as in risk and compliance.

Curbing risks

The ISO certification embeds a culture of corporate social responsibility and willingness to collaborate with law enforcement agencies. Cognisant of the backlash and opprobrium associated with corporate obstruction of justice in the investigation of bribery and corruption, the ISO certification allows organisations to document their proactive involvement in reviewing their compliance with global standards of anti-bribery management as well as the concrete measures the management has initiated to show its willingness to prevent and curb bribery risks.

Finally, it is important to note that organisations have a distinct legal personality away from the management and other stakeholders. The separate legal personality of an organisation means that an organisation is liable for bribery activities committed by its employees or its management. Under domestic laws, culpable organisations are subject to legal sanctions, which include hefty pecuniary fines and, in some cases, dissolution of the organisation. Pecuniary fines affect the operations of a company by diverting either operating capital or assets to unintended activities. Overall, diversion of financial resources to foot fines affects the profitability of a company as well. In addition, such diversion of financial resources through fines affects growth strategies, such as expansion into new markets. In this case, the provision of documented evidence to the prosecution or the courts demonstrates that an organisation has taken reasonable measures to prevent bribery and corruption, thus helping the organisation to avoid fines and sanctions, such as winding up.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Importance of leadership and culture for ABMS

There are many reasons why companies engage in corrupt practices; to win contracts, to speed up service delivery, to gain or retain political influence and so on. Nevertheless, all corrupt practices, in the end, are about gaining more money and more power. When justice is served the opposite happens. Share prices plunge, and leaders lose their power. Top 10 Bribery & Corruption Stories of 2020 (so far) or even last year’s Top 10 Bribery and Corruption 2019 Cases

Case Study: Samsung and laundering horses

Samsung Group’s third-generation leader, Jay Y. Lee has been accused of bribing Choi Soon-sil, a friend of former President Park Geun-Hye. Following Lee Kun-hee’s (Jay Y. Lee’s father), heart attack in 2014 it has been calculated that Jay Y. Lee would need to pay $6 billion in tax bills to be able to inherit his father’s shares and maintain control of Samsung. The company’s leaders have a standing history of tax aviation but up to now, the white-collar crimes have been pardoned by Park Geun-Hye and other South Korean’s Presidents. The easier option was to pay a bribe to orchestrate the merger of two divisions: Samsung C&T Corp., which is dedicated to construction and trading, and Cheil Industries Inc., which owned several entertainment properties. Upon completion, the merger would have given the Lee family more power over the entire Samsung Group.

Now that the plan was looking very promising, Jay Y. Lee used a living bribe to execute it. “The form of the alleged bribe was Vitana V, an $800,000 thoroughbred show horse, plus $17 million in donations to foundations affiliated with the friend, whose daughter was hoping to qualify for the 2020 Olympics as an equestrienne.” (Bloomberg, 2017).

Following the investigation, the situation took a significant downturn and Jay Y. Lee was sentenced to 5 years in prison. Chung Sun-sup, Chief Executive of research firm Chaebul.com said “The five-year sentence was low given that he was found guilty of all the charges. I think the court gave him a lighter sentence, taking into account Samsung’s importance to the economy.” It is, however, one of the longest given to South Korean business leaders. As for stock prices, they fell more than 1% the day after Jay Y. Lee was arrested and then a similar amount after the verdict. Samsung Group’s profit was not hurt but South Korea’s new liberal president, Moon Jae-in, has pledged to rein in the chaebols, empower minority shareholders and end the practice of pardoning tycoons convicted of a white-collar crime.

Case Study: Rolls-Royce and the $35 million in bribes

Another example of a company where corruption could equal to company culture is (or was – more on that later) Rolls-Royce plc. Between 2000 and 2013, the company conspired to violate the Foreign Corrupt Practices Act (FCPA) by paying more than $35 million in bribes through the third party to foreign officials to secure contracts. The Department of Justice (DOJ) reported that in Thailand, Rolls admitted to using intermediaries to pay approximately $11 million in bribes to officials at Thai state-owned and state-controlled oil and gas companies that awarded 7 contracts to Rolls-Royce during the same period. The way business was conducted in Kazakhstan, Azerbaijan, Angola, and Iraq did not differ. The corrupt practices were spread globally.

An event that coincides with the above is the appointment of Sir John Rose as Chief Executive of Rolls-Royce (1996 – 2011). In 2003 and before the company’s criminal activities came to the light, Rose was knighted. After the engineering giant admitted in a deal with US prosecutor that it had made corrupt payments, Labour is calling for Rose to lose his knighthood. Sir John Rose insists that he did not know of the corrupt practices. Let’s say that is the truth, did he not fail as a leader simply because of that?

> Learn more about the Rolls-Royce case study including how a full risk assessment would have mitigated the risk of corruption. Read more HERE or just DOWNLOAD NOW your FREE “Ethics, compliance & Rolls-Royce: Lessons Learned”

As a result of the scandal in 2016 Rolls-Royce has suffered the biggest financial loss in its history. Other factors include Brexit and drop of pound value, but the £671 charge for the penalties the company paid to settle bribery and corruption charges with Serious Fraud Office (SFO), the DOJ, and Brazilian authorities left a hole is Rolls’ accounts. Since then the company has a new management, and if their praised cooperation with SFO is an indication of the company’s culture shift, Rolls should not be in the news due to corruption scandals.

The answer to avoid failed leadership

Failed leadership is the obvious reason for the above bribery cases. ISO 37001:2016 Clause 5 Leadership outlines what is required from the top management in order be obtain ISO 37001:2016 Anti-Bribery Management System Certification. Information in ISO 37001:2016 standard is divided by verbal forms use; unsurprisingly shall indicate a requirement, should a recommendation, may a permission and can a possibility or capacity. Leadership is crucial for an anti-bribery management system to be effective and all points under Clause 5 Leadership are ‘shall’ requirements.

As illustrated in the standard: “For a compliance management system to be effective the governing body and top management need to lead by example, by adhering to and actively supporting compliance and the compliance management system.” Management has a number of other responsibilities which are outlined in the standard. There are responsibilities which are more obvious than others such as “ensuring that the anti-bribery management system, including policy and objectives, is established, implemented, maintained and reviewed to adequately address the organisation’s bribery risk” (5.1.2. a) and “deploying an accurate and appropriate resources for the effective operation of the anti-bribery management system” (5.1.2. c). There are also requirements which are not so obvious but just as important; “promoting an appropriate anti-bribery culture within the organisation” (5.1.2. h) and “promoting continual improvement” (5.1.2. i). These requirements highlight that obtaining ISO 37001:2016 certification is not just a box ticking exercise (contrary to what critics like to say). In order to obtain the certificate, a company needs to illustrate that compliance to anti-bribery is integrated within their business model and crucially, their culture. In practical terms that means that the tone at the top needs to align with ABMS and the message needs to be understood from the boardroom to the factory floor.

Leadership is one of the core seven elements of ISO 37001:2016. The remaining elements; the context of the organisation, planning, support, operation, performance evaluation and lastly improvement, will be discussed in the future. Watch this space.

ISO 37001:2016 Anti-Bribery Management System certification is offered under CRI Group’s ABAC® Centre of Excellence, an independent certification body established for Anti-Bribery Management System training and certification, ISO 37301 Compliance Management Systems and Risk Management System certification. The program will be tailored to your organisation’s needs and requirements. For assistance in developing and implementing a fraud prevention strategy, contact ABAC today or get a FREE QUOTE now!

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.[/vc_column_text][accordion_father caption_url=””][accordion_son title=”Take a Gap Analysis of Highest Ethical Business (FREE)” clr=”#ffffff” bgclr=”#1e73be”]

- We Welcome You To Have Free Gap Analysis of Highest Ethical Business Survey: prove that your business is ethical. Complete our FREE Highest Ethical Business Assessment (HEBA) and evaluate your current Corporate Compliance Program.TAKE THE GAP ANALYSIS NOW!

Find out if your organisation’s compliance program is in the line with worldwide Compliance, Business Ethics, Anti-Bribery and Anti-Corruption Frameworks. Let ABAC® experts prepare a complimentary gap analysis of your compliance program to evaluate if it meets “adequate procedures” requirements under UK Bribery Act, DOJ’s Evaluation of Corporate Compliance Programs Guidance and Malaysian Anti-Corruption Commission.

The HEBA survey is designed to evaluate your compliance with the adequate procedures to prevent bribery and corruption across the organisation. This survey is monitored and evaluated by qualified ABAC® professionals with Business Ethics, Legal and Compliance background. The questions are open-ended to encourage a qualitative analysis of your Compliance Program and to facilitate the gap analysis process.

The survey takes around 10 minutes to complete. ABAC® is powered by CRI Group – this GAP analysis will be performed by ABAC®

[/accordion_son][accordion_son title=”Sources & Credits” clr=”#ffffff” bgclr=”#1e73be”]

- Bloomberg (2017) https://www.bloomberg.com/news/features/2017-07-27/summer-of-samsung-a-corruption-scandal-a-political-firestorm-and-a-record-profit

- Chaebul (2016) http://chaebul.com/chaebul/eng/engnews/eng_news_list.jsp?section=0000000106

- Financial Times (2017) https://www.ft.com/content/1b62c007-e846-3feb-b23f-2eae5f180fd7

- Reuters (2017) https://www.reuters.com/article/us-samsung-lee/samsung-leader-jay-y-lee-given-five-year-jail-sentence-for-bribery-idUSKCN1B41VC

- Web archive (2016) https://web.archive.org/web/20091224225422/http://www.rolls-royce.com/about/who_are/management/board/rose.jsp

- US Department of Justice (2017) https://www.justice.gov/opa/pr/rolls-royce-plc-agrees-pay-170-million-criminal-penalty-resolve-foreign-corrupt-practices-act

[/accordion_son][accordion_son title=”About CRI Group” clr=”#ffffff” bgclr=”#1e73be”]Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

[/accordion_son][/accordion_father][/vc_column][/vc_row]

Corruption won’t stop: is your organisation protected?

In one case, an enforcement agent for a Malaysian government department pleaded guilty for receiving a bribe from a business owner. In another, a U.S. district attorney from Philadelphia was accused of taking cash in return for helping people with their legal cases. He was accused of 28 counts of bribery, and in the end was given a deal to plead guilty on one count. Both cases show how easy it is for organisations to fall victim to bribery and corruption.Businesses, non-profits, government organisations both face a risk to their financial well-being and reputation.

In Malaysia, the case centred around an employee of the Domestic Trade, Cooperatives and Consumerism Ministry. According to the article “Domestic Trade enforcement staff fined RM1,200 for bribery” published in the New Straits Times, Muhammad Mat Sa’ad, 36, was charged with taking bribes from a fuel storage owner in 2014. His case was prosecuted by the Malaysian Anti-Corruption Commission (MACC).

In the U.S., Philadelphia’s top law enforcement officer, District Attorney R. Seth Williams, pleaded guilty to bribery in a more sweeping case with some very troubling details. According to the New York Times article “Philadelphia District Attorney Pleads Guilty to Bribery and Resigns,” Williams allegedly accepted bribes from business people in return for offers of legal help with their cases or those of their friends. But he may have also defrauded his own mother.

The article states:

“Mr. Williams accepted gifts including a trip to the Dominican Republic and checks for thousands of dollars from people who wanted favours, prosecutors said. According to an indictment by the United States attorney’s office for New Jersey, he promised one of the business people that he would “look into” a case that had been brought against a friend of that person.

He also faced charges including wire fraud and extortion for his alleged personal use of political action committee funds and government vehicles. Among the most damaging charges against Mr. Williams was that he defrauded a nursing home and family friends of money that was designated for the care of his mother.”

He faces a up to five years in prison and a fine of up to $250,000.

These types of troubling cases can likely be prevented with the right training, internal controls, and certification. The International Organization for Standardization (ISO) issued the ISO 37001:2016 Anti-Bribery Management System standard to help companies worldwide increase and measure their efforts against bribery and corruption.

CRI® Group is registered as a foremost ISO 37001:2016 Certification Body with the Dubai Accreditation Center (DAC) Government of Dubai, UAE, and has formally launched its ISO 37001:2016 Anti-Bribery Management Systems certification program. ISO 37001:2016 certifies that your organisation has implemented reasonable and proportionate measures to prevent bribery. These measures involve top-level leadership, training, bribery risk assessment, due diligence adequacy, financial and commercial controls, reporting, audit and investigation.

Through CRI® Group’s 3PRM-Certified™, the ISO 37001:2016 Anti-Bribery Management System Certification will help your company, organisation or department to reduce risk of bribery and corruption by establishing, implementing, maintaining and improving your management system. The certification empowers you with the ability to safeguard and maintain the integrity of your company by:

- Guaranteeing that all workers and agents are devoted to the latest anti-bribery practice.

- Regularly validating compliance to appropriate legislation like the FCPA and UK Bribery Act 2010.

- Jointly cooperating with stakeholders to observe and reduce the risks throughout your supply chain.

- Externally scrutinising your company, testing the effectiveness of your anti-bribery policies and processes.

- Creating “Compliance in Action.”

ISO 37001:2016 Anti-Bribery Management System certification is offered under CRI® Group’s ABAC® Centre of Excellence, an independent certification body established for Anti-Bribery Management System training and certification, ISO 37301 Compliance Management Systems and Risk Management System certification. The program will be tailored to your organisation’s needs and requirements. For assistance in developing and implementing a fraud prevention strategy, contact ABAC® today or get a FREE QUOTE now!

Who is CRI® Group?

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI® Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI® Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Any successful ethics and compliance strategy needs 5 key ingredients …

Once upon a time, the idea of business ethics was more of an abstract or philosophical notion that seemed more suited for discussion in a university lecture or at a business conference. Today, however, organisations of all sizes and industries must have concrete ways of addressing ethics and compliance issues as a principal component of their business processes and strategy.

According to a study by PwC, 98 per cent of senior leaders say they’re committed to compliance and ethics; however, only 67 per cent have a process in place to identify the owners of compliance and ethics-related risks, with only a third having an officer in place for the overall compliance and ethics. Fifty-six per cent of the companies don’t have a chief ethics officer at all, and only 20 per cent have a Board of Directors that formed separate compliance and ethics committees. The study reports that 82 per cent of leaders communicated with employees on ethics, but 46 per cent of this is done in business meetings or by email. You can read the result on the full PwC website.